🔃 Has the Biden economic agenda been Up Wing or Down Wing?

I've assigned pro-progress and anti-progress evaluations to five major pieces of Washington legislation

After passing the Senate on Sunday, Build Back Manchin — more commonly known as the Inflation Reduction Act — heads to the House for a vote and, presumably, then to the White House for President Joe Biden’s signature. Washington is still a bit gobsmacked over the shocking revival of the downsized-legislation, which will spend some $400 billion on climate and healthcare programs over a decade while also raising taxes on large, profitable companies. Total revenue raised is expected to come in around $700 billion.

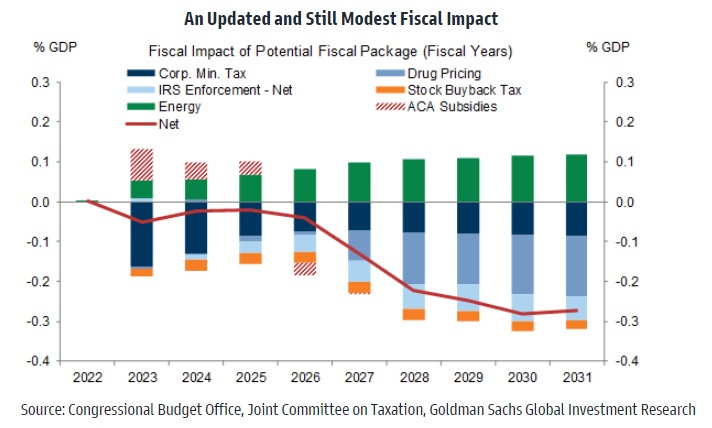

Here’s why I’m being a bit fuzzy on the numbers: Various last-minute tweaks mean the exact legislation has yet to be officially scored by the Congressional Budget Office. That said, concludes a Goldman Sachs analysis yesterday, “The net fiscal impact of these policies continues to look very modest, likely less than 0.1% of GDP for the next several years.”

Indeed, one political criticism is that passage of the bill is unlikely to “help Democrats much in November because it will provide little in tangible benefits for voters in the near term and does little to address their leading concerns (inflation, crime, border security, etc.),” argues the policy analysis team at Piper Sandler in a morning note.

That said, the Inflation Reduction Act marks the conclusion of a pretty remarkable run of economic legislation during the first half of Biden’s first term: the $1.9 trillion American Rescue Plan in March 2021, the $550 billion Infrastructure Investment and Jobs Act in November 2021, the $280 billion CHIPS and Science Act set to be signed tomorrow, and the IRA. By the way, I’m including with the IRA, the promise of new legislation easing the federal permitting rules for pipelines and other infrastructure, which will need GOP acquiescence in the Senate.

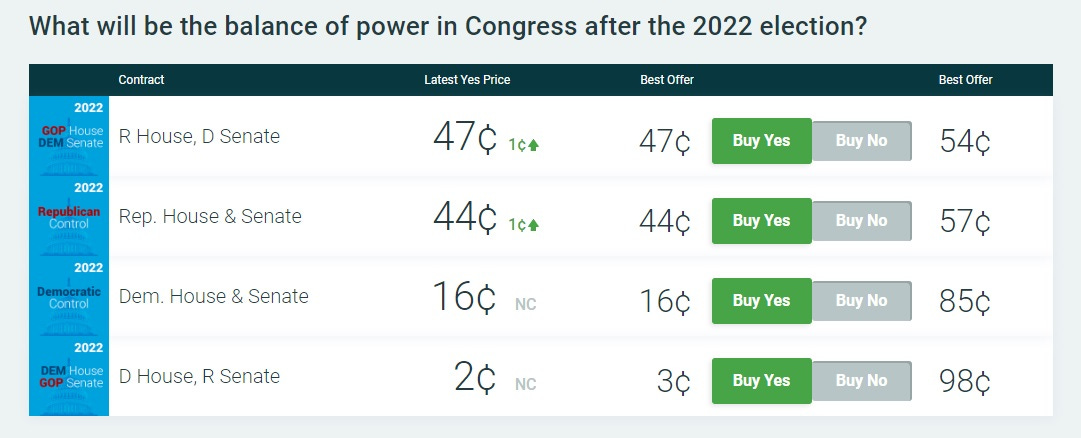

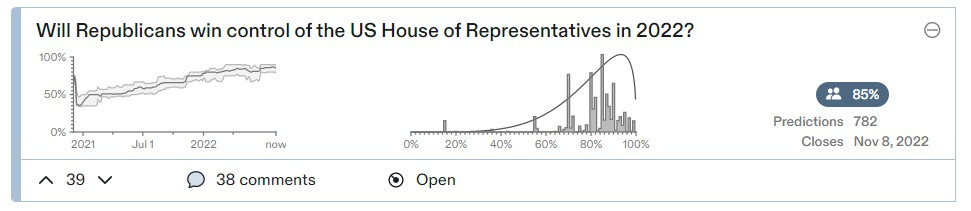

The reason I say “conclusion”: I think Washington is done with new fiscal policy for the rest of Biden’s term since the likeliest outcomes of the November midterms are the Republicans taking control of the House, leading to a divided Congress, or the GOP taking the House and Senate. The following odds from PredictIt: and Metaculus:

I’m highly skeptical, given the current level of contentiousness in Washington — along with the growing belief that Biden will not run again — that any further significant economic legislation is going to happen. All the action will be via executive order and foreign policy, as well as from the Federal Reserve. And if I’m right, now is a good time to rate the Biden presidency on the degree to which it has been Up Wing (encouraging economic growth, tech/innovation progress, creative destruction, risk taking) or Down Wing (creating obstacles to growth, innovation, and entrepreneurship).

A couple of notes before I begin:

First, these are preliminary ratings. As legislation is implemented, it may turn out that the things I believe today to be bad ideas or good ideas end up the opposite.

Second, American presidents tend to be pretty Up Wing. Jimmy Carter? Was pro-nuclear energy. Donald Trump? Was pro-manned space flight.

Third, I am of course assuming the best of intentions on the part of policymakers, whatever the resulting policy outcome.

Fourth, I’m not judging these strictly versus my ideal policy agenda. By that measure, all would probably fail.

⤵ American Rescue Plan. Long expansions are good. They drive down unemployment and raise wages — even at the bottom, eventually. So my big macro concern has been that spiking and sustained inflation — via Federal Reserve rate hikes and the Law of Demand — could lead to a recession. And I think there’s little doubt the ARP has played a role in the highest inflation rates in four decades. Jason Furman, economist for former President Obama, estimates the ARP increased inflation by about 2.5 percentage points, while economist Michael Strain, my colleague at the American Enterprise Institute, pegs the impact at three percentage points. The key thing here is that however you break it down and attribute inflationary blame, pro-inflation factors all cumulatively contribute to changing inflation expectations that raise the risk of a Fed-induced slowdown.

⤴ Infrastructure Investment and Jobs Act. America needs policymakers to focus on expanding America’s productive capacity. And connection is key to a more productive economy. So better infrastructure that makes it easier to connect all the nodes within the economy — cities, universities, companies, individuals — to each other is pretty important. Sometimes that means building new roads, bridges, and tunnels, as well as new digital links. It also means maintaining and upgrading what we have. Oh, boosting productivity is also anti-inflationary over the long run. There’s little debate that US infrastructure, while not terrible, could be better. And this bill helps. (Adding in a carbon tax payfor would have helped more.)

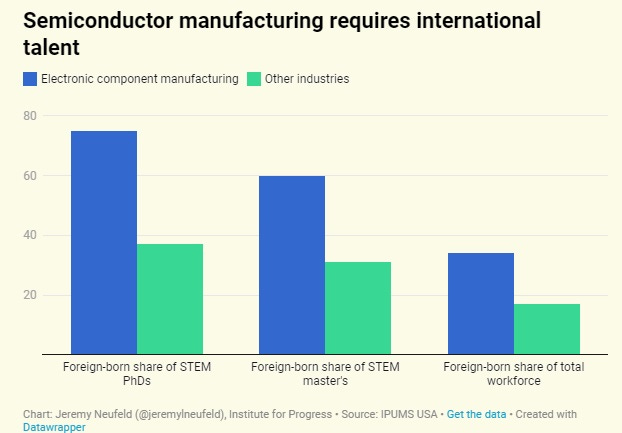

⤴ The CHIPS and Science Act. I’m going to overlook that Congress went with this name when, as Rep. Peter Meijer tweet quipped, “CHIPS & SALSA (Sustaining American Leadership in Scientific Affairs) was right there.” This is not a clear-cut Up Wing piece of legislation for me. I’m most bothered by the $52 billion in grants and incentives for domestic semiconductor manufacturing. I hope this doesn’t become a permanent thing that the sector comes to rely on, especially given the potential to warp the Market Test that businesses and their decision-making should be subject to. Also, this entire bill would benefit from increased immigration for both workers and researchers. Big flaw. But there’s no way I’m going to bash a bill that doubles the National Science Foundation's current budget from $9 billion in 2022 to $19 billion by 2027, including a 50 percent increase in the agency’s core research grants. The bill also would authorize up to $20 billion over five years for a new tech directorate to help translate basic research into business innovations. That’s something I will watch closely in the years ahead given my skepticism about government competency in this area.

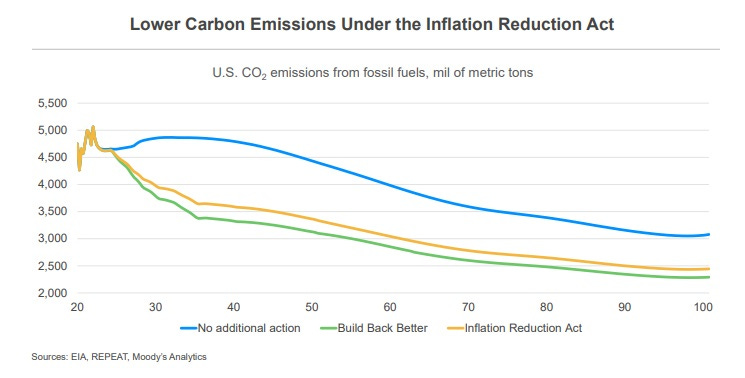

🔃 Inflation Reduction Act. Rising prices may slow in the coming weeks and months. But that is likely more due to falling gas prices than anything in this bill. “The Inflation Reduction Act passed by the Senate over the weekend will, despite its name, do little to rein in inflation,” concludes Capital Economics in a research note today. The drug pricing provisions, for instance, don’t start until 2026. Likewise, reducing the cumulative deficit over the next decade by $300 billion is hardly a game-changer when the cumulative deficit over the 2023–2032 period is projected to be $15.7 trillion, according to the Congressional Budget Office. And I’m not thrilled about the corporate tax hikes or the excise tax on stock buybacks, although last-minute changes may have made them less onerous. Then there’s all manner of tax credits, to the tune of some $400 billion, meant to accelerate the deployment of clean energy technologies (including nuclear production tax credit). The modeling does suggest a significant impact. For example: A Moody’s Analytics analysis finds “that by 2050, we estimate emissions will be reduced by nearly 30% compared with a scenario in which there is no additional policy changes to address climate change.” Likewise, modeling by the Rhodium Group finds that the US is currently on track to reduce greenhouse gas emissions by between 24 percent to 35 percent percent by 2030 compared to 2005 levels. IRA would increase that to between 31 percent to 44 percent by 2030. (Again, my ideal approach would be more R&D plus a carbon tax rather than all these credits.)

⤴ Energy Permitting Reform. As summarized by The Washington Post:

The side deal would set new two-year limits, or maximum timelines, for environmental reviews for “major” projects, the summary says. It would also aim to streamline the government processes for deciding approvals for energy projects by centralizing decision-making with one lead agency, the summary adds. Other provisions would limit legal challenges to energy projects and give the Energy Department more authority to approve electric transmission lines that are deemed to be “in the national interest,” according to the document. One provision in the agreement could make it harder for government agencies to deny new approvals based on certain environmental impacts that are not directly caused by the project itself.

Look: How much of this newsletter has been devoted to criticizing the impact of decades-old environmental laws on our ability to build infrastructure and clean energy projects? So while these changes fall short of the sort of sweeping reforms I would prefer, especially to the National Environmental Policy Act, it’s a step. "They're in the right direction but it still feels too small ball and piecemeal," Eli Dourado, a senior research fellow at the Center for Growth and Opportunity, told the WaPo.

If you’re keeping score that puts us at Up Wing 3, Down Wing 1, Up-Down 1. But quality is more important than quantity. The ARP was a pretty big fiscal policy error that compounded a pretty big Fed error. But if Jay Powell pulls off his Immaculate Disinflation, the ARP will no doubt be judged less harshly. Also, these are snap judgments. We’ll see how they play out long term. If a more applied R&D policy is eventually matched with some needed metascience reforms to what and how research gets funded, that would be a big plus. Same with immigration to supply needed talent. And if we finally get a handle on anti-build regulation, that would be truly massive. The only thing I’m might almost guarantee right now is that the legislative calendar is unlikely to be as busy over the next two years as it was the past two.

Micro Reads

How Tesla Lost The Race For Affordable EVs To An Unexpected Rival - Alan Ohnsman, Forbes | Tesla has now lost the affordable EV race to General Motors, which spurred Tesla’s creation after quitting the electric vehicle business 20 years ago. The Detroit-based automaker will offer its 2023 Bolt hatchback for only $26,600, slashing the previous sticker price by $6,300. The slightly bigger Bolt EUV loaded up with a high-end audio system, camera-based rearview mirror, sunroof and Super Cruise for hands-free highway driving costs just over $34,000. And GM is offering another cheap EV next year: An electric Equinox crossover that gets 300 miles per charge priced from $30,000, which is in line with gasoline-fueled rivals like Honda’s CR-V and Toyota’s RAV4.

Scientists Revive Human Retinas after Death - Tanya Lewis | In the new work, researchers restored electrical activity in human retinas—the light-sensitive neural tissue that sits at the back of our eyes and communicates with our brains—from recently deceased organ donors. This achievement, reported in Nature, offers a better way to study eye diseases such as age-related macular degeneration, a leading cause of vision loss and blindness. It could also lay the groundwork for reviving other types of neural tissue and perhaps—one day—for retinal transplants.

Researchers repaired cells in damaged pig organs an hour after the animal’s death - Rhiannon Williams - MIT Tech Review | A new system stopped the deterioration of cells in pig organs one hour after the animal’s death, a finding that suggests cells don’t die as quickly as previously understood. The technology successfully restored blood circulation and repaired damaged cells in the pigs.The research, described in Nature today, could pave the way to making human organs more viable for transplantation by making them last longer, and in better condition, post-removal. It could also help scientists develop methods to treat strokes and heart attacks in humans by providing insights into how cells react after being deprived of oxygen.

How effective altruism went from a niche movement to a billion-dollar force - Dylan Matthews, Vox | It’s safe to say that effective altruism is no longer the small, eclectic club of philosophers, charity researchers, and do-gooders it was just a decade ago. It’s an idea, and group of people, with roughly $26.6 billion in resources behind them, real and growing political power, and an increasing ability to noticeably change the world. EA, as a subculture, has always been categorized by relentless, sometimes navel-gazing self-criticism and questioning of assumptions, so this development has prompted no small amount of internal consternation. A frequent lament in EA circles these days is that there’s just too much money, and not enough effective causes to spend it on. Bankman-Fried, who got interested in EA as an undergrad at MIT, “earned to give” through crypto trading so hard that he’s now worth about $12.8 billion as of this writing, almost all of which he has said he plans to give away to EA-aligned causes.

Demography is not destiny - Ian Goldin, Financial Times | Demography is not destiny, but it does need to inform public policy and individual decisions. It means greater attention must be paid to improving health, extending working lives, accepting more migrants, increasing productivity and growing savings. The shift from consumption to savings can increase the potential for a circular economy and reducing carbon emissions. It also reduces interest rates and inflation, allowing for higher levels of investment in clean infrastructure, health, housing and education, which are the bedrock of sustained growth.

Please tell me that Federal money will go to actual geo-thermal power plant construction. We know that a geo-thermal well can power an existing steam generated electrical power plant. Grant money to a working model so the world can see that this is the answer to zero carbon, infinite power.