🤖 Will the Next Big Thing be (finally) humanoid robots?

Also: 5 Quick Questions for … AEI scholar Chris Miller on the geopolitics and economics of semiconductors

➡ Reminder: I will be writing much less frequently and much shorter in November — and November only. So for this month, I have paused payment from paid subscribers.

Also, I’m making all new content free without a paywall. In December, however, everything will be back to normal: typically three meaty essays and two enlightening Q&As a week, along with a pro-progress podcast several times a month (including transcript). And, of course, a weekly recap over the weekends.

Melior Mundus

In This Issue

The Essay: Will the Next Big Thing be (finally) humanoid robots?

5QQ: 5 Quick Questions for … AEI scholar Chris Miller on the geopolitics and economics of semiconductors

Micro Reads: Flying taxis, Africa and energy, SpaceX, and more

Quote of the Issue

“The world of the future will be an even more demanding struggle against the limitations of our intelligence, not a comfortable hammock in which we can lie down to be waited upon by our robot slaves.” - Norbert Wiener, The Human Use of Human Beings: Cybernetics and Society

The Mini-Essay

🤖 Will the Next Big Thing be (finally) humanoid robots?

Hey, what’s the Next Big Thing? Well, there’s a pretty strong case that the Last Big Thing was Apple’s iPhone, arguably the most popular consumer product of all time. Or let’s put it more broadly, the smartphone. It’s almost as if to be a human in the third decade of the 21st century is to own The One Device.

A Next Big Thing could be pretty darn popular and not be as popular as the smartphone — and yet qualify as a Next Big Thing. With that caveat, here’s what Goldman Sachs thinks might be the Next Big Thing worthy of being mentioned in the same breath as the smartphone and automobile, at least the electric sort:

That’s right, the Wall Street bank has big dreams for the potential of Optimus, Tesla’s humanoid robot project, and the technology more broadly. The concept for what was first referred to as the “Tesla Bot,” was first introduced at Tesla’s AI Day in August 2021. And as its recent AI Day in September, the company unveiled the prototype and plan for commercialization starting next year. “Our goal is to make a useful humanoid robot as quickly as possible,” Musk said at the event. “Optimus is designed to be an extremely capable robot made in very high volume, probably ultimately millions of units, and is expected to cost much less than a car.”

There’s enough there there for GS to write a new report “The investment case for humanoid robots” (boldface by me) in partnership with a Chinese investment firm:

The investment case for humanoid robots is sizable – we estimate that in 10-15 years a market size of at least US$6bn is achievable to fill 4% of the US manufacturing labor shortage gap by 2030E and 2% of global elderly care demand by 2035E. Should the hurdles of product design, use case, technology, affordability and wide public acceptance be completely overcome, we envision a market of up to US$154bn by 2035E in a blue-sky scenario (close to that of the global EV market and one-third the global smartphone market as of 2021), which suggests labor shortage issues such as for manufacturing and elderly care can be solved to a large extent. With the supply chain likely evolving from robotics/automation, AI, self-driving, etc, we believe the best investment plays at this stage are motion components

Yeah, there are a still lot of technical problems that need solving before there is a roughly $150 billion market by 2035. And the products need to be sold at a price that makes replacing workers worth the cost. On the potential “payback period,” which is derived from Tesla’s automobile manufacturing experience:

According to Payscale, the average hourly wage for a Tesla factory worker is US$23.75, who can work roughly 8 hours a day. Tesla Bot will be trained in the factory over the next few months to a year, to find initial use cases. It will take time for the robot to get trained and be equipped with more job functions, thus increasing its daily working hours to a maximum of 20 hours a day (saving roughly 4 hours a day for charging). With limited functions now, the payback period is very long . But at 20 hours a day (implying 2.5 times higher productivity than a worker), a humanoid robot can reach a payback period of two years by 2025-26E, indicating feasibility for commercialization. The bottlenecks for commercialization lie in the progress of prototype training and testing, for the humanoid robot to prove its usability around the factory.

Assumptions: We assume the base case unit costs of US$250k (by calculating the bill of materials should Tesla purchase mid-to-high end components at market prices for very small volumes) at -15% cost reduction p.a. and for the bull case, we assume unit costs of US$50k (by calculating the bill of materials should Tesla purchase those components at a much cheaper price leveraging the broader vehicle procurement team), at a -20% cost reduction (-20% for Tesla vehicles). As for the increase in humanoid robots’ productivity, we set the bull case as the functions of the robots’ growing exponentially, and the bear case with the functions growing steadily and the working hours growing by one hour each year.

Again, GS calls this a “blue sky” scenario. A step below is a mere “bull case” where a million units a year are sold by 2035 instead of 2030. Definitely still pretty blue, I think. Of course, the whole plan could get dropped. Consider, as the report notes, that “in the history of humanoid robot development, no robots have been successfully commercialized yet.”

That’s right, all those viral videos of humanoid robots doing indoor parkour does not a market make. But the market demand for labor certainly provides an incentive for innovation here. Who’s going to take care of us when we get old, especially if the “we” is folks in countries that are older with lower birthrates than America? GS:

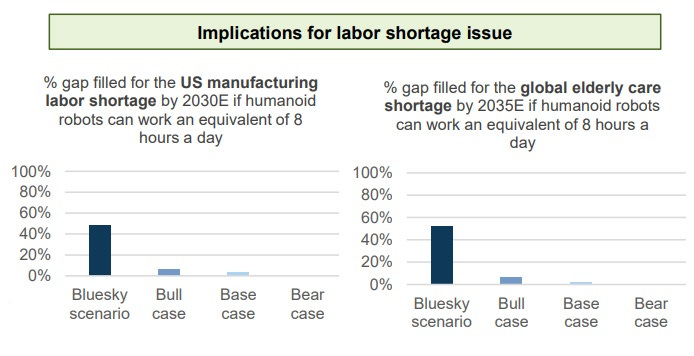

Our forecast implies the labor shortage gap (with the US as the test) could be 48%-126% filled by 2030E under the blue-sky scenario, if humanoids can work an equivalent of 8hrs/20hrs a day, vs only 4%-9% in our base case. While on the global elderly caregiver demand gap, our forecast under the blue-sky scenario implies it could be 53% filled by 2035E vs only 2% in our base case.

And it’s not just caregivers, but factor workers, too, of course. GS:

We think certain factory applications could be the starting point for the commercialization of humanoid robots: There are fewer scenario variations encountered in the factory (vs. consumer-facing scenarios) and it's easier for the robots to take on repetitive tasks; however, humanoid robots could potentially achieve more functions than the existing form of industrial robots and could smoothly ease into the existing infrastructure.

One reason GS is even contemplating such a rosy scenario is that something like Optimus wouldn’t be a started-from-scratch technology. GS: “Humanoid robot technologies are not revolutionary but rather an evolution of existing applications (industrial robots, autonomous driving, etc) with more complex integration.” But there’s a long way to go. For example: Musk said is being designed with a market price of just under $20,000 per unit in mind. But none of the component suppliers GS spoke “thought that such a cost disruptive product as a US$20K humanoid robot was achievable using current technologies.” The bank’s response:

Early adoption of deep learning / autonomous technologies by robotics industries has already happened. One interesting point is that many start-up companies in this are failed to access the mass-addressable market, as they were not able to reduce the costs. This is because the level of AI needed in the manufacturing process is rather specific, and cost reduction is the most critical catalyst for its users. The US$20K target makes sense to us, yet we believe this would only be achievable if Tesla’s autonomous related technologies can sufficiently reduce the use of hardware components (sensors, axis, with the software playing the key role).

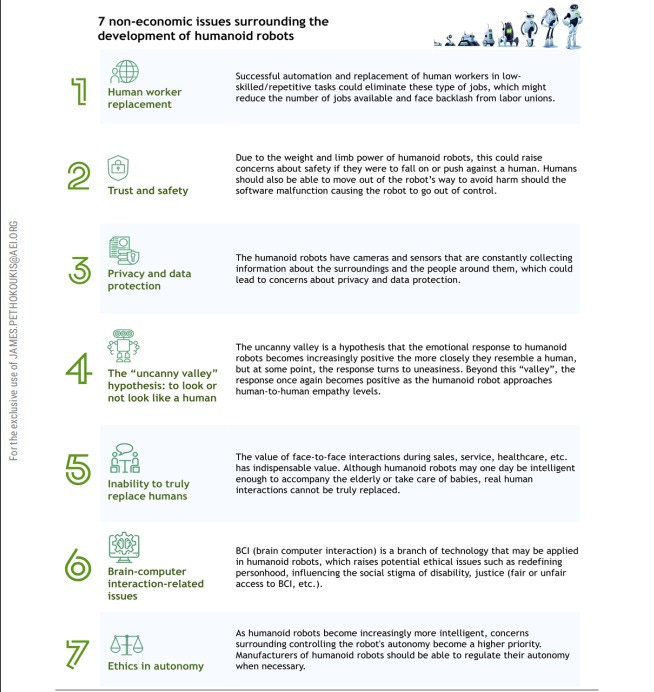

But the economics humanoid robots themselves are hardly the only problem, as this graphic suggests:

This is why I talk about a pro-progress culture. My guess is that the Down Wing media will focus far more on these “non-economic issue” rather than the advancement of the technology itself and its positive potential. Hope I’m wrong.

5QQ

💡 5 Quick Questions for … AEI scholar Chris Miller on the geopolitics and economics of semiconductors

The creation of the microchip is at the center of many themes that appear in this newsletter: the unplanned (and not easily replicated) rise of Silicon Valley, the economic gains ushered in by the ubiquity of computers, and the possibility of an AI productivity surge in the coming years, to name a few. But semiconductors also play a key role in today’s debates about industrial policy, government technology strategy, and national security. A new book says this about the importance of the chips that power our devices: “[S]emiconductors have defined the world we live in, determining the shape of international politics, the structure of the world economy, and the balance of military power.” Here’s my 5QQ with the author.

Chris Miller is a Jeane Kirkpatrick Visiting Fellow at the American Enterprise Institute and author of the new book, Chip War: The Fight for the World’s Most Critical Technology.

1/ As the US looks to stay competitive in the chip space, what lessons should we draw from the history of the development of the microchip?

Today, all manner of devices depend on chips, from microwaves to automobiles to smartphones. Chips have spread across the economy, providing computing power to these devices, only because it has been economically viable to do so. Scientific advances alone weren't enough to turn an invention into a society-transforming technology. It was only because companies were able to find profitable businesses manufacturing chips by the millions that they've had such a transformative impact. Government can play a role in funding science and technology development, but it takes companies to scale technologies and distribute them across society.

2/ In your book you argue that geopolitically microchips have become the new oil. How does that illustration help us understand the importance of chips? What are the limitations of that analogy?

Oil is often considered a "strategic" commodity because a small number of countries can, if they choose to cut supply, drive up oil prices and exert a major impact on other countries' economies. Saudi Arabia is the best example — the Saudis have used this capability repeatedly for political aims. The chip industry is no less important than oil to the functioning of modern economies, but production is even more concentrated. Taiwan, for example, produces over a third of the new computing power the world consumes each year — a far greater market share than the Saudis have in oil.

3/ To what extent should we view the coming "chip war" between the US and China as a competition between state planning and market capitalism?

The US-China chip war is partly a competition between state planning and market capitalism. But its more complex than this. China has managed to adapt some market mechanisms in its state planning system, which has helped it avoid some of the worst errors of Soviet-style state socialism. On top of this, Chinese firms often compete in the same global markets as Western market-oriented firms, but they have access to highly subsidized capital investment whereas Western firms don't. So in many ways it is an uneven playing field between Chinese and Western firms.

4/ What principles should guide policymakers in Washington as they craft policy to further our chip-making capacity?

I think there is a strong national security rationale to reducing our reliance on chipmaking capacity in geopolitical hotspots in East Asia, above all, in Taiwan. This isn't about economic efficiency, this is about preparing for a potential crisis. Given that 90 percent of the world's most advanced processor chips are produced in Taiwan, we have little margin for error in beginning to prepare.

5/ Why does Taiwan have such an edge in chipmaking? How can we learn from their success?

Taiwan's biggest chip firm, TSMC, has grown to become the world's biggest chipmaker for several reasons. First, it was founded with an innovative business model. Before its founding, almost all companies designed and manufactured their chips in house. TSMC aimed only to manufacture chips, allowing other companies to specialize in design. This let TSMC acquire a large array of customers and fabricate far more chips than competitors, producing dramatic economies of scale. In addition, TSMC benefitted from a supportive government, which provided generous tax incentives for investment — a crucial factor in such a capital intensive industry. Finally, TSMC executed flawlessly on its business, earning a reputation for excellent customer service alongside top-notch technology. TSMC's rise is a reminder that tech companies' fate doesn't only depend on having the best technology, but also the best business model.

Micro Reads

▶ When Will Flying Taxis Get Off the Ground? The CEO of Boeing-Backed Wisk Aero Has Some Ideas. - Andrew Tangel, The Wall Street | “Are these flying taxis for real? And when are we going to see these commonly in U.S. cities?” Yes, they are for real. The large regulatory authorities have strong initiatives to bring these services to market. There are a lot of entrants in the space, and a lot of people say that they’re going to build something. To me, it’s like the early auto industry. It’s just not possible there are going to be 200 companies that actually survive and build a full-scale airplane that gets certified for flight in the U.S. or flight in Europe. There are many serious, credible players, and this market will absolutely happen. Maybe 2025 is the first time you might see a piloted version of an air taxi that enters the market. But it’s 2025 to the end of the decade when you’ll start to see all the action.

▶ Africa will remain poor unless it uses more energy - The Economist | In the rich world the big energy challenge is how to make the supply cleaner. In Africa the problem is how to generate more energy. Average consumption per person in sub-Saharan Africa, excluding South Africa, is a mere 185 kilowatt-hours (kWh) a year, compared with about 6,500kWh in Europe and 12,700kWh in America. An American fridge uses more electricity than a typical African person. Low energy use is a consequence of poverty; but it is also a cause of it. If Africa is to grow richer it will need to use a lot more energy, including fossil fuels. Yet its efforts to do so put it on a collision course with hypocritical rich countries. The rich world is happy to import fossil fuels for its own use, while at the same time restricting public financing for African gas projects intended for domestic use. “Is the West saying Africa should remain undeveloped?” fumes Matthew Opoku Prempeh, Ghana’s energy minister.

▶ SpaceX is now building a Raptor engine a day, NASA says - Eric Berger, Ars Technica | The Raptor rocket engine is crucial to Starship's success. Thirty-three of these Raptor 2 engines power the Super Heavy booster that serves as the vehicle's first stage, and six more are used by the Starship upper stage. For a successful lunar mission, these engines will need to re-light successfully on the surface of the Moon to carry astronauts back to orbit inside Starship. If the engines fail, the astronauts will probably die. "SpaceX has moved very quickly on development," Mark Kirasich, NASA's deputy associate administrator who oversees the development of Artemis missions to the Moon, said about Raptor. "We've seen them manufacture what was called Raptor 1.0. They have since upgraded to Raptor 2.0 that first of all increases performance and thrust and secondly reduces the amount of parts, reducing the amount of time to manufacture and test. They build these things very fast. Their goal was seven engines a week, and they hit that about a quarter ago. So they are now building seven engines a week."

▶ The fractured land hypothesis: Why China is Unified but Europe is not - Jesus Fernandez-Villaverde Mark Koyama Youhong Lin Tuan-Hwee Sng, VoxEU | Western Europe is characterised by politically fragmented states, while China is dominated by political centralisation. A leading explanation for this divergence is the ‘fractured land’ hypothesis, whereby natural barriers precluded the development of large empires in Europe. This column models the dynamic process of state-building and explores how fractured land shaped inter-state competition in unexpected, non-linear ways. Simulating the model between 1000 BCE and 1500 CE, it can replicate the fragmentation of Europe and the consolidation of China. Modified versions of the model can predict patterns of development in the Americas and Africa, while future extensions could try to disentangle the importance of culture and religion versus geography.

We will be diving into this topic as well in the coming weeks. Bipedal machines have existed for some time. The difference, I think, in Tesla's approach lies in the AI component and design/manufacturing approach, which we explored here: https://www.lianeon.org/p/a-five-step-approach-to-problem-solving

In a world beset by labor shortages, and aging population, Tesla might be onto something. I don't think that these machines would result in net jobs loss. Automation, throughout history, has paradoxically created more jobs, not less.

Great. Cheaper labor for manufacturers, more profit for shareholders - and more people in tents under the freeways.

So clever these robots: but can someone maybe build me a properly programmable washer first ?