🌟 Nuclear fusion: the state of play among the startup firms

Also: 5 Quick Questions … on the economics of artificial intelligence

🎄 First things first: To celebrate my return to writing after a November hiatus — back to the regular schedule of three essays a week (one with no paywall), a weekend recap, and a regular podcast (with transcript) — I’m thanking my free subscribers for their patience by offering a special deal all December. See the Big Blue Button below for details!

In This Issue

The Essay: Nuclear fusion: the state of play among the startup firms

5QQ: 5 Quick Questions … on the economics of artificial intelligence

Micro Reads

Quote of the Issue

“Today, you will witness the birth of a new fusion-based energy source. Safe, renewable energy, and cheap electricity for everyone.” - Dr. Otto Octavius, Spider-Man 2.

The Essay

🌟 Nuclear fusion: the state of play among the startup firms

In December of last year, Bloomberg Intelligence put out a research note pegging a potential $40 trillion valuation for the emerging nuclear-fusion sector. The big picture justification is that energy is the “center of all economic activity,” the ultimate General Purpose Technology. Back then, BI analyst Mike Dennis put it this way: “The efficiency afforded by fusion — low input cost and the promise of endless energy produced — suggests that viable commercial nuclear fusion is a development off the Richter scale of modern advancements.”

So where does that $40 trillion number come from? The back-of-the-envelope calculation goes like this: Take a high-potential growth stock, in this case, Tesla, which was valued at just over $1 trillion last December. (A lot has happened since then!) Applying that kind of valuation to a nuclear fusion sector that supplants 1 percent of the global energy gigawatt output (much as Tesla has grabbed a comparable amount of the global auto market) would supposedly imply a $40 trillion valuation on fusion. I mean, I guess. Dennis: “This could completely change the valuation of the energy market, despite limited actual initial fusion power contributing to the global grid.”

Also of interest: how nuclear fusion might affect productivity and economic growth:

The enterprise value of global energy is about $15 trillion, we calculate, and viable fusion could not only reverse the deceleration in world energy productivity gains since the 1970s (as extracting energy got more expensive), but also claim a superior valuation for the efficiency leap. If $1 trillion of the $9.5 trillion in renewables investment planned over the next 20 years, based on IEA data, was invested in fusion projects, they might achieve their goals to deliver electricity to the grid by 2030. The cost of an ARC fusion reactor is a fraction of that of renewables, ENI estimates. Since 2000, $5.1 trillion has been spent on renewables and related infrastructure, yet its share of production grew to just 5.7% as of 2020, based on BP data.

So how do the odds of this forecast ever actually happening look a year later? One would have to say they look a bit better after last week’s news that researchers at Lawrence Livermore National Laboratory, using 192 lasers blasting a capsule the size of an eraser on the end of a pencil, generated more energy output from an experimental fusion reactor than the amount of energy put it. For the first time, humans made energy like the sun does. “Simply put, this is one of the most impressive scientific feats of the 21st century,” said Energy Secretary Jennifer Granholm.

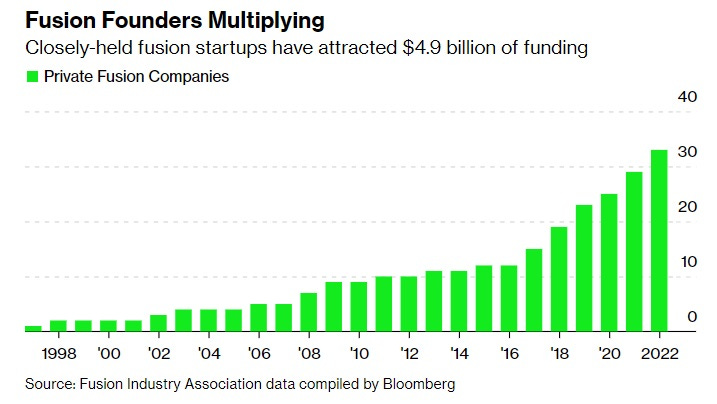

But the route to a commercial fusion reactor will be different than the path to that historical moment of stellar-like ignition. As important as such successful science experiments — and the knowledge they generate — are, we need to keep close track of what the private sector is doing since it will be what ultimately makes commercialization possible. (Investment into fusion startups like Commonwealth Fusion Systems and Helion Energy jumped to $2.3 billion in 2021 and will likely total more than $1 billion this year, according to BloombergNEF.)

So it was pretty enlightening, then, to hear what three leading fusion company CEOs had to say — before the Lawrence Livermore news, mind you — at a recent Goldman Sachs investment conference about the state of play in the sector and at their firms: Bob Mumgaard of Commonwealth Fusion Systems; Jonathan Toretta of TAE Global; and Chris Kelsall of UK-based Tokamak Energy. I thought I would offer a bit of flavor from that conversation. (This transcription is mine and probably imperfect.) The panel started with a general question to Mumgaard about fusion versus fission. Mumgaard:

The nuclear power we have today, fission, is based on splitting very heavy things, splitting uranium … and converting a tiny bit of mass into energy, E = mc2. A lot of energy, not a lot of fuel. But you’re left with the pieces, and those pieces [are] nuclear waste, and those continue to be dangerous for a long time, and if you don’t cool them they continue to split and that’s a meltdown. So fusion is the opposite: You put things together. You put light things together to make things heavier. And in that process, you also convert a tiny bit of mass into energy, and E = mc2 is a lot of energy. That reaction, the fusion reaction, is the reaction that happens inside the stars, and the reaction that built up all the atoms in this room and into you. It built them up from little pieces to bigger pieces. That’s the energy choice the universe picked 13 billion years ago, and that’s what it’s been doing ever since. And if you were to make that reaction work, you would make a lot of energy without very much fuel, and you wouldn’t have the same hazards that you have in traditional nuclear power. You would build a completely different type of machine to make that reaction go. But that machine at the end of the day would make a bunch of heat, and that heat would be used to make power the same way we use heat to make power with nuclear fission, the same way we use heat to make power with fossil fuels, just a different reaction.

The moderator asked what role nuclear fusion might play in the year 2050? TAE’s Toretta:

Certainly the energy mix will be very different in 2050. But I think each of us sitting here in our executive positions expects that fusion is delivered either late this decade or something in the 2030s depending on our own expectations. So if we jump ahead to 2050, I would imagine fusion playing a significant role and listening to many of the presentations today (at this decarbonization conference), whether they’re around carbon capture, carbon sequestration, desalination projects, and other energy-intensive regimes, they’re going to need a lot of power, and fusion truly is — if it all works the way we expect it to work — truly a baseload power solution that not only … would slow down the acceleration of carbon into the atmosphere but could potential actually start reducing the amount of carbon in the atmosphere. So bringing it to a fine point, a different energy mix, and if all works, I would say fusion has a pretty robust future.

Next came a question about the companies themselves. Mumgaard:

So fusion is great in the long run because it’s an energy source that is basically post-resource. Today, energy is tied to a resource, and you collect it in the ground or collect it from the sky. Fusion is tied to a machine. You build a machine, and you have energy where you want it and when you want it. No pipeline, no smokestack. So the question is: What’s that machine? What does that look like? At the heart of it, all the types of machines are doing the same basic thing: They are creating the conditions necessary for the reaction of fusion to happen. And you need that to be hotter than the center of the sun … it has to be enough of it, it has to be dense, and it has to be insulated otherwise you spend all your energy heating it up. If you don’t insulate it well enough, you won’t get the power you put it in. And so far, we have not yet built any machine that does those three things at the same time to make more power out than in, but we are actually surprisingly close. The worldwide academic and national labs, the public funded system, has advanced that science a long way, of what type of condition and how to get there. Now, these companies are trying to build different types of machines to see if we can get more power out than in, and then commercialize that machine — sell the machine instead of sell the resource.

In our case, we are based on the premise, “Let's go as fast as possible.” We try to take things that we know how to do today, that are close to working and get them over the hump. In our case, that’s a certain type of machine called tokamak …and it’s the highest performer today, within a factor of two of what’s needed within those parameters. And we’ve now taken that and added very strong magnets to it — sort of a boring science experiment with new materials and new engineering — and we’re building a machine now called Spark outside of Boston that is predicted to be the first machine to make more power out than in. Push a button make a bunch of fusion heat, and do it again, over and over again, and show you get those conditions. That machine is early stages of construction. .. And that will turn on about 2025.

That answer really gets at the difference between the successful Lawrence Livermore experiment and commercialization: the ability to generate the fusion reaction over and over again for a long duration. Asked about why nuclear fusion seems more possible now than ever before, Mumgaard mentioned advances in material sciences, machine learning, and additive manufacturing. Advances in fusion science also allow the creation of simulation tools, so fusion firms are “no longer guessing and checking. You’re now predicting, the same way you predict the way planes are going to fly before you build them.” TAE’s Toretta also mentioned advances in AI, saying it couldn’t build its version of a reactor even a decade ago. There also seemed a consensus that energy security, prompted by Russia’s invasion of Ukraine, has joined climate change as a key factor creating momentum by government and investors toward fusion. In addition, complaints about the availability of high-skilled labor.

Toward the end of the chat, the GS moderator asked about tailwinds and headwinds facing their companies. Mumgaard:

Lots of tailwinds. … Headwinds: We actually have to deliver. Building things is hard. People who’ve built software companies, that’s hard. Putting steel in the ground, concrete, making sure all the pipes fit together — that’s how you're going to solve climate change. Climate change is not bits, it’s atoms. That means supply chain. That means integration. And that means turning it on, and showing it works. What should you look for in us overcoming those headwinds? One, people build machines that reach the right conditions. Where’s that being peer reviewed? That being knocked down. Next, more power out than in. That means an integrated machine that looks like a commercial machine making actual fusion heat. After that, a lightbulb on a grid, powered by fusion. You’ll know that the tailwinds are winning against the headwinds when you see those happen.

Toretta:

Bringing it to today’s problems, this year and next year, labor being one, that I’ve mentioned before. And the fact that we’re facing some supply chain concerns, relative to the geopolitics of today. And inflation is a bit of a factor. We raise money by milestones. We typically raise exactly the amount of capital we think we need, with a factor of risk built into that, per each machine that we’re building. It’s a little bit different world today. But the tailwind that I would add to this is regulatory. Two to three years ago, we really wondered how we would get enough regulatory support for nuclear. We were speaking to certain asset managers, certain members of government who said this was never going to happen. The world has fundamentally changed in that context, as well.

And Tokamak Energy’s Kelsall

I’ll jump into the tailwinds. First of all … a substantial inflection in funding quantum that’s been made available, but that journey can and should and will continue. … The private sector has stepped up, and to the extent that we can get the public sector to contribute toward that — I don’t think we can rely on that. We have to be self sufficient and self supporting. … But let’s not forget back in the 1990s the assistance that was given to [solar and wind] which have now matured, and I think it’s fair to look at what the equivalent calibration is for our space now to give it a little bit of a catalyst. The other great tailwind is that you’re seeing the delivery partners, the industrial sector coming into the space and saying we need a seat at the table: Google Ventures, Sumitomo, Chevron the big oil and gas majors, Shell, Eni ... We’ve seen the big sovereign wealth funds .. You’re getting the big end of town saying we need a seat at the table. We have to get involved. This is the next energy evolution. This will take us right out of the carbon journey. It’s been a wonderful journey for 200 years, but then about 150 years into the journey, we figured that it had some costs that have really started escalating in the last 20, 30 years. It’s time to move on to that next revolution. And that going to be fusion, combined with some of the other fantastic technologies.

Again, this conference happened before the Lawrence Livermore news, but CFS’s Mumgaard did offer one comment that may be relevant to that breakthrough. An audience member asked for his thoughts about the multinational International Thermonuclear Experimental Reactor, or ITER, under construction in southern France. It’s a project plagued by delays and cost overruns. Mumgaard said ITER shows why such projects are valuable: “It’s a statement of conviction that fusion is worth doing and is doable … but it’s also an example of why you need things in the private sector.”

One more thing: Investor Sam Altman tweeted out a link to this new video about Helion Energy, a fusion firm he led the funding for:

Here’s hoping for plenty of news in 2023 that shows the sector heating up further!

5QQ

💡 5 Quick Questions … on the economics of artificial intelligence

It might seem as if advances in artificial intelligence-machine learning are accelerating. At least to the regular, non-expert person, something like ChatGPT must seem like a huge breakthrough. It sure seems pretty amazing to me. As Financial Times columnist John Gapper wrote recently:

ChatGPT is eerily impressive, as is Dall-E, the AI generator of digital images from text prompts first unveiled by OpenAI last year. Once you have tried both out, it is impossible to avoid the sense that natural language agents are going to disrupt many fields, from music and video games to law, medicine and journalism. The chatbots are coming for us professionals rapidly.

I’ve covered the economic impact of AI frequently in this newsletter. So with the year winding down, I’ve selected five interesting experts and five interesting questions — and five interesting answers, I think — on the subject

➡ Anton Korinek, professor in the department of Economics and at the Darden School of Business at the University of Virginia: I am leaving such predictions to people who are greater experts on this than I am, and yes, they are indeed predicting this for the second half of this century. I personally think that the transition will be gradual. In fact, we are already living in a world in which we are interacting with AI systems that exhibit superhuman levels of intelligence in narrow domains. These systems will become more and more powerful and ever more general - and I think it is prudent and reasonable to prepare for the possibility that human labor will largely be replaced by the second half of the 21st century - to prepare both at a personal level and for our systems of governance.

2/ How optimistic are you that AI will deliver significant productivity gains in the 2020s?

➡ Tamay Besiroglu, a visiting research scientist at MIT’s Computer Science and Artificial Intelligence Laboratory: I think that there is only a modest chance—say, around 25%—that by the end of this decade, AI will significantly boost aggregate US productivity growth (by “significantly”, I have in mind something like reverting to the 2% productivity growth rate that we observed before the productivity slowdown that occurred in the early 2000s).

I’m not more optimistic because boosting aggregate productivity is a tall order. In the past, few technologies—even powerful, general-purpose, and widely adopted ones like the computer—have had much of an effect. Deep learning has been applied with some success to a few problems faced by large tech companies (such as facial recognition, image detection, recommendations, and translation, among others). However, this has benefited only a small sliver of the overall economy (IT produces around 3% of US GDP). It also does not seem likely that AI has enhanced productivity of technology companies by a large enough margin to produce economy-level productivity effects.

Over longer timescales—say, 15 or 30 years—I think there are good reasons to expect that conservative extensions of current deep learning techniques will be generally useful and reliable enough to automate a range of tasks in sectors beyond IT; notably in manufacturing, energy and science and engineering. Concretely, I think it is more likely than not that over such a time frame AI productivity effects will dominate the productivity effects that computers had in the late 20th century.

Given the importance of technological progress for driving economic growth among frontier economies, I pay particular attention to the use of AI tools for automating key tasks in science and engineering, such as drug discovery, software engineering, the designing of chips, and so on. The widespread augmentation of R&D with AI could enable us to improve the productivity of scientists and engineers. Automating relevant tasks will also enable us to scale up aggregate R&D efforts (as computer hardware and software for AI are much easier to scale up than it is to increase the number of human scientists and engineers). I think it’s possible that by the middle of this century, the widespread augmentation of R&D with AI could increase productivity growth rates by 5-fold or more.

➡ Economist Bryan Caplan, George Mason University: I'm even more confident than ever. The great successes of AI, to me, seem quite petty, actually. I'm not impressed. Rather, I think there's a lot of cheerleading where people who love DALL-E, or who love GPT-3, go and find the very best thing they can do. Whenever I've had access to the system, the typical output is pathetic and I'm not impressed at all. The funny thing about this bet is it is a bet on the end of the world, essentially. And many people say "You can't bet on the end of the world." Au contraire, you can. So the bet is with Eliezer Yudkowsky. He says the world will end, roughly. I say it will not. And the bet consists in, I immediately paid Eliezer 100 bucks. And then if the world is not destroyed, he owes me a pile of money. If he's right, he gets to enjoy some money before the world ends. And if I'm right, I get to enjoy more money when the world does not end, which it's not going to. Not from that anyway.

➡ Michael Strain, AEI economist: I think that there's no question that we will see significant labor market disruption from continuing technological change and that there are job tasks that human beings do now that will be done by robots or by software or by new technology generally. I don't think this is hypothetical. We've been living in this world for 40 years now. (We've actually been living in this world for over 200 years.) We've been living in a world for the last four decades where the advance of technology has displaced manufacturing and production workers, where it has displaced clerical workers, and where in what we think of as traditionally middle-skill, middle-wage, middle-class occupations, the share of employment in those occupations has reduced substantially.

I think the important thing to remember is that that's not the end of the story. Technology will have those kind of destructive effects, but it will also have creative effects. Technology is one of the ways by which creative destruction happens in a market economy. We spend a lot of time focusing on the destruction component of creative destruction. We spend much less time focusing on the creative component of it. And my view is that technological advances will lead to new goods and new services that people are going to want to buy; they'll boost the incomes that people have at their disposal; businesses eager to take advantage of these new opportunities will find uses for workers; workers who in the past might have been employed in an occupation that's been displaced by technological advances won't just be sitting at home without a job. Instead, those workers will be employed in a different industry that doesn't currently exist or for a different company that doesn't currently exist. And they'll be doing different things than they otherwise would've been doing.

➡ Avi Goldfarb is the Rotman Chair in Artificial Intelligence and Healthcare and a professor of marketing at the Rotman School of Management, University of Toronto: I am bullish about the potential for machine learning to accelerate productivity growth. Of the emerging technologies today, our research says it is relatively likely to emerge as a GPT. I am wary to say it will be a Roaring ’20s or Roaring ‘30s. Co-invention takes time. It was clear that electricity would be a transformative technology by the end of the 1870s. It didn’t hit half of US factories until the 1920s. It took decades to figure out how to build factories to take advantage of what distributed power could do. Hopefully the discovery process for the new systems to take advantage of machine learning technology will be faster than that, but there is no doubt that the necessary system-level change has a long way to go.

Micro Reads

▶ 2022 was filled with progress and optimistic news - Mathias Sundin, Warp News

▶ ‘Bottling the Sun’: is this a new dawn for the fusion industry? - John Thornhill, FT Opinion

▶ Generative AI is changing everything. But what’s left when the hype is gone? - Will Douglas Heaven, MIT Tech Review

▶ What Happened When the Bay Area Rejected Growth - Justin Fox, Bloomberg Opinion

▶ J. Robert Oppenheimer Cleared of ‘Black Mark’ After 68 Years - William J. Broad, NYT

▶ More Nuclear Power Is What Both Parties Want - Matthew Yglesias, Bloomberg Opinion

▶ The Contribution of High-Skilled Immigrants to Innovation in the United States -Shai Bernstein, Rebecca Diamond, Abhisit Jiranaphawiboon, Timothy McQuade, and Beatriz Pousada

▶ As the world turns back to nuclear power, it should heed the lessons from France - The Economist