🚀 Elon Musk could become the world's first trillionaire. And that's OK.

It's a great thing that the US economy can generate tremendous entrepreneurial wealth from technological innovation

One of the articles in the recent “Money Issue” of The New York Times Magazine tries to calculate just how many American billionaires there are: “Forbes thinks there are 735 of them in America. Another count finds 927. Whatever the answer, the mystery is revealing — and the number is growing rapidly.”

Yes, reporter Willy Staley does try to parse the differences between how Forbes, Bloomberg, and a research company called Wealth-X all try to tally the super-rich of the USA. But the piece’s deeper purpose is to persuade Times readers that any number of billionaires greater than zero is probably a bad thing. Here are a few snippets that give the flavor of Staley’s prose — and perhaps politics:

As the ultrawealthy have multiplied, some Americans have drifted toward a sort of billionaire Gnosticism, a sense that we live in a fallen world run by a demonic group of plutocrats. … But you don’t need to think of any individual billionaire as evil to find the sheer concentration of power they have disturbing. ... The issue with billionaires is not that they’re sociopaths, though certainly some are. … And until something changes, we will live in a nation that is substantially warped by the gravity of their fortunes.

It’s almost as if when Staley thinks of billionaires, he thinks of them as a demonic group of evil, sociopathic plutocrats who are substantially warping America in the worst way possible. One wonders how a future “Money Issue” of The New York Times Magazine will handle things if Elon Musk (currently worth $261 billion and change) becomes a trillionaire. (Actually, I think I can make an educated guess.) Because it could happen — and before we reach decade’s end. (Boilerplate: I do not approve of everything Elon Musk does or says, especially on Twitter. And I don’t listen to Joe Rogan.)

Now there’s never been an individual trillionaire in the age of modern capitalism. (We’re going to set aside figures from the distant past such as Caesar Augustus, Genghis Kahn, and the Emperor Shenzong, as well as the Saudi royal family of today.) It’s even hard to find a fictional trillionaire. Neither Scrooge McDuck nor Tony Stark come close to qualifying, apparently. Oddly, real-world richies are generally a lot richer than their counterparts in film, television, and books — comic or otherwise. One that does come to mind, however, is Lady Trieu from the 2019 HBO mini-series Watchmen. She’s CEO of Saigon-based Trieu Industries, a conglomerate that specializes in biotechnology, energy, and nanotechnology. Unsurprisingly, Lady Trieu is not the hero of Watchmen. And to be honest, she is a bit of a sociopath intent on warping America in the worst way possible.

It wouldn’t be surprising if Musk were treated as a supervillain, too, especially since the media is already calling him a “supervillain.” Yet should he hit the trillion-dollar level in personal wealth, it won’t be because he extorted world leaders with a diabolical superweapon or became an autocrat who treated his country as his own personal piggy bank (or benefitted from an autocrat privatizing some national industry and then handing it over to him, Russian oligarch style). Musk would almost certainly become a trillionaire by taking two valuable companies that he’s been running for nearly two decades and making them even more valuable over the next decade or so.

Autonomously driving to trillionaire status

For example: Musk currently owns about a fifth of Tesla (Actually, 17 percent, but we’re going to try to keep the math simple.) So a roughly $200 billion stake given the company’s current trillion-dollar market valuation. Recently, investment firm Ark Management published a research note outlining scenarios for the stock to quadruple or even quintuple by 2026. Key to this big valuation increase is the firm’s expectation of Tesla developing a huge robotaxi business — a predicted $11 trillion to $12 trillion market — that would contribute 60 percent to Tesla’s expected future value.

From the Ark note:

We also have updated how the robotaxi business feeds into the model, reflecting our increased conviction in Tesla’s ability to achieve full self-driving. The question is when. Whereas our previous downside case assumed that Tesla would never launch autonomous ride-hailing, our updated downside case assumes launch in 2026, four years later than Elon Musk expects. Bolstering our current view are not only the commercial launches of Waymo and Cruise but also fundamental advances in AI. … The midpoint of our assumptions, as shown in the chart below, suggests that Tesla will commercialize autonomous ride-hail in 2024. In 9% of our model cases, however, Tesla does not commercialize robotaxis within our five-year window. Even in cases where robotaxi does commercialize within the forecast window, our modeled financial results for Tesla are highly sensitive to the year of launch, as described below.

This forecast might be all wrong. And some Tesla watchers find it wildly bullish. But should things play out as Ark speculates is possible, Musk might already be roughly four-fifths of the way to becoming a trillionaire in four or five years based on Tesla alone. This is key: He would get there by his company grabbing a big chunk of a new market — one created through technological progress — with huge potential environmental and safety benefits.

What’s more, Musk and Tesla would be passing the market capitalist test, not the crony capitalist one, by out-competing rivals such as legacy automakers Ford and Honda, and new players like Rivian. (The Biden White House seems to avoid acknowledging that Tesla exists. So no favors there.) As JPMorgan describes the company: “[Tesla] products are bold, distinctive, elegant, and highly entertaining to drive. The company is led by visionary leadership, backed by a management team with solid functional strength.” That bit about “visionary leadership” refers to a certain supervillain immigrant.

Rocketing to historic wealth

Then there’s satellite broadband and rocket company SpaceX, currently valued at around $100 billion after a secondary share sale. What might it be worth five or 10 years from now? One way to approach that question is by looking at potential market size. For instance: Bank of America expects the growing space economy — including space launches and satellite internet — will more than triple in size over the next decade to become a $1.4 trillion market. What chunk might SpaceX grab? Impossible to know, of course. But I would point to a 2021 Morgan Stanley investor survey where nearly two-thirds thought SpaceX might be a better long-term investment than Tesla:

“From our investor conversations, the sentiment on SpaceX has increased substantially along with the company’s valuation in the private market,” Morgan Stanley analyst Adam Jonas said. Jonas said that “investors are beginning to appreciate the potentially wide-ranging use-cases for SpaceX’s reusable launch architecture across communications, transportation, earth observation and other space-related domains.” SpaceX is “clearly seen” as the “Apex Player” in the global space industry, Jonas said. The sentiment shows in its soaring valuation, which makes it the second-most valuable private company in the world, according to CB Insights. The company’s valuation has spiked in the last few years as SpaceX has raised billions to fund work on two capital-intensive projects: Starship and Starlink.

Of course, a lot of that optimism might already be built into the valuation. But space is also an industry sector with an extraordinary number of unknowns. No one is even sure what the most valuable space economy application will be over the long run, much less how valuable it will be. (For more on the future of the space economy, I highly recommend this chat with several industry executives that I conducted last year.)

I just heard that journalist Walter Isaacson is writing a biography of Musk. If the entrepreneur ends up playing a significant role in cleanly electrifying the world’s largest economy and creating a space economy — not to mention a permanent human presence on the Moon, Mars, and beyond — he appropriately belongs in the company of other Isaacson subjects Benjamin Franklin, Steve Jobs, Albert Einstein, and Leonardo Da Vinci. Indeed, he would arguably be a more important historical figure than any of them.

If not Elon, maybe somebody else

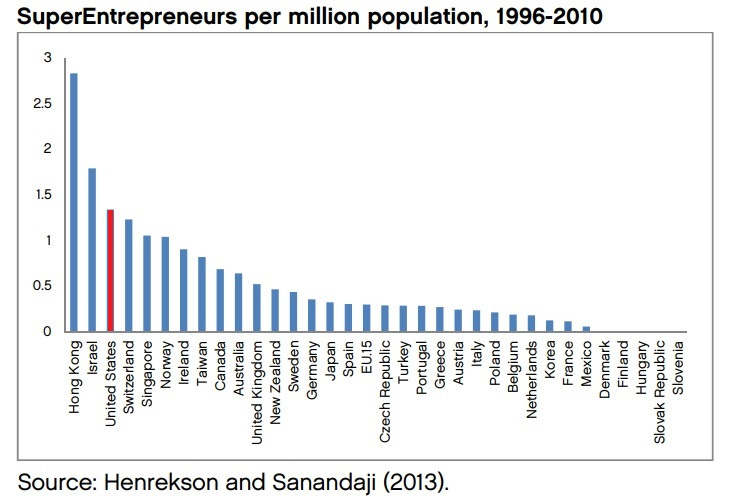

Then again, maybe Musk fails. Maybe the first American trillionaire is Jeff Bezos or one of the Google guys. Or maybe it will be the head of a nuclear fusion or genetic editing company. But the ability of the American economy to generate lots of superrich people who get that way by starting and building businesses that sell highly valued goods and services is one of its economic superpowers.

Any economy that can produce entrepreneur billionaires is revealing something really positive about itself. As journalist Will Wilkinson wrote in a 2019 NYT column that the editors of the NYT magazine “Money Issue” might want to check out: “Inspect any credible international ranking of countries by democratic quality, equal treatment under the law or level of personal freedom. You’ll find the same passel of billionaire-tolerant states again and again. If there are billionaires in all the places where people flourish best, why think getting rid of them will make things go better?”

Now imagine if Musk buys Twitter and turns it into the first social media platform to effectively balance free speech with responsible content moderation. Maybe Twitter becomes as valuable as Facebook — and Musk becomes a trillionaire, twice over. Seems like a good outcome to me.

Thanks for reading this far! Just a quick note for first-time visitors and free subscribers. In my twice weekly issues for paid subscribers, I typically also include a short, sharp Q&A with an interesting thinker, in addition to a long-read essay. Here are some recent examples:

Silicon Valley historian Margaret O’Mara on the rise of Silicon Valley

Innovation expert Matt Ridley on rational optimism and how innovation works

Existential risk expert Toby Ord on humanity’s precarious future

More From Less author Andrew McAfee on economic growth and the environment

A Culture of Growth author and economic historian Joel Mokyr on economic growth

Physicist and The Star Builders author Arthur Turrell on the state of nuclear fusion

Economist Stan Veuger on the social and political impact of the China trade shock

Researcher Alec Stapp on accelerating progress through public policy