📉 Here's what the (likely) upcoming US recession will look like (probably)

Also: My fun conversation with economist Tyler Cowen on 'Talent'

In US Senate testimony earlier today, Federal Reserve Chairman Jerome Powell said it’s “certainly a possibility” the central bank’s inflation-fighting efforts could lead it to raise interest rates high enough to cause a recession.

Hey, I appreciate the candor. But it’s not like I nor probably anyone else is going to need much persuasion here about the risk of a downturn. A few recent headlines from the editors at Bloomberg:

“Musk, Roubini and Goldman Warn of Rising US Recession Risk”

“Deutsche Bank, Citi See 50% Recession Chance as Rates Rise”

“Former NY Fed President Dudley: The US Economy Is Headed for a Hard Landing”

“US Recession This Year Is Now More Likely Than Not: Nomura”

“JPMorgan Strategists Say Stocks Imply 85% Chance of US Recession”

At this point, I’m less interested in guesstimates of recession probabilities than I am in the nature of the likely coming downturn. Question: What do regular Americans think of when they hear the word “recession?” Well, if the cognitive quirk known as “recency bias” has any power, then they probably think of a pretty ugly economic scenario.

The most recent downturn was the COVID-19 recession of 2020, a mini-depression, really. The pandemic and the public health response to it — the IMF, for instance, calls the global downturn that year the “Great Lockdown” — led to the shortest US recession on record, just two months, in March and April. (A reminder that a recession doesn’t require consecutive quarters of contraction.) But though the recession was brief, it was brutal. Real GDP fell by more than 10 percent. (On an annualized basis, second-quarter GDP fell by 31 percent). Employers cut 22 million jobs over those two months as the unemployment rate surged to 14.8 percent, the highest level since the Great Depression of the 1930s. Gross domestic product fell by more than 10 percent.

Then there’s the Great Recession/Global Financial Crisis of 2007–2009. In addition to a shrinking economy and lost jobs, the GR/GFC also led to numerous bank failures and a housing crash, including mass defaults and foreclosures. But then the Great Recession was followed by the Not-So-Great Recovery, a not atypical phenomenon for a downturn accompanied by a financial shock and housing crisis. The headwinds to growth included a decline in household wealth and big price declines in homes and stocks, and household deleveraging, including debt defaults. During the recovery, GDP grew slowly and unemployment fell slowly (though the length of the expansion eventually led to the lowest jobless rates in a half century and real wage growth across the income spectrum.)

Clearly, we’re not going to get a repeat of the COVID-19 recession. (Probably never again unless we get a truly apocalyptic outbreak of the sort seen in the 2011 film Contagion, which we all watched back in early 2020.) Nor is a replay of the Great Recession likely. As my colleague and AEI economist Michael Strain recently told me in an upcoming podcast:

I think it is unlikely that the Fed will be able to engineer a soft landing. I think the odds of a recession at some point in the next 18 months are two-thirds, maybe higher. The severity of that recession is [to be determined]. The argument in favor of a mild recession is that there is no real underlying structural problem in the economy right now. We don't have a situation, for example, where people own more houses than they should. … Housing prices have gone up. [But] housing prices are primarily driven by market fundamentals. Equity prices had also gone up quite a bit. [Those] prices are now down 20 percent, which is probably the more reasonable valuation. Household debt service ratios are low. Household balance sheets are strong. Businesses are profitable. So we are in a situation where we can have a kind of textbook recession: The Fed raises interest rates, that reduces demand, demand goes down, economic output goes down, we're in a recession, unemployment rises, prices moderate.

In a recent analysis, the economics team at Goldman Sachs takes a similar view: “We are not particularly concerned about [a financial crisis] or more broadly about major financial imbalances that would need to slowly unwind in a recession because private sector balance sheets remain robust.” Nor is GS worried that inflation and inflation expectations will stay stubbornly persistent amid rising unemployment, thus delaying monetary easing. GS: “In short, our best guess is that a recession caused by moderate overtightening would be shallow, though we could imagine it dragging on for a little longer than it would with more policy support” such as large fiscal stimulus, which GS sees as unlikely give the probability of divided government after the upcoming midterm elections.

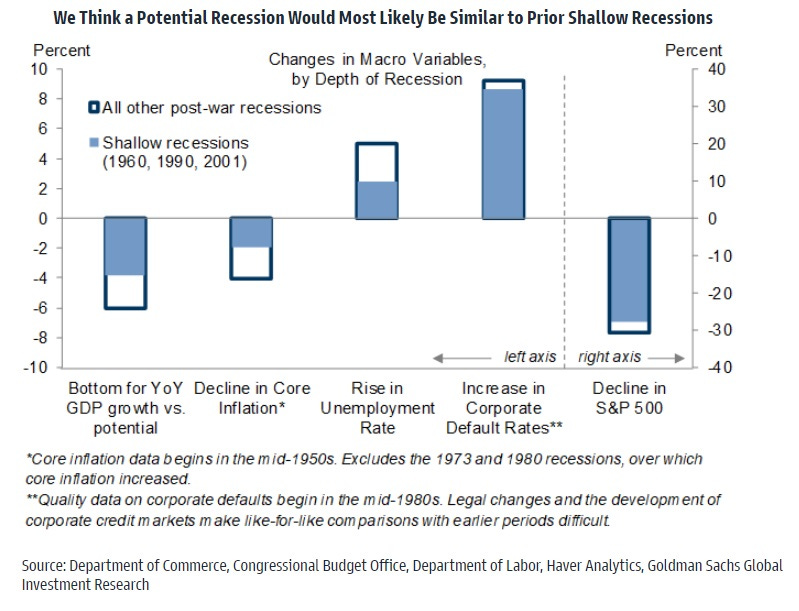

So two problems here: First, a recession is still an economic contraction that will cause job loss. And those losses might feel particularly painful given that we just experienced a mini-depression. Here’s what “shallow” recessions have looked like in the past, according to GS, providing some idea of the severity of a modest downturn today:

Year-on-year real GDP growth bottomed at 3¾pp below potential (which would translate to -2% real GDP growth today).

The unemployment rate rose by about 2½pp.

Default rates have increased by roughly the same amount on average in shallow and deeper recessions.

The S&P 500 has likewise declined by roughly 30% in both shallow and deeper postwar recessions, though this is not much more than the 25% decline that has already been sustained since the January peak.

So we could be looking at an unemployment rate back over 6 percent, if history is a guide. Kind of a bummer, though the lack of financial shock would hopefully mean a recovery would not be slow and grinding. I’ll take rapid, robust, and lengthy. Faster, please!

But I should also note the downside risk here. The world is … kind of a lot, right now. The Fed got really behind the inflation curve, and then came Russia’s brutal and evil invasion of Ukraine and the subsequent rise in oil prices. This is a toxic combo. I’m going to give Strain — who’s absolutely nailed macro forecasting over the past year — the final word here:

My concern is that expectations about future inflation on the part of households and businesses are trending in a bad direction and getting worse relatively quickly. And the Fed can't end the war in Ukraine, and the Fed can't do much at all to affect the global price of oil. But if high oil prices are spooking households and businesses and making households and businesses think that we're going to have inflation for a long time and are affecting [their decisions] … then the Fed may have to slam on the brakes a lot harder than it otherwise would. And if that's happening at a time when demand is already cooling as a consequence of high prices, as a consequence of the steps the Fed has already taken ... the Fed could find itself in a position where in order to get expectations under control it has to increase the unemployment rate significantly higher than it otherwise would.

You can’t say you haven’t been warned. So that’s something.

💡 My conversation with economist Tyler Cowen on Talent

I recently did one of my quirky, wide-ranging — and subscriber-only — 5 Quick Question chats with Tyler Cowen, the George Mason University economist, Bloomberg Opinion columnist, Marginal Revolution blogger, and co-author (along with Daniel Gross) of Talent: How to Identify Energizers, Creatives, and Winners Around the World. (The 5QQ with Tyler, however, was longer than five questions.) But I also recently did a podcast chat with Tyler that was more focused on Talent. Here’s an edited version of that conversation

You define talent as a person’s “creative spark.” Can we create creative people, or is it innate?

A great deal of talent can be developed. Look at how many talented individuals are coming right now from India and South Asia. Far, far more than was the case 40 years ago. It’s the same basic set of people, right? But they have better education systems, better nutrition, more internet access, and so on.

It’s not just about cognitive ability and IQ tests, right?

Energy is extremely important. Persistence, the ability to work together with other people, the ability to look at a complex social structure and figure out how it operates: All those factors are at least as important as intelligence.

Google used to be famous for asking bizarre questions of candidates — “How many golf balls could fit into a bus?” or “Create an evacuation plan for San Francisco” — where there was no right answer. Is there any value to these sorts of questions?

There’s a very, very narrow set of jobs—some of them do seem to be at quant hedge funds—where the ability to pose people very specific mathematical questions is of value. But for the most part, it’s not a valuable interview technique. We steer people away from it in our book.

Is trying to find people with creative spark the same as people thinking outside the box?

A lot of creative spark actually is thinking very well inside the box, or just seeing what the box is, or choosing the right box. There are brilliant people who play chess, but unless you’re, say, in the world’s top 10, your career is probably a big mistake. You might have creative chess moves, but you’re focused on the wrong box. So a lot of what we talk about in the book is, how do you find people who understand what the box is?

Is there a quantitative or Moneyball kind of way of looking at talent where you can run the numbers in some fashion?

For some jobs, that is significant. For instance, in sports — you referenced Moneyball — you actually have data, even for people who are doing well in collegiate sports. Typically, they’re taped; there’s statistics. But for most actual jobs where you’re hiring, if anything, I think there’s too much emphasis on data. If you’re hiring a young writer, of course you might ask, “Well, how many people have read your blog?” Or “How many Twitter followers do you have?” But you’re looking for potential. Everyone else sees those numbers, too. You’re looking for the people who are going to be better in five years than right now. So just ask them a question like, “What is it you do to practice every day?” If they don’t do anything to practice every day, maybe you’re not going to be that much better. If they have a convincing, detail-oriented answer about their practice habits, now you’re onto something.

The Houston Astros at one point several years ago basically got rid of almost all their scouts. They cut them by like three-fourths and decided just to go to videotape and data. Then three years later, they started hiring scouts back again. They found out that they were missing something about these players. Just having lots of high-def video, and there’s more statistics than ever . . . They can gauge the spin and everything on the baseball and their sprint speed. That wasn’t enough.

Look at the Philadelphia 76ers, one of the most quantitative teams in the NBA. Well, they stuck with Ben Simmons for too long. Though, he is in a way a remarkable talent. They got rid of Jimmy Butler, who’s just been phenomenal since he left. So I think everyone understood the athletic abilities of those players at the time and now, but the difference in determination and sticking with it has made all the difference between Jimmy Butler and Ben Simmons. So that’s another case where the numbers don’t tell you everything. On net we end up steering people away from the numbers, noting that in some specialized sectors, sales would be one example, they’re very useful. “How much did you sell?” It’s not the only question, but surely it is relevant for assessing a salesperson.

Do we have any idea what better talent acquisition and talent allocation would mean both for companies and for the economy in general?

Well, for the economy in general, I would like to see much higher levels of immigration into the United States. I know people like to say more high-skilled immigration. That’s fine, but I would just stress the best way to get more high-skilled people is to let in what are called both high-skilled and low-skilled people. The history of US immigration has been that we don’t have a skills-based requirement for general immigration, and we end up taking in a lot of highly ambitious, often less educated people who do wonderful things. So at the national level, that’s what I’d like to see.

At the institutional level, I think we are far too credentialist. We are far too bureaucratized. We don’t give young people enough chances. If you go back to the middle of the 20th century, you have American universities like University of Chicago: the university president, I think, was 28 years old. He did a great job. That is just impossible to happen today. But we know 28-year-olds can run great companies, not that most of them can. So we should have a world where it is possible for a brilliant 28-year-old to be president of the university. That is not the world we live in.

One of the quotes from the book that’s sort of getting a little internet buzz is the quote, “Personality is revealed on the weekends.” What do you mean by that?

That shows who you really are. When you get home on Saturday, Sunday, it’s what you really want to do. It is a sign of your motivation Monday through Friday and how keen you are to improve yourself. So it does reveal your personality, and for the better. So there are plenty of people who do what they’re told nine through five, Monday through Friday, and they can be good hires for a wide variety of jobs, but their leadership potential, their upward mobility, it’s quite limited. And in our world of ideas, they are very often not the people I want to be hiring.

I often hear that too much talent has gone to Wall Street. Do you agree with that criticism?

I don’t think there’s any simple way you can show that with actual evidence. If someone becomes a quant in a hedge fund and is highly successful, obviously they’ll earn a lot of money. How good would they have been at the next best thing, other than being a quant at a big tech firm? I don’t feel I have a very solid answer to that question, but it reminds me a bit of chess players. There are some phenomenal chess players I’ve known, and they’re not also fantastic at doing other things, even though they are highly intelligent and you have to work hard to become a top chess grandmaster. So I would be agnostic on that, but people simply assume it’s a huge problem. I think they have this limited notion of talent that if you drain that particular bunch of people away from the economy, all the rest of us are stupid and feckless. And we’re hopeless, and we can’t run a decent furniture factory in Cincinnati or something. I’m pretty skeptical there. I’m still waiting to see the core evidence.

What do you think motivates the talented? Is it building something, accomplishing something? Is it money? Any thoughts?

All of the above in a bundled package. I sometimes say, if you’re looking for drummers, well, you could look for someone who wants to be the greatest drummer in the world. That’s a pretty strong ambition. Maybe that’s a positive sign. But most of all, look for someone who loves to drum. That’s the person who will become the greatest drummer in the world.

Tyler, I’m not against a good gimmick. You have a couple pages with sample interview questions. I’m just going to ask you one: Which of your beliefs are you most likely wrong about?

If you ask what I would consider my intelligent friends and peers, the belief of mine they make fun of the most often is I think there’s a very good chance that the Navy UAP — or UFO, we used to call it—that data actually represents alien drone probes that have been sent to us. I think it’s well below 50 percent, but I think the chance is 10 percent or maybe a bit more. They all think I’m wrong. They’re pretty smart, so that would be my pick.

Thanks for reading this far! Just a quick note for first-time visitors and free subscribers. In my twice-weekly issues for paid subscribers, I typically also include a short, sharp Q&A with an interesting thinker, in addition to a long-read essay. Here are some recent examples of those interviewees:

Economist Tyler Cowen on innovation, China, talent, and Elon Musk

Existential risk expert Toby Ord on humanity’s precarious future

Silicon Valley historian Margaret O’Mara on the rise of Silicon Valley

Innovation expert Matt Ridley on rational optimism and how innovation works

More From Less author Andrew McAfee on economic growth and the environment

A Culture of Growth author and economic historian Joel Mokyr on the origins of economic growth

Physicist and The Star Builders author Arthur Turrell on the state of nuclear fusion

Economist Stan Veuger on the social and political impact of the China trade shock

AI expert Avi Goldfarb on machine learning as a general purpose technology

Researcher Alec Stapp on accelerating progress through public policy