🤖 Why Goldman Sachs thinks generative AI could have a huge impact on economic growth and productivity

The end of the Long Stagnation might finally be at hand

“In the limit, if capital can replace labor entirely, growth rates could explode, with incomes becoming infinite in finite time.” - “The Future of U.S. Economic Growth” by John G. Fernald and Charles I. Jones, January 2014

The Essay

🤖 Why Goldman Sachs thinks generative AI could have a huge impact on economic growth and productivity

The raison d'être of this newsletter is building a better world — wealthier, healthier, more opportunity, more resilience, more fun — through faster technological progress and economic growth. And while big advances in artificial intelligence are likely going to be a big part of making that goal a reality, I’m not banking on human-level AI, much less superhuman machine intelligence. Humanity can accomplish a lot merely by progressing as fast in the future as it has during peak periods of the past. And at least one Wall Street megabank thinks generative AI technologies such as ChatGPT and Bard can do the trick.

The title of the new Goldman Sachs report, “The Potentially Large Effects of Artificial Intelligence on Economic Growth,” is pro-progress, Up Wing music to my conservative-futurist ears. From the report:

The recent emergence of generative artificial intelligence (AI) raises whether we are on the brink of a rapid acceleration in task automation that will drive labor cost savings and raise productivity. Despite significant uncertainty around the potential of generative AI, its ability to generate content that is indistinguishable from human-created output and to break down communication barriers between humans and machines reflects a major advancement with potentially large macroeconomic effects. … The combination of significant labor cost savings, new job creation, and a productivity boost for non-displaced workers raises the possibility of a labor productivity boom like those that followed the emergence of earlier general-purpose technologies like the electric motor and personal computer.

Here are the main takeaways from GS economists Joseph Briggs and Devesh Kodnani, which I shall subsequently dive into:

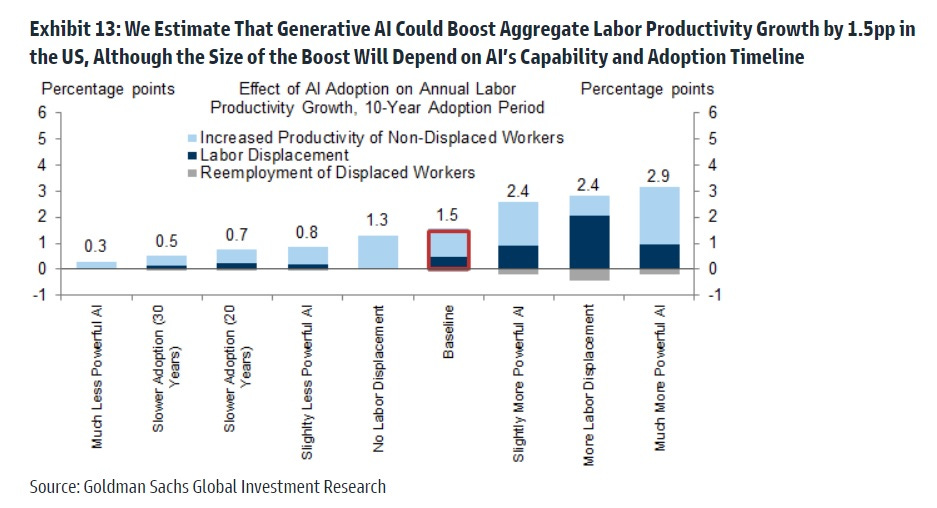

Generative AI could raise annual US labor productivity growth by just under 1½ percentage points over a 10-year period following widespread business adoption.

Generative AI could eventually increase annual global GDP by 7 percent, equal to an almost $7 trillion increase in annual global GDP over a 10-year period.

Generative AI will be disruptive to jobs: “We find that roughly two-thirds of current jobs are exposed to some degree of AI automation, and that generative AI could substitute up to one-fourth of current work.”

AI investment could approach 1 percent of US GDP by 2030 if it increases at the pace of software investment in the 1990s. (That said, US and global private investment in AI totaled $53 billion and $94 billion in 2021, a fivefold increase in real terms from five years prior.)

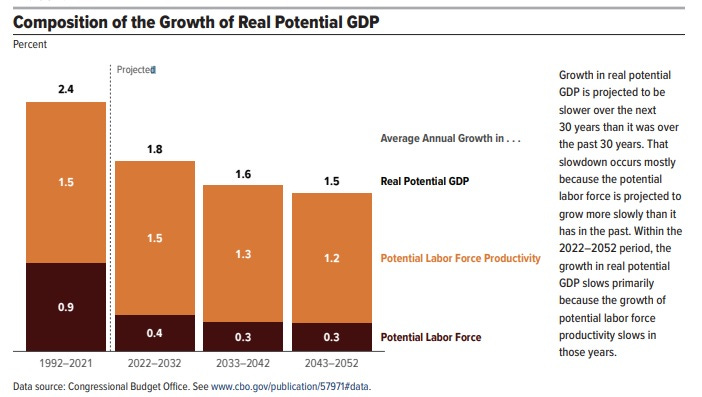

For context, such a labor productivity increase would double the long-term Congressional Budget Office forecast of US productivity — and economic growth.

It would create a long-term 3 percent economy (again), instead of a 1.5 percent economy, with productivity growth at the highest levels since the boomy late 1990s and early 2000s. The Long Stagnation could soon be over. Well, soon-ish. Key caveats here include how good generative AI gets (the difficulty level of the tasks it can automate) and how fast the evolving technology is adopted throughout the economy.