When does economic policy become industrial policy, and has the Biden administration crossed that line? In this episode of Faster, Please! — The Podcast, I'm talking with industrial policy skeptic Scott Lincicome about the CHIPS and Science Act, how competition with China complicates the argument for free markets, and more.

Scott is the director of general economics and the Herbert A. Stiefel Center for Trade Policy Studies at the Cato Institute. He is the author of numerous reports on industrial policy and international free trade, including "The (Updated) Case for Free Trade" with Alfredo Carrillo Obregon and “Questioning Industrial Policy” with Huan Zhu. He’s also the author of Capitolism, a Dispatch newsletter.

In This Episode:

Is Bidenomics really about boosting productivity? (1:19)

We’re all industrial policy enthusiasts now (3:37)

The climate change exception (9:34)

Thinking about China (17:29)

Can the US play the semiconductor game and win? (21:35)

Below is an edited transcript of our conversation.

Is Bidenomics really about boosting productivity?

James Pethokoukis: The Biden administration has been doing quite a bit: this infrastructure bill, we've had a chips and R&D bill, now we have the Inflation Reduction Act. The president has said that one thing he's trying to do is boost the productive capacity of the economy. Do you view that as the main thrust of these bills?

Scott Lincicome: No. I think it's actually much more about picking and choosing specific sectors. You can maybe argue for infrastructure: to the extent that roads and bridges are going to actually lead to the expansion of the national productive capacity, okay. But particularly with semiconductors and the IRA, this is just classic industrial policy. “The market has failed. We don't like the sectoral composition of the United States economy. In particular, we are not making enough semiconductors. We are not making enough solar panels and wind turbines and electric vehicles, and government needs to get involved. We need to not only encourage the consumption of these goods, but we need to actually forcibly, or through a lot of subsidies and sweeteners, incentivize onshoring of these critical industries.”

I know that there are some attenuated ideas that this will then boost the overall productive capacity after several years. This is the whole idea that the Inflation Reduction Act will actually reduce inflation by spending all this money. But let's be clear: the immediate effects, the ones that don't require stretching the economic imagination beyond all recognizable length, are about a sectoral composition. It's about changing the shape of the US economy.

We’re all industrial policy enthusiasts now

A more market-oriented approach would focus on things like creating a favorable tax code that's neutral to sectoral composition and funding basic research. But with industrial policy, you care about sectoral composition. You care about what the economy looks like, rather than just GDP growth. Is America now doing full-throated industrial policy?

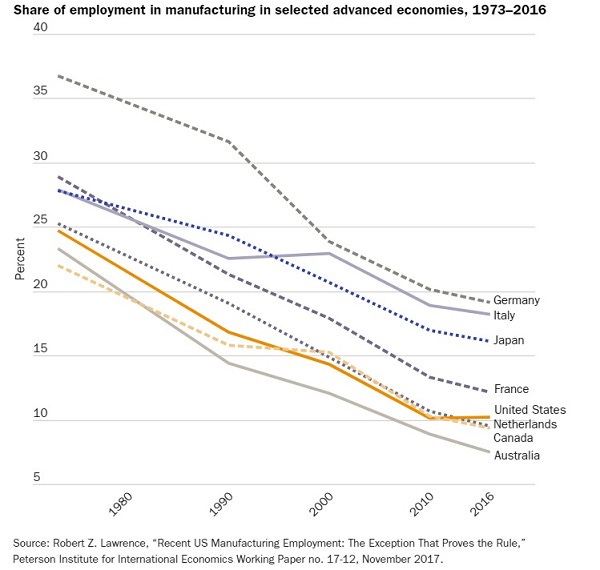

No, but we definitely have pushed the envelope. That actually gets to one of the big myths that is pushed by industrial policy advocates here in the United States: this idea that we lived through this grand or terrible — depending on your viewpoint — era of free market fundamentalism in which Milton Friedman got a hold of the economy and ran it like a textbook. That's absolute nonsense. We have experimented with industrial policy for ages, going back to the ‘60s, the ‘70s, then into the ‘80s. We really liked it in the ‘80s and ‘90s. We backed off a little bit in the ‘90s and 2000s but still had tons of industrial policy initiatives to encourage certain types of manufacturing, certain types of jobs, to protect certain sectors. And some of this was new; some of it was longstanding stuff like the Jones Act. So the idea that we weren't engaging in industrial policy is pretty silly.

But we certainly have pushed the accelerator down a little bit in the last few months, starting with the infrastructure bill which has local content provisions: “Buy American” this, “Use these American workers,” “Produce these types of charging stations,” that kind of stuff. Specific things, not just infrastructure as we normally consider it. But then really ramping up with the CHIPS Act, which certainly has some basic research stuff in it. But throws $80 billion — potentially more, depending on how these tax credits shake out — to domestic semiconductor manufacturers to actually put more fabs in the United States

It's a subsidy to build these plants in the United States.

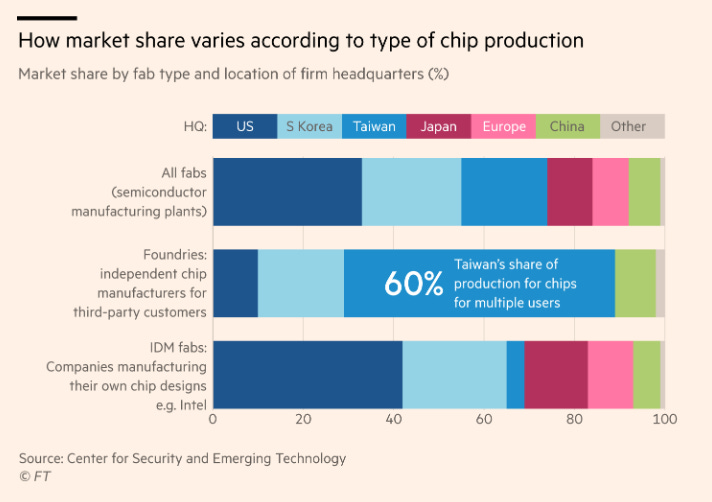

Correct, and with several strings attached even further. But the idea, generally, is (so the argument goes) the United States has experienced a dramatic collapse in semiconductor productive capacity over the last 30 years — thanks, again, to the Milton Friedmanites, us at Cato, we libertarians always run Washington so it's all our fault. And we need to tilt the scales. We need to do industrial policy like the Koreans and the Taiwanese and the Chinese are doing, and we need to get more fabs, semiconductor manufacturing facilities, here in the United States. That’s the idea. And then the IRA basically turned the knob to 11. The IRA went and did very much the same thing with tens of billions of extra dollars — hundreds of billions, really — looking into renewable energy: all sorts of programs, advanced manufacturing, tax credits, grants, you name it. Again, this is not new. Most of the stuff that the IRA did was expand Obama-era programs that went on during the 2009 stimulus bill, essentially revitalizing some of these programs, for example at the Department of Energy, that had been in place for more than a decade.

Industrial policy can refer to a lot of things: protecting industries from foreign trade, cutting checks to businesses or sectors deemed "important," or offering strategic tax breaks and the like. Is what we're doing now closer to classic industrial policy?

This is classic industrial policy. And in a sense, I'm relieved. Because for the last two years, before the CHIPS bill and the IRA and a little bit on infrastructure, we had this very painful debate that we wonks have to have about definitions. If you listen to some industrial policy advocates out there, like Mariana Mazzucato, the Italian economist who's all the rage in Europe with industrial policy, to them — and there are some folks here in the United States who do this too — industrial policy is anything and everything. WTO reform was industrial policy, basic research gets thrown in, military spending … You get these ridiculous statements like, “Everything that goes into an iPhone was the result of government industrial policy.” That's a lot of nonsense. There’s plenty of free-market, market-oriented, libertarian, whatever you want to call it, stuff that just does not meet the traditional definition of industrial policy, meaning targeted and directed government action — tariffs, subsidies, whatever — to achieve a specific microeconomic advantage over what the market could produce within national borders. And always pursuant to some strategic plan. This is not the NIH just giving out some grants. No, you have a big plan, a strategic plan, and you're going to go out and determine winners and losers. That is very much what we're doing in the CHIPS Act and the IRA. It's nice in the sense that we're getting back to a discussion of traditional industrial policy.

The climate change exception

Certainly some would argue, even if they're generally skeptical of industrial policy, they would say, “Well, sometimes we have to do it. Maybe for defense-related reasons we need to do it. Maybe there's some other emergency. People think climate change is that kind of thing: We can't wait for the market to figure it out. It’s a pressing emergency, as much as a geopolitical conflict would be. It's that kind of thing. Therefore, we must act.

Even zany libertarians like me acknowledge a national defense exception to all of this stuff. There's actually a lot of literature I've written about, about how national defense is quite different from socially related industrial policy. And for those reasons, and for very legitimate national security reasons, you tend to push defense-related stuff over the side. Even I am not going to say we should be outsourcing our nuclear weapons technologies to China. That kind of stuff is obvious. Just as importantly, or almost as importantly, there are pretty huge differences between defense procurement and commercial industrial policy. One is, there's no other buyer for defense-related stuff. The market is the government's market. That makes the government uniquely positioned and attuned as the consumer to care about how it's spending its money, to actually have sophisticated, detailed information about the sector. The government knows a lot more about tanks than basically anybody else, because the government is in the tank consumption business. Finally, the public tends to give the government a lot more of benefit of the doubt about failures, about dollar figures and the rest. It's kind of the government's unique, constitutional responsibility. National defense works.

Climate change, though, I think is a problem. Because climate change is very much a consumption issue as much as it is a production issue. And it's very little of a domestic production issue. Of course we care about coal-fired electricity plants and the rest. But at the end of the day, all we really care is that we want to increase domestic consumption of renewable energy. With respect to all of these products, there's no need that solar panels be made in America. Quite frankly, there's a very strong argument that by raising the prices of our renewable energy goods — by slapping tariffs on them, by localization mandates like Buy American policies — we're actually raising the prices of these goods and then discouraging consumption of renewable energy. So there's a really tough tension between classic economic nationalist industrial policy and environmental goals. You don't have to take it from me. A big initiative of the Obama administration was to liberalize trade in environmental goods. The Obama administration quite rightly observed that production of these things is not nearly as important as consumption of these things. And what helps maximize consumption? Free trade. That deal never got finished. It's been shelved because, of course, everybody hates trade these days. But I think that it's a lot tougher argument on the climate change side that we need industrial policy, because it just doesn't have the same dynamic as something like national defense.

Let me frame it somewhat differently. What if the policy was, “Here’s how we’re going to deal with climate change: We need to pull carbon from the air”? Carbon removal technology is something that doesn't really exist right now, other than in some very experimental forms. “We're going to fund it, just like Apollo, just like the Manhattan project.” Would you favor something like that, assuming you thought there was the actual need to pull carbon from the sky?

This is a great example of where you have the industrial policy approach and the more market-oriented approach. The industrial policy approach is that we need that carbon capture technology to be made by Americans in America. And not just deployed by Americans; we need it made in America. Whereas the more free-market approach would be a prize: We don't care how it's made. We don't care who makes it, with a few security-related exceptions. If tomorrow the Korean government or Samsung or whatever comes up with the most amazing carbon capture technology in the world — it's like Mr. Fusion from Back to the Future, you just slap it on a power plant and suddenly we're zero emitters — you win the prize. We don't care that it was made by a Korean company. We don't care that they are going to be Korean jobs and not American jobs. No, the industrial policy side says, “We care a lot about who makes this stuff and that it's made in America, using American materials.” The pandemic, for all of its terribleness, provided us a pretty good example of the industrial policy approach to pandemic stuff and the market approach. And that's in the vaccines. The more free-market approach, essentially a prize but a procurement contract, was we went to Pfizer and BioNTech, and if you look at the contract for those vaccines, it said we have nothing to do with your supply chain. “We don't care how you do it. We don't care what you do. Just get an FDA-approved vaccine and we are all in, we're going to pay.” That's it. There are clauses in that contract that literally say we will have no control over how you make this whatever. A ton of global collaboration, of course. BioNTech is a German company, blah, blah, blah.

Totally different approach: There's another company in Maryland called Emergent BioSolutions. Emergent BioSolutions is a heavily government-connected contract manufacturer that has been essentially put here for pandemic preparedness. Lots of government involvement over the years. Emergent was the kind of all-American government contractor model. It is very much similar to a lot of the stuff we hear today about what we need, not just for pandemics, but for other stuff as well: We need to put this factory in America; we need to put it right outside of Washington. Well, Emergent hasn't made a handful of finished doses, and in fact has had a ton of problems with sanitation issues. They've had to destroy a bunch of doses. It's a nice contrast between a more market-oriented approach and a very domestic-oriented approach, one being much more industrial policy than the other. We can argue on the margins about how we funded mRNA research back in the day… But look, comparatively, there are two very different approaches to economic policymaking.

Thinking about China

It was kind of easy to defend free markets during the Cold War, but have things become more complicated with China given the interdependence of our economies? How easy is it for you to maintain your pro-market views on industrial policy questions with China?

China certainly makes it a little bit harder, and the nature of technology makes it a little bit harder. But we have existing laws and processes for a lot of that. You used a word there that sets off my libertarian Spidey senses. You said “important.” The issue there is, who decides what's important? The idea is not that we allow mass proliferation of dual-use technologies, we rely on China for weapons systems or critical inputs to weapon systems. But it's also that we have to have a lot of skepticism about what is and isn't important. I have very little problem allowing the Office of Foreign Assets Control and all the guys that commerce and whatever to apply the export control regime. We have US laws that require the Department of Defense to look at defense procurement and look at weak links in the chain. In fact, the Defense Production Act, before it was used to make baby formula, used to be used correctly. DOD used to look at its defense supply chain and say, “We don't have a stable producer of widgets that are important for our weapon systems. We need to subsidize that. We're going to give them $20 million.” You know what? No problem.

The problem is that now the word “important” has become so distorted from its original meaning that steel rebar is being restricted on national security grounds. Not to mention all of the other areas. Certainly there is a need to consider China, to consider the natures of technologies and all that. But we've gone way, way beyond what is in any way a rational policy. And you have to be very concerned about politics. One of the little-known secrets about the global chip shortage is how American export control policy contributed to the global chip shortage. The Trump administration started restricting pretty basic semiconductor technologies to China and Huawei and the rest. That reduced the global supply of bulk semiconductors. I'm not talking about the fancy three nanometer or whatever stuff. I’m talking about the junky stuff that we put 100 of them in a car for not a great reason, but we do. Not only did that reduce global capacity, but it also caused all these Chinese companies to start hoarding chips because they were scared to death of being cut off from these chip supplies.

Believe it or not, China remains very dependent on the United States for a lot of semiconductor stuff. That, of course, made things worse. The Biden administration quietly rolled some of that back in response to shortages. But that's the type of stuff we need to be really worried about. We also need to be concerned about, if we restrict these exports, is that just going to harm American tech champions like Qualcomm or whatever while bolstering French competitors, European competitors, Korean competitors, that are still going to sell to China anyway? There needs to be a very rational, skeptical approach to all this stuff. You can't just scream “China!” and then suddenly protect, subsidize, and do the rest. Of course, there are going to be exceptions. The goal is to get back to a saner approach to those exceptions.

Can the US play the semiconductor game and win?

How do you see this experiment with semiconductor subsidies playing out? When we look back at it in 10 years, will we say, “We learned that we can do that; we learned the United States can play that game and win,” or are we going to say, “It didn't really quite work out the way we'd hoped”?

It's always hard, because any time there's a new industrial policy announcement, you're going to get companies that are beneficiaries making all these investment announcements. The goal and the hard part is then tracking and determining whether those announcements were made because of the subsidy or whether they were already going to do it and they're just trying to get government cash or curry favor with the administration and the rest.

The other problem is determining what would've happened in the absence of the program. One of the things I was yelling about before the CHIPS Act was implemented was that semiconductor companies and big consumers, like Apple and Ford and GM, had realized years ago that they needed to rebalance a little bit. That, because of the pandemic, geopolitical stuff, and just other reasons, they were a little top heavy in Taiwan or in Asia. They started planning to invest back in the United States. Apple was saying, “We're willing to pay more to have Samsung right next to our big facility in Austin,” for example. All these investments were already planned before the CHIPS Act ever became a thing. Of course, the government is going to take credit for all of this. “We did all of this. Feast upon our works.” That's a challenge. I'm pretty confident, quite frankly, that they're going to run into a lot of problems. One problem is, like I said, they've attached strings to this stuff. There are prevailing wage requirements and other rules and regulations about favoring disadvantaged communities and all the usual stuff. These things always tend to gum up the works a little bit.

The other big issue is that we run into preexisting policies that didn't fix: immigration bottlenecks, other labor supply problems. There was a big story in the AP last week that Intel in Ohio can't find construction workers. That's because we didn't liberalize immigration along with all this industrial policy money we just threw at the economy. We have, of course, plenty of tariffs on stuff that you need to build factories. We have tax policy with respect to expensing that discourages long-term investments in capital-intensive manufacturing. I can go down the list. We didn't fix any of that. At the end of the day, will we move the needle a little bit? Maybe. Government is very powerful; we're throwing a lot of money at this. But will there be a great global rebalancing? Color me quite skeptical.

The other thing we have to consider are the risks. If we are successful and there is suddenly a glut in global semiconductors — reading the news right now, the semiconductor industry is actually kind of in some trouble globally right now. Gluts are popping up, people stockpiled, like I mentioned. And now they realize that actually Americans' consumption or the world’s consumption of chips isn't insatiable. There are concerns there. If we have a chips-related glut, because the United States and Europe and Korea and others all threw subsidies at this, what are we going to do with all those extra chips? If you look back at the ‘80s and ‘90s, we had trade wars. We slapped tariffs on Japanese semiconductors and then Korean semiconductors, which caused all sorts of ripple effects throughout the US economy. It pushed the computer industry offshore, for example. Being a libertarian ideologue, but also a student of history and industrial policy, I remain pretty confident that we're going to look back on this and go: “Eh, that was not the greatest idea.”

🚀 Faster, Please! — The Podcast #8