🌊 Are we about to see a wave of energy innovation? (Let's hope so.)

Also: 5 Quick Questions for … China expert Dan Blumenthal on US-China tech competition

🎄 First things first: To celebrate my return to writing after a November hiatus — back to the regular schedule of three essays a week (one with no paywall), a weekend recap, and a regular podcast (with transcript) — I’m thanking my free subscribers for their patience by offering a special deal all December. See the Big Blue Button below for details!

In This Issue

The Essay: Are we about to see a wave of energy innovation?

5QQ: 5 Quick Questions for … China expert Dan Blumenthal on US-China tech competition

Micro Reads

Quote of the Issue:

“Energy is the only universal currency: one of its many forms must be transformed to get anything done.” - Vaclav Smil

The Essay

🌊 Are we about to see a wave of energy innovation?

There’s so much focus on the need for “clean” energy — energy whose production generates little or no carbon emissions — that often overlooked is the equally important need for “abundant” energy. And not just for Bitcoin mining!

For example: Average energy consumption per person in sub-Saharan Africa (excluding South Africa), notes The Economist, is just 185 kilowatt-hours (kWh) a year, compared with about 6,500kWh in Europe and 12,700kWh in America. “An American fridge uses more electricity than a typical African person,” the magazine adds. If we want everyone in every country to live like Americans, Europeans, Japanese, and Koreans — and we should want that — we’re going to need more energy. Our World in Data’s Max Roser frames the stakes this way:

Every country is still very far away from providing clean, safe, and affordable energy at a massive scale and unless we make rapid progress in developing these technologies we will remain stuck in the two unsustainable alternatives of today: energy poverty or greenhouse gas emissions.

At the core of much future-optimism is the notion that artificial intelligence will make us more productive, both as workers and scientific researchers/technologists. But computers use energy. AI uses energy. (Indeed, this is a key plot point in The Matrix film franchise. ) As such, this insight from Citigroup in its annual “Disruptive Innovations” report is kind of worrisome:

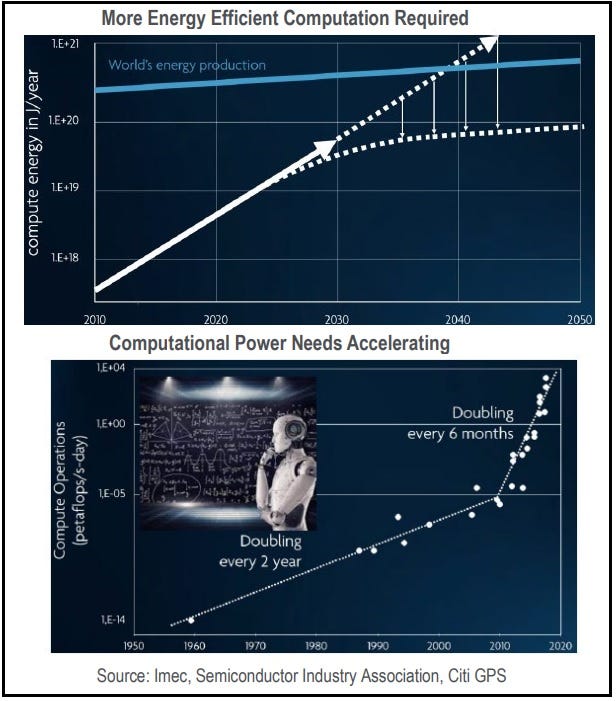

The total energy consumption by general-purpose computing continues to grow exponentially, doubling every three years. As a result, in the absence of innovation, computing energy needs are predicted to exceed energy production in 15-20 years. The rapid emergence of artificial intelligence (AI) over the past decade and its associated computational power requirements are only making this challenge tougher.

Two charts from the report illustrate the point:

Which brings us to nuclear fusion. The need for clean and abundant energy is a big reason the announcement this week about America’s Lawrence Livermore National Laboratory achieving a historic net-energy-gain reaction was such a big deal. That, even if the path from that experiment to a commercial reactor isn’t obvious. In a podcast chat I will post early next week, Arthur Turrell, a plasma physicist whose book The Star Builders documents the effort to achieve an energy dream that goes back a century, makes a great point about the importance of the achievement:

We, today, don't know what version of fusion, what way of doing fusion is going to ultimately be the one that is the most economical and the most useful for society. But what I think this result will do is have a huge psychological effect because throughout fusion's history, researchers have said, “Hey, I'd really like to, you know, build a reactor, a prototype reactor.” And funders have quite reasonably said, “We don't even know if the principle works. Go off and show us that it can produce, in principle, more energy out than is put in.” And of course, fusion research has been trying to do that since the 1950s. Now we finally and absolutely have proof of that. I think that it's going to crowd in innovation, interest and investment in all types of fusion because even though this approach got to that milestone first, it doesn't necessarily mean that this is going be the most economical or the best in the long run.

It is likely to take some time for that new “innovation, interest, and investment” to pay off. And it might never pay off. We need plenty of innovation, interest, and investment directed toward other clean and abundant energy sources, too. One the Citi report devotes attention to as potentially disruptive innovation: small modular nuclear reactors, or SMRs. Citi:

The advancement of SMRs could be very disruptive to global energy markets, as it could stabilize power prices and shift incentives away from gas and coal power generation throughout the world. It could also suppress global demand for solar, wind, and batteries. It would advance the electrification of the global economy over time, including transportation, industrial activity, and hard-to-abate sectors. With increased use of a cheap zero-carbon fuel source, the outlook for GHG emissions would materially improve.

SMRs have a lot going for them. They would be about a fifth of the size of a standard light-water reactor and could be mass-produced, helping avoid the high construction costs of large reactors, which typically end up as bespoke megaprojects. The Nuclear Regulatory Commission has already granted approval for a 50-megawatt reactor design to NuScale, something that Citi calls “a big milestone for the industry, with more reviews and approvals to come as the company is now uprating its design to 77 MWe.” (Though we don’t seem to be out of the regulatory woods just yet.) The Energy Department is also providing R&D funding for SMRs, including a $250 billion loan guarantee program for clean energy innovation that’s part of the Inflation Reduction Act.

So what might go wrong? Citi identifies four potential problems:

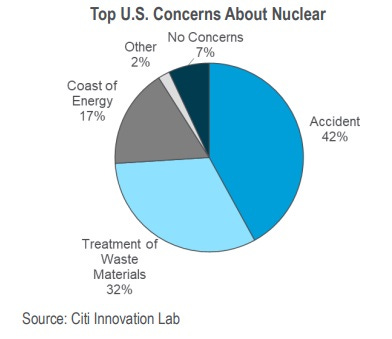

There are a few key barriers to widespread SMR adoption, including: (1) a strong “Not in My Back Yard” (NIMBY) public attitude, (2) technological advancements, (3) timing of regulatory approval, and (4) costs of competing forms of resource adequacy. Citi’s survey of about 3,000 Americans demonstrated that 42% of people were concerned about a nuclear accident, which likely drives the NIMBY attitude. The nuclear industry also has a history of projects costing more than the initial guidance and taking longer than expected, given their complexity. The outlook for nuclear does not involve the energy source in isolation — competing forms of power generation are also innovating and looking to drive their costs lower.

Let’s end with another example of an innovation that could really use lots of clean energy: vertical farming. It’s a possible disruptive innovation also on Citi’s list. What’s the use case? It’s a way to boost agricultural productivity for a growing global population, especially in places that may suffer the worst from climate change. Citi:

Vertical farms generally grow inside buildings but can also be housed in containers, tunnels, and abandoned mines. As they are not dependent on weather, they can run year-round, bolstering their productivity. They also do not need pesticides, herbicides, or chemicals. The farms are generally built in urban centers close to where crops are consumed, thus reducing the carbon footprint of transporting crops while making fresher produce available to consumers.

One hitch: Vertical farming needs lots and lots of energy:

Vertical farms are energy intensive. If the energy used comes from fossil fuels, the carbon footprint of vertical farms is greater than that of conventional farms. Using energy-efficient LEDs and cleaner energy sources can help vertical farms operate more efficiently.

My focus here on nuclear fission/fusion is not to suggest nothing is happen with solar or geothermal. That’s obviously not the case.

The more good news the better!

5QQ

💡 5 Quick Questions for … China expert Dan Blumenthal on US-China tech competition

Earlier this week, I wrote about the temptation among Democrats in the 1980s to envy and want to mimic Japan’s industrial policy. Japan’s rapid postwar growth, Atari Democrats reasoned, demonstrated the superiority of greater government direction in the economy. Of course, Japanese economic growth slowed by the early 1990s, which took the wind out of that movement’s sails. Fortunately for industrial policy advocates, China soon came on the scene as the go-to exemplar of economic planning’s wonders. But America’s relationship to China today is certainly not like its relationship to Japan in 1983. It’s no secret that we’re in the middle of a Sino-American geopolitical and technological rivalry. As I wrote in Faster, Please! last fall:

There’s bipartisan concern in Washington about China’s increasing tech prowess, both for economic and military reasons. Also importantly, Beijing is presenting an alternate socioeconomic model to the democratic capitalism of America and the West, one which promises authoritarian governments both economic success and permanent political power.

So what’s the nature of America’s competition with China? What are the stakes? And what can policymakers do? My AEI colleague Dan Blumenthal provides some insights:

1/ Americans view the US and China as engaged in geopolitical competition to control the latest technology, one in which the Chinese government is far more willing to tip the scales than is the US government. Does China view it the same way?

China believes the worst about the US. Even though our actions are limited, China believes that we are hell-bent on squeezing their economy, weakening them, manipulating their import vulnerabilities, generally containing them. They took advantage of us for a long-time. So, they obviously believed for a while that our supposed greed would win over our national security concerns. But now they, and when I say "they" I mean Xi Jinping because he is the only person who really matters in China, believe we have changed course and will contain them.

2/ Should China pull decisively ahead of the US in cutting-edge critical technologies, what would the result be? How big are the stakes in this competition?

I do not think China's strategy is to pull ahead decisively. They just do not have the innovation system for that. They could not make an mRNA vaccine, and it is not for lack of trying, spending, stealing. They could not create a TSMC, despite billions in subsidies. They are going for maximum economic leverage. They want control over key segments of supply chains. Derek Scissors and I have a piece coming out on this economic strategy. For example, in biopharma they want control over Active Pharmaceutical Ingredients such that we cannot produce without them. That is not innovation, that is manipulation.

3/ Many Chinese students come to the US to study STEM and then return home. Should we be offering them visas in an attempt to drain China's brains?

We should be doing so, mindful of the fact that China has active programs to recruit science and technological talent from the US. Unfortunately, Beijing puts enormous pressure on overseas Chinese to "serve the motherland." That is not to say every Chinese national is working for the CCP. But in key areas of science and technology (e.g. virology), China has an active and deliberate program to transfer knowledge illicitly from the US to serve sometimes very nefarious ends. We need talent from overseas but we need to be mindful of these talent recruitment programs. We should also encourage more students and post-docs to come here from countries with whom we want better relations. There are so many younger people in Vietnam, Indonesia, the Philippines. Why not actively repurpose our efforts to bring Chinese students here, a legacy of our now defunct engagement policy with China, to engagement with other students from other countries?

4/ Is it appropriate to view US-China tech competition as top-down centrally-directed research vs. profit-driven capitalistic research? Is that overly simplified?

It is not overly simplified. China puts out documents and strategies from the top and often implements them. They said they would subsidize semiconductor fabs and they have, to a massive extent. The goal is not to allow animal spirits to roam. The goal is to create overcapacity and put more internationally competitive firms out of business. Scissors and I have found that China's top-down policies make everyone less innovative. Take the Huawei’s strategy, no one could compete with China's state-centered strategy and so Huawei has almost no competition. We are all worse off as a result. China is doing the same now in aerospace. There will be one major supplier of commercial aircraft thanks to China's policies. It will not be Boeing. It is not a technology race, in that sense. The US has a highly innovative system that will make disruptive breakthroughs. But China will dominate the production and manufacturing of these breakthroughs and scale them.

5/ Both the US and China seem to talk as if they'd like to disentangle our economies. Is that even possible?

China is moving to de-couple. It is happening. They are setting the terms—call it asymmetrical de-coupling. China disallows the US to compete in China in important sectors (e.g. telecom, soon in aircraft) and outsubsidizes the competition. We are slowly awakening to this. The only way for use to partially de-couple on our terms is to have a trade policy that opens our market more to the large Southeast Asian economies. We can de-couple if we have an international economic strategy that incentivizes production to move out of China and into friendlier countries. That requires both carrots and sticks. We need to control what we export to China, in conjunction with allies. But we also need to get back into the trade game.

Micro Reads

▶ Fusion Power Is Possible in Next Decade, Former US Energy Chief Says - Ari Natter Bloomberg |

▶ Fusion Wariness - Eli Dourado, City Journal

▶ Cancer mRNA vaccine completes pivotal trial - Michelle Roberts, BBC |

▶ NRC Staff Whiffs On Nuclear Licensing Modernization - Ted Nordhaus and Adam Stein, Breakthrough Institute

▶ The State of AI in 9 Charts - Shana Lynch, Institute for Human-Centered AI, Stanford University |

▶ How electric air taxis could shake up the airline industry in the next decade - Mikaela Cohen, CNBC

▶ Sam Altman: This is what I learned from DALL-E2 - Will Douglas Heaven, MIT Tech Review