⏰ When will the Next Big Thing arrive?

Also: 5 Quick Questions for . . . economist Michael Strain (part two)

“There is nothing stable in the world; uproar’s your only music.” - Joseph Schumpeter

In This Issue

Long Read: When will the Next Big Thing arrive?

5QQ: 5 Quick Questions for . . . economist Michael Strain (part two)

Micro Reads: Productivity growth, nuclear Europe, geoengineering, and more …

Nano Reads

Long Read

⏭ When will the Next Big Thing arrive?

Forget about just wondering, “Where’s my flying car?” What about “Where’s my self-driving car?” Or “Where’s my quantum computer?” Or “Where’s my supersmart AI?” Or “Where’s my CRISPR cure?” Or, do I even dare ask, “Where’s my dang hyperloop?”

It’s the lack of those technological marvels and others that has The New York Times asking its own pointed question: “Why Is Silicon Valley Still Waiting for the Next Big Thing?” The recent piece by reporter Cade Metz then proceeds to offer a couple of pretty reasonable answers that might satisfy most entrepreneurs, scientific historians, and technologists. The less important explanation concerns the indefatigable optimism that is the warp and woof of Silicon Valley and the American tech sector. What critics dismiss as “hype” serves an important function: It attracts talent and money as tech is being developed. It then generates acceptance and interest among a public that will eventually need to use these gadgets. So we get Elon Musk promising a million fully autonomous Teslas on the road in 2020. (Spoiler: It’s now 2022.)

The more important explanation concerns the nature of many recent notable Silicon Valley innovations. They’re mostly not gadgets — with the exception of the most valuable gadget of all time, Apple’s iPhone. Advances in software, whether improving internet search technology or a cool new app, don’t require pushing the known boundaries of physics or hurdling numerous regulatory obstacles. In other words, the “atoms” versus “bits” dichotomy. Building a metaverse isn’t easy, of course, but the challenges are different than building a nuclear fusion reactor or orbital hotel. The American Innovation System should be able to do both sorts of things, as venture capitalist Marc Andreessen argued in his influential 2020 essay, “It’s time to build.”

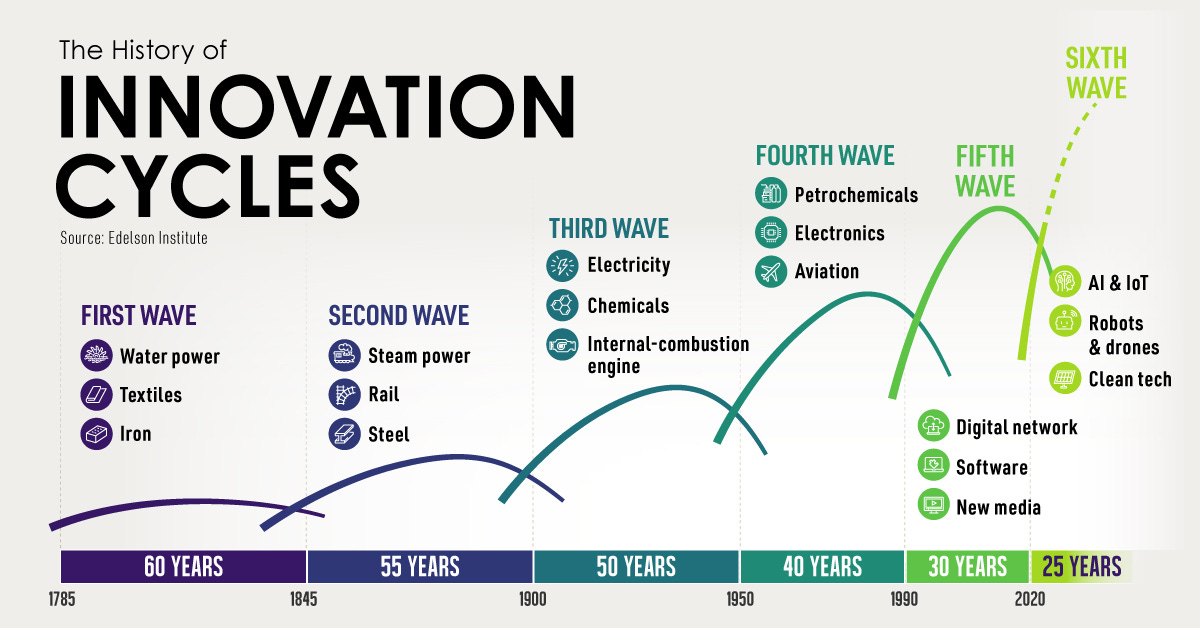

Explaining the sometimes excruciating wait for the Next Big Thing is hardly a phenomenon of only the Internet Era. The problem has long preoccupied economists, often as part of their explorations as to why sometimes economies boom and sometimes they go bust. Some scholars saw the global economy subject to long, inexorable cycles or waves of regular duration, driven by technological progress.

Building upon the work of Russian theorist Nikolai Kondratieff, the Austrian economist Joseph Schumpeter suggested the existence of 40- to 60-year “Kondratieff waves” where “swarms” of innovations would regularly disrupt an economy’s “circular flow” through the “creative destruction” of existing firms. Such disturbances are propel capitalist economies forward. “Stabilized capitalism is a contradiction in terms,” Schumpeter writes in the 1939 two-volume Business Cycles: A Theoretical, Historical, And Statistical Analysis of the Capitalist Process.

Schumpeter’s view of technology and business cycles receives a modern update from economist Carlota Perez in her neo-Schumpeterian 2002 book Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Perez analyzes the 200-year relationship between major technological innovations and financial cycles. She explains that key innovations — textile production in the 1770s, steam and railways in the 1830s, steel and electricity in the 1870s, automobiles and oil in the 1910s, and information technology in the 1970s — proceed through multi-decades cycles, each separated into four phases: “irruption,” frenzy, synergy, and maturity.

A more orthodox view of technological waves and the economy comes from Northwestern University’s Robert Gordon. In his award-winning 2017 magnum opus The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War, Gordon sees American economic history as “one big wave” with a “unique clustering” of foundational “Great Inventions” in the late 19th century — electrification of work and home, the internal combustion engine, chemicals, and telecommunications — leading to a “Special Century” of rapid productivity growth from roughly 1870 to 1970. In short, some inventions are more important than others.

For the purposes of this essay, however, I am less concerned about how clusters of innovation drive economic cycles or waves of productivity growth than what explains the irregular nature of innovation — the episodic “clustering” Gordon mentions. Why after a long interregnum, do Next Big Things often come in bunches?

That’s exactly the question asked by Swedish economist Ola Olsson in his 2001 paper “Why Does Technology Advance in Cycles?” And the answer might center around what Olsson calls “technological opportunity.” He explains his basic model this way:

As technological opportunity becomes exhausted, profits and income growth rates diminish. Eventually, profits from incremental innovation fall below expected profits from highly risky and costly drastic innovations. Entrepreneurs then switch to drastic innovation, which introduces new areas of technological opportunity and a new technological paradigm. When technological opportunity once again is abundant, incremental innovation resumes and growth rates increase. In this way, development proceeds in long waves of varying duration and intensity. The fundamental determinants of the economy’s behaviour are the capacity of a society to exploit existing technological opportunity and its system of rewards for drastic innovation.

So in addition to the explanations in that New York Times piece, let me offer this possible additional one based on Olsson’s scholarship: The past decade in America has seen the gradual exhaustion of opportunities in social media and in apps that transform offline businesses into online businesses. “Uber for X” became tiresome several years ago. And slowly over the period, the opportunity from incremental innovations waned while the potential from more drastic innovations gained. (Certainly, one could view Facebook’s decision to bet big on the metaverse as one sign of this shift.)

If so, we are in a period supportive of the Next Big Thing arriving sooner rather than later.

A further bit of evidence is the emergence of “deep tech” venture capital funds, also known as “frontier funds.” These funds tend to specialize in “hard” tech startups based on science-driven and research-fueled innovation in sectors such as robotics, life sciences, and space. According to a Boston Consulting Group analysis, 83 percent of deep tech ventures are designing and building a physical product. BCG also notes that the amount of capital plowed into deep tech has grown fourfold, from $15 billion in 2016 to more than $60 billion in 2020. ( For more, I recommend my podcast chat with Ramez Naam and Christie Iacomini of Prime Movers Lab where we discuss their bold vision for tomorrow.)

Moreover, many of the advances we are currently seeing can be thought of at least partially as a new stage of the Moore’s law-driven IT revolution as the technology slowly improves and diffuses into various sectors from lifesaving mRNA vaccines to cheap, reusable rockets to AI programs that can accurately predict the structures of proteins to stunning developments in nuclear fusion. To again economist Erik Brynjolfsson: “AI is a general-purpose technology that is affecting almost every industry while accelerating the pace of discovery. Recent breakthroughs in machine learning will boost productivity in areas as diverse as biotech and medicine, energy technologies, retailing, finance, manufacturing and professional service.”

Finally, let me quote again that final sentence from the “Why Does Technology Advance in Cycles?” paper: “The fundamental determinants of the economy’s behaviour are the capacity of a society to exploit existing technological opportunity and its system of rewards for drastic innovation.”

In addition to funding the basic research that generates what Olsson terms “discovery” — the discovery of electricity or the effect of molds on bacteria — it’s up to policymakers to create an innovative ecology that helps entrepreneurs “makes a successful drastic combination between the ideas inherent in the older paradigm and the new discovery.” This ranges from making sure incumbents don’t use their political power to quash the drastic innovation to housing policy that encourages agglomeration spillovers to a tax code that lets innovators get rich from their know-how and achievement to the education and skilled immigration that boosts human capital.

In the excellent paper “The Sources of Growth in a Technologically Progressive Economy: the United States, 1899-1941,” economists Gerben Bakker (London School of Economics), Nicholas Crafts (University of Warwick), and Pieter Woltjer(University of Groningen) note two key factors that contributed to the most innovative part of Gordon’s Special Century: “The United States was, of course, pre-eminent in performing R&D but also intervened less than leading European economies to inhibit the forces of creative destruction.” A great lesson for the policymakers of today as several Next Big Things in AI, genetics, energy, and space can be glimpsed on the horizon.

5QQ

❓❓❓❓❓ 5 Quick Questions for . . . economist Michael Strain (part two)

Michael Strain is the director of Economic Policy Studies and the Arthur F. Burns Scholar in Political Economy at the American Enterprise Institute, where he oversees the institute’s work in economic policy, financial markets, international trade and finance, tax and budget policy, welfare economics, health care policy, and related areas. Dr. Strain is the author of “The American Dream Is Not Dead: (But Populism Could Kill It).” Before joining AEI, Strain worked in the Center for Economic Studies at the US Census Bureau and in the macroeconomics research group at the Federal Reserve Bank of New York. (The first part of this Q&A can be found here.)

1/ Might we see an anti-automation backlash much like the one we’ve seen with trade?

One of the curious things about U.S. politics is that trade has been demonized instead of automation, even though automation has played a much larger role in the deindustrialization that trade critics lament. I am not an expert on politics or public opinion, but my guess is that this has happened because it is easier to demonize trading partners, like China, and to demonize companies that outsource operations overseas than it is to demonize robots and software. For at least the next few years, I expect the focus of the backlash to continue to be on trade and not automation, though elites will likely make a stronger (and quieter) push to make automation harder through industrial and tax policies.

2/ What do you think about the theory that the US tax code favors automation at the expense of hiring humans and thus should be changed in some way?

This view is backwards. I would rather the tax code impose even lighter taxes on business investment than it currently does. Lighter taxes on investment will lead to higher worker productivity, which in turn will lead to higher wages for workers. The additional national income from this productivity increase will fuel greater labor demand, making workers as a whole better off. Discouraging productivity-enhancing investment is exactly the wrong direction for tax policy.

3/ If there is no New Roaring Twenties of faster growth despite new technologies — AI, space economy, CRISPR, for example — what probably went wrong?

If this doesn’t happen in the current decade then I would answer that nothing has gone wrong. It takes a while for new technologies to lift the overall productivity growth rate. It is easy for me to imagine that some of these technologies will fizzle. But taken together they are an impressive group, and I am optimistic about their potential even if I am uncertain about the timeframe.

4/ What would say to some who stated that “billionaires are a policy error” or “billionaires shouldn’t exist”?

This is exactly backwards. We should want more billionaires, not fewer. We should celebrate billionaires, not demonize them. What kind of a message are we sending to young people when we criticize aspiration, ambition, hard work, and success?

5/ Is there a pro-growth, pro-productivity policy that deserves more attention than what it currently gets?

Investments in basic scientific research and investments in human capital.

Micro Reads

📈 U.S. Productivity Increases by the Most in More Than a Year - Bloomberg | I would be more excited by news that US productivity — how much the average worker produces in a typical hour — grew at a 6.6 percent annual rate in the fourth quarter from the third quarter if that gain had not come after a substantial 5 percent decline in Q3. For all of 2021 productivity rose 1.9 percent, less than the 2.4 percent gain in 2020 and the 2 percent gain in 2019 — but way better than the average 0.8 percent gain from 2011 through 2018. A cautionary note from JPMorgan: “The productivity data can be noisy from quarter to quarter and we think the 4Q surge — which came after a 3Q drop — likely significantly overstates the underlying trend.”

⚛ Europe Is Losing Nuclear Power Just When It Really Needs Energy - Rachel Morison, Jonathan Tirone, and Francois De Beaupuy, Bloomberg | Amid an energy crisis the countries of Europe are divided on nuclear. Complicating the controversy is the push for carbon neutrality, with France and Austria quarreling over whether nuclear energy should be designated "green" at all. Despite energy shortages, old nuclear plants are being phased out. And while Europe faces record-high electricity prices and the possibility of rolling blackouts this winter, investments in nuclear made today won't be realized for another decade. Good news on this front: The EU said Wednesday that it would label some nuclear power as “transitional” green investments as it scrambles to cut the continent’s greenhouse gas emissions.

☀ Predictions Favored Solar Over Wind Power. What Happened? - Lois Parshley, NYT | In the 1970s, experts bet on solar over wind, but today solar generates less than 3 percent of American electricity while wind accounts for around 8 percent. So why didn't solar grow the way experts predicted? The US scaled back research support for solar in the '80s and '90s, relying on advances from countries like Japan and Germany — which might have delayed solar's cost decline to gas and coal levels by a decade.

💣 Giving an AI control of nuclear weapons: What could possibly go wrong? - Zachary Kallenborn, Bulletin of the Atomic Scientists | Given humans' emotions and biases, should we hand nuclear launch codes over to artificial intelligence? No, says Kallenborn. While autonomous systems can aid human decision-making, they also introduce serious risks from hacking to false positives. To prevent a Skynet-esque global nuclear war, the Nuclear Non-Proliferation Treaty should be amended to make sure countries maintain human control of their atomic armaments. Kallenborn: "Humans can create theories and identify generalities from limited information or information that is analogous, but not equivalent. Machines cannot."

🌐 Scientists leave the UK as China overtakes US as most favoured destination - Science|Business | Extremely concerning. “The new analysis of scientific migration data also shows a remarkable turnaround in the fortunes of the US and China In 2015, the US was the most attractive scientific destination in the world, enticing close to 3,000 net scientists. But by 2020, that dropped to 1,000. In the same period, China went from losing scientists, to replacing the US as the world’s most attractive destination. In 2020, a net total nearly 1,800 academics relocated to the country.”

🏫 Keeping kids home from school is even more harmful than we first thought- James Pethokoukis, AEIdeas | In “The triple impact of school closures on educational inequality,” researchers model the impact of at-home learning. They find that “among 9th graders, children from low-income neighborhoods in the US are predicted to suffer a learning loss equivalent to almost half a point on the four-point GPA scale, whereas children from high-income neighborhoods remain unscathed.” And the problem probably goes beyond high school: “Four years down the road, the school closure causes an average 25% reduction of labor earnings for the poorest children when these [kids] enter the labor market. This implies that the future society will be more unequal and have less social mobility.”

🌤 Solar Geoengineering Research Is a Risk Worth Taking - Clara Ferreira Marques, Bloomberg | A group of scientists have argued for an international non-use agreement on solar geoengineering — reflecting sunlight back into space to cool the Earth. Further, some have suggested that researching solar geoengineering will only enable climate irresponsibility, but, FerreiraMarques argues, research into this break-the-glass option is vital. And beyond public research funding, we need to think about geoengineering governance. "Who would eventually authorize the technology or oversee it, should it ever be used? How would any cross-border disputes be regulated? Who decides what side effects are permissible, or not? How can all parties, even those must vulnerable, be included?" It's time to begin answering those questions.

Nano Reads

▶ AI’s J-curve and upcoming productivity boom - Ben Dickson, TechTalk |

▶ A New Industrialist roundup - Noah Smith, Noahpinion |

▶ ‘The Power Law’ Review: Chasing Unicorns - Daniel Rasmussen, WSJ |

▶ DeepMind says its new AI coding engine is as good as an average human programmer - James Vincent, The Verge |

▶ What if We Could Eliminate Lead Poisoning as a Threat to All Children? - Rachel Silverman, Center for Global Development |

▶ Oil Frackers Brace for End of the U.S. Shale Boom - Collin Eaton, WSJ |

▶ Piloting and Evaluating NSF Science Lottery Grants - Institute for Progress |

From the interview: "Lighter taxes on investment will lead to higher worker productivity, which in turn will lead to higher wages for workers."

That has not proven to be true in the US. Search for "productivity vs pay united states" and see for yourself! Productivity is at an all-time high and wages are stagnant. This fact makes me extremely critical of the rest of the interview.

(Edit—Here's a source for my claim: https://www.epi.org/productivity-pay-gap/)

David Thomson wrote a book called "Blueprint to a Billion" which observed that of the companies that made it to > 1B in market cap, the time varied greatly from start to 1B. Specifically it varied greatly from 0 to 20M, but then it was consistently 7 years +/2 to 1B.

I see innovation as the intersection of Invention and Customer Demand. When the two are in sync, productivity flourishes. We often think of the need for more research to generate more productivity. Perhaps we need more matching of demand and supply. For every great innovation, how many similar innovations occurred (Telephone, TV, polio vaccine, etc) but failed?

Going back to Law of Accelerating return - the process of "word of mouth" and establishing "dominate design" (Steering wheels should be on the left side of car, computers should run on DOS) allows the market to agree and accelerate. My guess is if we built a system dynamics model of this the boom bust component of waves would be closely tied to information gaps signally a new evolution of technology.

Arguing against this point, there is also a David/Goliath element to entrepreneurial focus. Clay Christensen noted "New Starts" win when the Y access of "Value" changes. i.e. we use to care about speed of computers, now we care about how long they run on battery. Driving the new variable means the New Start needs to be better than baseline. So there is a selection bias to entrepreneurs capable of very high performance that overcomes incumbent advantage. This step function could easily trigger a bust in a dynamic system (on big step change).

My reading of Schumpeter and Hayek (Perhaps the whole Austrian school) is the view that the interface between customer and technology, and unmet needs in the market place, have a lot to do with the boom bust of innovation markets. While the "Natural rate" of innovation is perhaps unchangeable, the speed of information flow to establish dominant design could be muted by poor capital allocation, regionalization, rent seeking, regulatory capture, etc.

If the barriers to signaling are high, then it takes an extra special entrepreneur and customer, and time, to build up enough energy, to punctuate dominant design and establish a new order at a better, more productive, valence level.