👽 Washington is taking UFOs more seriously. Should Wall Street?

Also: The fate of Build Back Better and the US economy

“The single word for vertical, 0 to 1 progress is technology. The rapid progress of information technology in recent decades has made Silicon Valley the capital of ‘technology’ in general. But there is no reason why technology should be limited to computers. Properly understood, any new and better way of doing things is technology.” - Peter Thiel, Zero to One

In This Issue

Short Read: OUT: Infrastructure Week; IN: Build Back Better Week (Month? Year? Ever?)

Long Read: Washington is taking UFOs more seriously. Should Wall Street?

Micro Reads: Elon Musk, Nuclear-powered Europe; Washington and the blockchain; and more . . .

Short Read

⏸ OUT: Infrastructure Week; IN: Build Back Better Week (Month? Year? Ever?)

It’s hard to imagine some version of the Build Back Better legislation not passing at some point next year. Not only is BBB the heart of President Biden’s agenda, there actually seems to be agreement on the top-line number of around $1.7 trillion. But the political process has dragged on long enough that some on Wall Street are contemplating failure and what it would mean for the economy. This from a new Goldman Sachs research note:

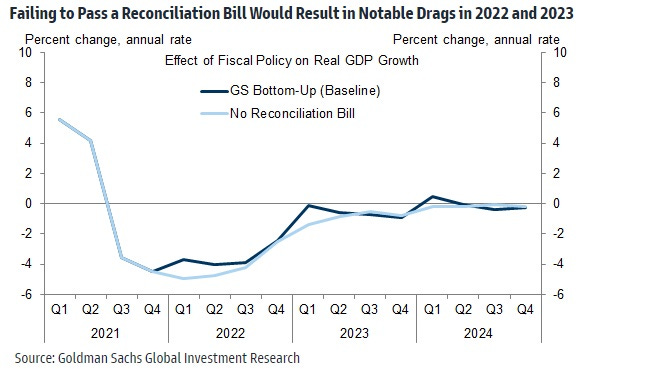

However, we see larger downside risk versus our forecast if none of the spending in the BBB is approved, as the expiration of the expanded child tax credit would weigh heavily on growth in 2022, and less spending on green energy initiatives and other social programs (vs. our current forecast) would weigh on growth in 2023 and 2024, although these drags on spending would be partially offset by a smaller tax burden. We estimate that GDP growth would be more than ½pp lower in 2022 (Q4/Q4 basis, vs. current forecast) and more than ¼pp lower in 2023 if fiscal support is limited to spending that has already been passed into law.

The current GS forecast for 2022 real GDP is 3.9 percent, 2.2 percent for 2023. Now keep in mind these are short-term forecasts based on the flow of net new spending. They doesn’t take into account any supply-side impacts. Here’s what those look like, at least according to Moody’s Analytics economist Mark Zandi: “Longer term, the economy’s growth enjoys a measurable increase due to stronger productivity growth given greater educational attainment and higher labor force participation.” I should note that I’m far more confident of the supply-side impact from the infrastructure package than BBB. Anyway, what is the case for failure? This from the folks at Cornerstone Macro:

[Senator Joe] Manchin is a legislator who negotiates in good faith and believes in compromise. He has signaled he wants to get to “yes.” The body language of the White House and the Democratic leadership is that Manchin wants to get to “yes.” Manchin is unlikely to walk away from the table. If a deal falls apart, it will probably happen because Manchin demands more sweeping changes than some progressives are willing to accept.

Long Read

👽 Washington is taking UFOs more seriously. Should Wall Street?

The Pentagon is taking Unidentified Aerial Phenomena — UAP is now the preferred acronym over UFO — more seriously. The new $770 billion defense bill creates a new taskforce to coordinate government efforts to “rapidly respond to military UFO sightings and conduct investigations through the recently passed legislation,” according to USA Today. The office is the result of an amendment pushed in the Senate by Marco Rubio, a Florida Republican, and Kirsten Gillibrand, a New York Democrat, along with Rep. Ruben Gallego, an Arizona Democrat, in the House. As Rubio put it:

It is my hope that the creation of a new joint Defense Department and Intelligence Community office focused on UAPs will provide the resources, analytics and attention needed to determine what is loitering around our military training ranges. The DoD and IC need to ensure a more uniform collection strategy is in place and that we continue to destigmatize reporting on UAPs, particularly from military aviators. Significantly, we also maintain the transparency and accountability that my provision in last year’s Intelligence Authorization Act report provided, by ensuring ongoing unclassified reporting.

In other words, it’s now safer than ever for serious people to discuss UAPs and not undermine their credibility as serious people. This new UAP office comes after the emergence in recent years of US Navy videos and aviator testimony about what they’ve seen in the skies off America’s coasts. Maybe there are alien spacecraft buzzing about, maybe it’s high-end Chinese drones — the possibility of the latter seems to have increased after reports of those Chinese hypersonic weapons tests this summer that appeared “to defy the laws of physics,” according to one analyst quoted by the Financial Times.

But what if a task force from the new UAP office reports evidence supportive of UAPs being not from this Earth or perhaps even from this dimension? A recent FT piece by columnist Izabella Kaminska speculates on the economic impact:

Award-winning investigative journalist and author of “In Plain Sight” Ross Coulthart has been investigating what officials really know about UAPs for years. One of the biggest concerns among those in the know, he says, was the potential economic impact on markets if the scale of uncertainty surrounding UAPs in the military became known. “Everyone talks about a potential for a massive collapse in the world economy if this revelation is not handled properly,” he told the FT Alphaville.

The piece goes on to quote from the prospectus of the Procure Space ETF, an investment product that owns shares of various satellite companies. It may be the first and so far only prospectus to warn of portfolio risk from UAP activities: “Given that currently there is no identification of these observed phenomena, it is possible that UAPs could create unintentional or deliberate operational, data security, ‘cyber,’ and other interference with the operation of satellites and other objects in space.”

Of course, UAPs interfering with satellites is probably one of the less scary scenarios potentially emerging from alien contact. Maybe put economic collapse in the middle, and something out of a big-budget Hollywood production on the most apocalyptic end. Indeed, most books, television shows, and films focus on such negatives. (Along those lines, I would highly recommend the slow-burn series Invasion on Apple TV+. Spoiler: I doubt stocks are doing well in that universe.)

But there are also potential upsides. The FT points out “the opportunity to benefit from superior technologies and knowledge sharing, such as the chance to obtain zero-gravity or ‘free energy systems,’ would be tantamount to a global wealth injection. That is the sort of optimistic scenario less frequently depicted in science fiction. One example that does come to mind is the comic-book series Miracleman from the 1980s and early 1990s where alien-created superhumans create a Marxist utopia — free food and shelter, free education, superpowers for all — here on Earth, although there are strong hints that this paradise comes at the expense of freedom. This page is from issue #16:

But even if we never got hold of alien tech, just their presence would show humanity that we’re nowhere close to our potential. As I wrote earlier this year:

I would like to think there would be renewed interest in science of all sorts, in discovery, in maximizing human potential — especially when we could see such vivid evidence that advanced civilizations won’t ultimately destroy themselves through war or planetary negligence. There might also be a greater sense of humanity’s shared destiny, as President Reagan noted in his 1987 UN speech where he speculated an alien attack would bring together the nations of the world. But maybe it doesn’t need to be an attack, even a friendly “hello” might do.

Micro Reads

🏆 Elon Musk: Interview with FT’s Person of the year - Financial Times | Whatever the controversy about Musk being Time magazine’s POY, it certainly makes sense for the FT, a business-oriented publication. This is my favorite Musk quote: “I’m just trying to get people to Mars, and enable freedom of information with Starlink, accelerate sustainable technology with Tesla, free people from the drudgery of driving. It’s certainly possible that the road to hell to some degree is paved with good intentions — but the road to hell is mostly paved with bad intentions.”

🚀 How did SpaceX revolutionize private spaceflight? My long-read Q&A with Eric Berger - James Pethokoukis | I really enjoyed conducting this deep-dive chat (also available via podcast) with the senior space editor at Ars Technica and the author of Liftoff: Elon Musk and the Desperate Early Days That Launched SpaceX. It’s even Musk approved:

⚛ Dutch explore nuclear 'taboo' as part of energy transition - Reuters | That “taboo” seems to be quickly eroding across Europe. The Netherlands’ new “government-in-waiting” says the country may build two nuclear reactors to help achieve a carbon-neutral economy. “We're going toward climate neutrality in 2050. We're doing that . . . with green taxes, with enormous investments in renewable energy, and by getting rid of taboos not only on taxes on driving but also on nuclear energy.” said the leader, leader of D66, the coalition's second-largest party.

☀ Solar Is Dirt-Cheap and About to Get Even More Powerful - Bloomberg | The steady and significant decline in photovoltaic panel cost seems to be bottoming out. Now it’s time to make the panels more powerful. The piece mentions a number of innovations but “perovskite promises a genuine breakthrough. Thinner and more transparent than polysilicon, the material that’s traditionally used, perovskite could eventually be layered on top of existing solar panels to boost efficiency, or be integrated with glass to make building windows that also generate power.”

🔗 America’s Future Depends on the Blockchain - Jay Clayton, Wall Street Journal | The former SEC chairman argues that innovators in this space need regulatory certainty from government as well as active participation:

One potential path is an open public-private effort to explore the tokenization of the U.S. Treasury market and related funding processes. Imagine the efficiencies and regulatory enhancements provided by real-time trading, clearing and settlement in the U.S. Treasury market. How about the many efficiencies and welfare-enhancing products that could be built off tokenized interoperability among the Federal Reserve, regulated financial institutions, other financial services providers, investors, savers and consumers? Imagine the benefits to the U.S. from modernizing current payment markets rather than waiting for new ones to develop. Imagine the investment and human capital that would flow in the direction of U.S. ingenuity, virtually immediately, if such an effort were announced.

⛈ Tweetstorm of the issue:

I love this newsletter. You hit on all the right topics every week.