⚛ Why France has a nuclear-powered economy — and America doesn't

Also: Five Quick Questions for tech progress advocate Eli Dourado

“Let’s make the roaring 20’s happen!” - Elon Musk, via Twitter, on Jan. 2, 2022

In This Issue

Long Read: Why France has a nuclear-powered economy — and America doesn't

5QQ: Five Quick Questions for . . . Eli Dourado

Micro Reads: Apple, terraforming Mars, Chinese dynamism, and more . . .

Long Read

⚛ Why France has a nuclear-powered economy — and America doesn't

There’s an escalating fight inside the European Union over nuclear energy. France and Germany, the two countries that dominate EU policymaking, have taken polar opposite positions over Brussel’s plans to classify nuclear power as a “green” energy generation technology. (Industries with a “green” designation “face a life of subsidies and cheap capital as governments tighten investment rules elsewhere” notes The Economist.)

Here’s what really strikes me: France produces over 70 percent of its power from nuclear reactors, and in October, President Emmanuel Macron said the country will develop small modular reactors by 2030, reversing a long-term plan to reduce France’s dependence on nuclear. Germany, on the other hand, has pledged to close all its nuclear power plants by 2022, a rash decision made after the 2011 Fukushima, Japan, nuclear disaster.

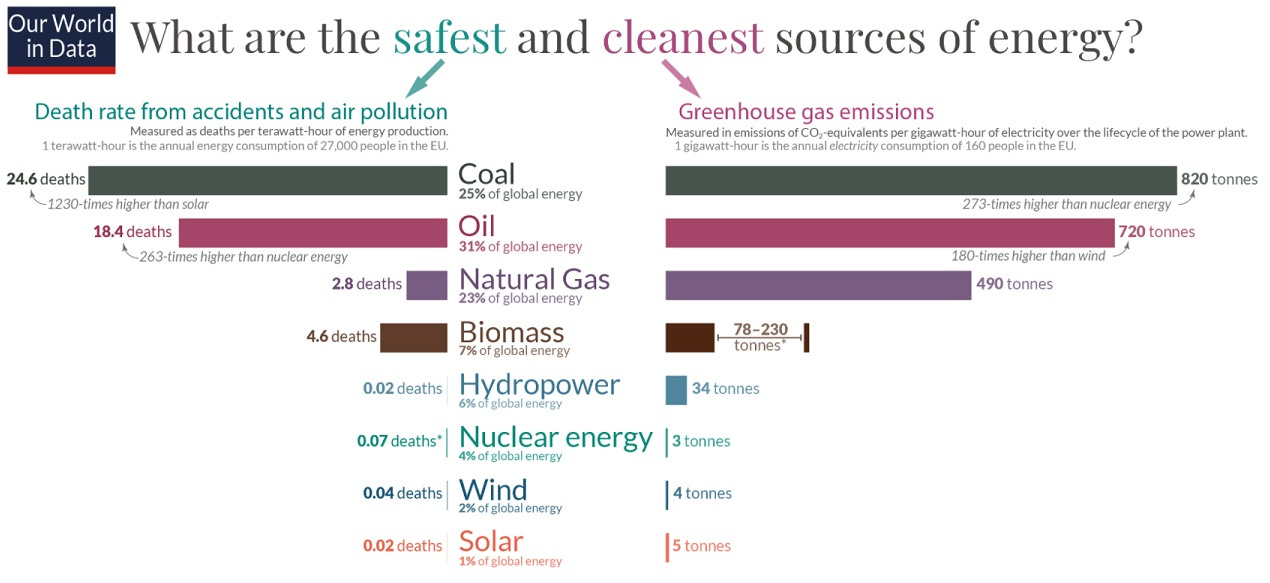

In other words, a terrible own-goal by Germany given the current European energy crisis and the longer-term geopolitical implications of dependence on Russian natural gas. Even more so when you consider the costs Germany has already borne from its anti-nuclear shift. This from the 2019 paper “The Private and External Costs of Germany’s Nuclear Phase-Out” by Stephen Jarvis, Olivier Deschenes, and Akshaya Jha (bold by me):

Following the Fukashima disaster in 2011, German authorities made the unprecedented decision to: (1) immediately shut down almost half of the country’s nuclear power plants and (2) shut down all of the remaining nuclear power plants by 2022. We quantify the full extent of the economic and environmental costs of this decision. Our analysis indicates that the phase-out of nuclear power comes with an annual cost to Germany of roughly $12 billion per year. Over 70% of this cost is due to the 1,100 excess deaths per year resulting from the local air pollution emitted by the coal-fired power plants operating in place of the shutdown nuclear plants. Our estimated costs of the nuclear phase-out far exceed the right-tail estimates of the benefits from the phase-out due to reductions in nuclear accident risk and waste disposal costs. Moreover, we find that the phase-out resulted in substantial increases in the electricity prices paid by consumers.

So once again France is taking the lead among rich economies in embracing nuclear power. But have you ever wondered why France generates more than two-thirds of its energy from nuclear versus just a fifth for the US? Here’s a quick story: The 1973 global oil crisis led to French Prime Minister Pierre Messmer announcing a plan in 1974 to pour resources into building nuclear reactors, with more than four dozen coming online in the 1980s and 1990s.

A key moment: On July 31, 1977, some 50,000 to 60,000 protesters marched on the Super-Phoenix, a prototype nuclear reactor on France’s Rhône river at Creys-Malville, near the border with Switzerland. The Super-Phoenix could both generate power and, more controversially, reprocess nuclear fuel from France’s other conventional nuclear reactors. It was a rainy, messy day, and the behavior of the crowd soon matched the weather. As Spencer R. Weart writes in The Rise of Nuclear Fear:

The anti-nuclear movement with its environmentalist and pacifist background was by nature nonviolent, but also by nature it lacked strict organization. Small bands came with iron clubs, helmets, red or black flags, and Molotov cocktails. The police met the marchers with truncheons, high-pressure water hoses, and tear gas grenades. When the cries and confusion ended there were over 100 injured, and one demonstrator was dead.

And thus France’s nuclear program came to an end — just kidding, of course it didn’t. France wasn’t the United States, which at that time was already experiencing a rise in costs and decline in construction starts due to new regulatory burdens, including the 1970 National Environmental Policy Act. Again, Weart:

Construction of the Super-Phoenix and dozens of other French reactors went ahead on schedule. The opponents could not win in the field, and they could not win in the French courts either. Unlike the American and German systems for licensing reactors—mazes of hearings in which a determined group of opponents could raise endless obstructions against a builder—French licensing was a straightforward matter of working things out among government experts. The French governing system did not leave as many openings for opponents as did the American and German systems, with their numerous rival local and national authorities, any of which might be turned into a roadblock. French reactors would go ahead so long as a bare majority of the nation’s citizens continued to trust their leaders.

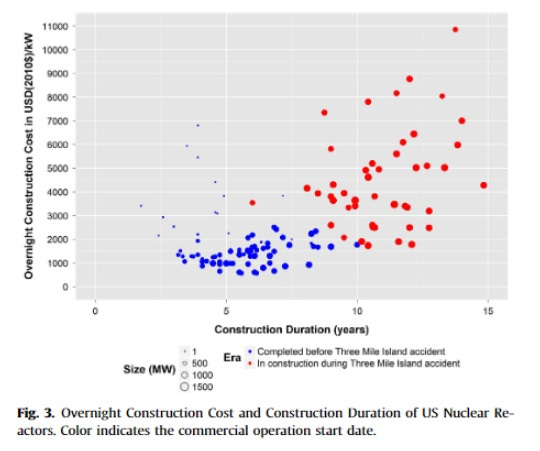

It also helps if your leaders are pro-nuclear. France’s were. Not so in the United States. That same year, President Carter asked Congress to eliminate all future funding for breeder reactors like the one at Creys-Malville. Now remember, this was before the partial meltdown of the fuel in the Three Mile Island, Unit 2 reactor near Middletown, Pennsylvania on March 28, 1979. But that accident seems to have worsened rising cost trends for building reactors in the US as licensing, regulatory delays, and back-fit requirements lengthened construction times.

The above chart comes from “Historical construction costs of global nuclear power reactors,” a 2016 paper by Jessica R. Lovering, Arthur Yip, and Ted Nordhaus. The blue dots are reactors that received their operating licenses before the TMI accident, and you can see that they were experiencing mild cost escalation, according to Lovering, Yip, and Nordhaus. But for reactors (shown in red) that were under construction during Three Mile Island and eventually completed afterward, median costs are 2.8 times higher than pre-TMI costs and median durations are 2.2 times higher than pre-TMI durations: “These results suggest that the Three Mile Island accident in 1979 did uniquely affect the nuclear industry in terms of overnight construction cost,” the paper concludes.

As long-time readers of Faster, Please! know, I am skeptical of monocausal explanations. In that spirit, let me offer a more multi-faceted explanation, via Weart:

The American [anti-nuclear] movement was the first to achieve a major political goal: the destruction of the Atomic Energy Commission. . . . One part became the hapless Nuclear Regulatory Commission, while the rest, demoralized, eventually joined the new Department of Energy. Meanwhile Congress stripped the Joint Committee on Atomic Energy of its unique powers. Nuclear energy had lost its strongest institutional supports. . . . It was not only politics that slowed the deployment of reactors. Largely because of the rise in oil prices, the world economy stagnated and interest rates soared, undercutting any industrial project that had to borrow large sums of money. Reactor construction was further wounded by errors and delays. These came partly because the technology of giant reactors was new and untried, and partly because a stream of government safety regulations required seemingly endless design changes. Costs climbed far above the cost of reactors finished in the 1960s. . . . Planning an electrical system meant peering thirty or forty years into the future. Yet nobody could predict even a few years ahead what would happen to fuel costs, interest rates, or demand for electricity. Estimates about reactor economics varied wildly from one expert to another.

And in the excellent 2010 book Atomic Awakening, nuclear engineer James Mahaffey also argues that rising costs before Three Mile Island doomed the industry:

By the 1970’s the United States had made it through the experimental phase of nuclear energy without any show-stopping problems and was trying to do a nation-wide conversion, but environmental and public-safety factions had begun serious campaigns to stop the progress and send the country back to pre-atomic-power levels. Nuclear engineering, under withering attack, was somewhat bewildered by the attention and circled the wagons. . . . Designs of nuclear reactors, plants, auxiliary mechanisms, and associated facilities, such as waste-disposal systems or fuel-handling strategies all became more conservative, with less engineering risk or innovation. . . . The nuclear power expansion was already dead years before the [Three Mile Island] disaster. TMI was merely the “last nail in the coffin.”

Two other things. First, if you would like to know more about the possible impact of 1970s environmental regulations and the rise of “citizen voice” in government decision-making on US infrastructure costs, please check out my Faster, Please! essay from last March on the subject. Second, we may be at the start of a renaissance in nuclear fission (but for real this time), in addition to new advances in emerging energy technologies such as nuclear fusion and advanced geothermal. And while it’s great to get excited about technological breakthroughs — some courtesy of government investment — we shouldn’t forget about how government can also hinder progress.

5QQ

❓ Five Quick Questions for . . . Eli Dourado

Eli Dourado is a senior research fellow and technology policy analyst at the Center for Growth and Opportunity at Utah State University. He’s also, in my opinion, one of America’s leading public thinkers and evangelists on the power of technological progress and a pro-growth policy mindset to create a better world. I’m delighted to have Eli as the subject in this first edition of the new 5QQ series.

1/ What is the best scenario for a future where we generate abundant, cheap, clean energy?

The best scenario is one where we exploit the entire menu of non-fossil energy options. We put next-gen solar panels wherever it makes sense, use deregulated fission plus geothermal to supply cheap baseload power, put portable microreactors in our flying vehicles, and supplement everything with wind and sanely permitted long-distance transmission lines. Batteries are located in people’s homes and cars, and dynamic electricity pricing lets them be used for arbitrage and to smooth out demand.

2/ On your personal website, you say that “your fondest wish is that GDP per capita would reach $200k by 2050.” Why did you pick that dollar amount?

GDP per capita was around $65k in 2020, and it would need to grow at around 3.8 percent per year to reach $200k in 30 years. Real GDP per capita has been growing at around 1.5 percent for the last 30 years. So we’d need to add around 2.3 percent annually to growth, which is about what I think is possible if everyone became a technological progressive.

3/ What do you think caused the “long stagnation” in US productivity growth since the early 1970s?

I think it’s overdetermined. Complacency, mass media and the Internet fueling the culture war, the scope of government getting so large that no single mind can comprehend everything it’s doing, growing suspicion of achievement and success, vetocracy and NIMBYism, the ugly parts of the environmental movement, lousy education, bureaucratic risk aversion. The only thing I am sure didn’t play a role was a lack of low-hanging fruit.

4/ If there’s no “New Roaring Twenties” of faster economic growth, what probably went wrong?

We probably literally just kept doing what we’ve been doing. Stagnation is the default. There’s plenty of low-hanging fruit, but if we want to reap it, we’ve got to be committed to dynamism and disruption.

5/ What is a pro-progress economic policy that deserves more attention?

The policies holding back growth are all unsexy to work on. I have become convinced that one of the most damaging ones is the National Environmental Policy Act, which has become embedded in our federal permitting system. NEPA compliance adds delay, expense, and risk to every activity that requires a federal agency to say “yes” to, hitting every innovative company building something new in the physical world.

Micro Reads

🍏 Apple becomes first $3tn company after boost from pandemic demand - Patrick McGee, Financial Times | The stock has outpaced the S&P 500 by a factor of five over the past five years alone. This is interesting: “Tom Forte, analyst at DA Davidson, said investor enthusiasm for Tesla and electric vehicles was also spilling over into Apple’s stock, on the hopes that the iPhone maker will enter the car industry in the next five years.”

💡 The Return of America’s Celebrity Inventor - Eric S. Hintz, Smithsonian |

The celebrity status of today’s high-tech innovators echoes an earlier era when inventors commanded similar attention. During the 19th century, dozens of gifted inventors—Samuel Colt (revolver), Isaac Singer (sewing machine), Samuel Morse (telegraph), Cyrus McCormick (mechanical reaper), Alexander Graham Bell (telephone) and Thomas Edison (incandescent lighting)—became wildly famous, their names synonymous with their inventions. These homegrown American inventors became a source of national pride for a country that was quickly surpassing Great Britain and the rest of Europe as the crucible of industrial activity.

✉ 2021 Letter - Dan Wang | Another great annual roundup from the tech analyst at Gavekal Dragonomics, a global macro research firm based in Hong Kong and Beijing. One topic — one of many — he delves into happens to be one I’m also pretty interested in: How China’s tech crackdown will affect the country’s entrepreneurial spirit. Wang: “A more serious risk with Beijing’s crackdown is its potential to dampen economic dynamism writ large. People working in online education today suffer from PTSD. Jack Ma has been mostly out of the public eye for a year. Meanwhile, many of the most successful Chinese founders have stepped down or into the background. No public figure in China dares to be too visible today. One motivation for dreamers to start companies might be to enjoy the outrageous excesses of being billionaire playboys.”

🌌 NASA’s Retiring Top Scientist Says We Can Terraform Mars and Maybe Venus, Too - Jonathan O’Callaghan, New York Times | A fascinating Q&A with James Green, chief scientist at NASA. Green sounds like exactly the person you would want in that job. He’s long been a proponent of exploring Europa, Jupiter’s icy moon (a launch scheduled for 2024), and in the piece, he talks about creating a scale for verifying the detection of alien life, as well as terraforming Mars. But he also stresses that sometimes a small step is better than a giant leap: “Viking is that example, where we took too big a step. We didn’t know where to go, we didn’t know enough about the soils or the toxins in the soils. We hadn’t really gotten a good idea where water was on the planet in the past. There were 10 things we should have known before we put the two Vikings on the surface [of Mars].”

⚕ Sci-fi types of medical implants will soon become reality, researchers say - Kenneth R. Rosen, Washington Post |

More recently, consumers have started tracking their own heart rates and number of steps taken with watches, bracelets, cellphones and other wearable devices. Researchers and doctors are now dreaming up more ways to merge those technologies, to move consumer-driven monitors inside bodies. “We started to see this line blur with Fitbit,” said Amal Graafstra, who produces magnet implants and other technology through a company called Dangerous Things, which he founded in 2013. “When you start looking into medical applications, there’s going to be a convergence, and I think that’s going to be inevitable.”

😝 The 10 Worst Americans of 2021 - Jon Schwarz, The Intercept | Apparently we don’t love all celebrity inventors. The piece really exemplifies a certain kind of mindset: If someone gets rich doing something tremendously valuable, it’s a bad thing because if that thing is so valuable, they should just be doing it anyway. Also, all billionaires are bad — even those helping create a green economy down here and a space economy up there. (Elon Musk is #3 on the list.) Even those developing the coronovirus vaccines that are saving million of lives and allowing the $100 trillion global economy to reopen. (Moderna and Pfizer executives and investors are #8 on the list.)

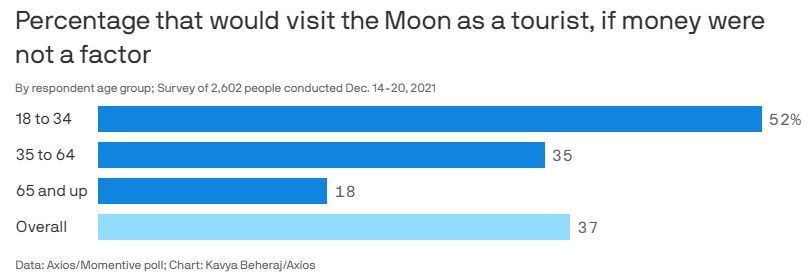

🚀 Majority of Americans don't want to travel to the Moon - Miriam Kramer, Axios | Way to go, Gen-Z!