⏩ Trump’s 3% growth challenge

The president-elect's pick for treasury secretary, investor Scott Bessent, wants to accelerate, but it won’t be easy

First thing first: I’ll keep this short and sweet. Between right now and Sunday, December 1, all my wonderful free subscribers can purchase an annual subscription for just $42. That’s a NICE 30 percent discount from the current price of $60 a year. The discount is even deeper on a monthly basis!

For this low price, you’ll get three to four essays a week, Q&As with fascinating thinkers, a regular podcast, and a Saturday recap of the biggest pro-progress Up Wing news of the week (as well as some Down Wing news. Booo!)

Hey, miss a little, miss a lot! Smash the Big Blue Button and subscribe now!

Hedge-fund manager Scott Bessent, Donald Trump’s pick for US treasury secretary, is promoting what he calls a 3-3-3 plan: reduce the federal budget deficit to three percent of gross domestic product by 2028, produce an additional three million barrels of oil (or its equivalent) a day, and boost economic growth to three percent through deregulation (also playing the key role in deficit reduction).

The result, according to Bessent, would be “an economic lollapalooza.”

I will mostly focus on that last line, the effort to spur faster real GDP growth. Let’s start with some context to outline the challenge. Considering the long history of US economic growth, three percent might seem unambitious and quite doable. Since World War II, growth has averaged just over three percent, with half that growth coming from a growing labor force and half from increased worker productivity. So based on that history, Bessent is merely aiming for the US economy to grow as fast in the future as it has in the past.

Doesn’t seem so unreasonable, yes?

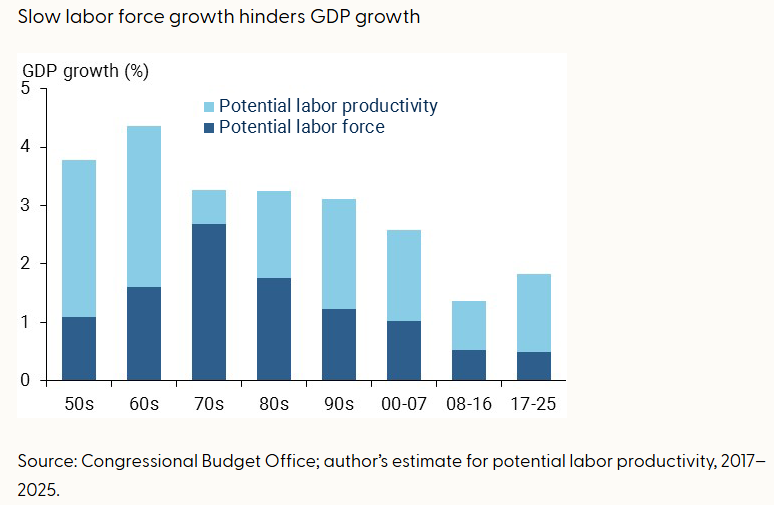

But here’s your trouble (or, rather, Trump’s and Bessent’s): US GDP has been a full point slower this century. A Two Percent Economy rather than a Three Percent Economy or better. This chart tells the story of how slower productivity growth and, especially, slower labor force growth have curtailed the economy’s growth potential:

Briefly: In the 1970s, labor force growth drove 2.7 percentage points of GDP growth. Now it's projected at just a half point at best through 2025, largely due to retiring baby boomers and declining birth rates. This demographic shift, which all rich economies are experiencing, limits US economic growth unless offset by much faster productivity growth.

The JPMorgan economics team gives a nice rundown of the challenge in its 2025 economic outlook report. Think of labor supply and productivity as the supply side of the US economy. Both have been performing well of late, helping power a 2.3 percent pace of GDP growth since the fourth quarter of 2022, a rate that JPM suggests is roughly the economy’s non-inflationary potential growth rate.

But going forward, moderation looks likely. The post-pandemic surge in business churn and labor reallocation that boosted productivity is fading, and expected immigration policy changes should slow labor force growth by about 100,000 workers monthly. The bank also notes “downside risks from tariffs and general policy uncertainty.”

JPM: bottom lines it: “Finally, to tie it all together, we think trend labor force growth will slow to around 0.45% per year. Along with the economy-wide 1.35% productivity growth, this would put medium-run trend growth at 1.8 percent.” That growth number, by the way, is in line with forecasts at the Federal Reserve and Congressional Budget Office.

Faster growth through deregulation

So how to upshift from 1.8 percent economic growth to three percent? Bessent is counting on deregulation to greatly improve that status quo. Is it possible? Well, I have little doubt that overregulation has greatly constrained American growth potential for decades. It's a key point in my 2023 book, which I support with several studies.

Economists John Dawson and John Seater found federal regulations have reduced real GDP growth by roughly two percentage points annually since World War II. Without these regulatory constraints, the US economy could have grown at five percent instead of three percent annually.

Regulation costs in home building are 11 percent higher today than they were five years ago, accounting for $93,870 of the final price of a new single-family home. In the last decade alone, regulation costs have increased by 44 percent. In the construction sector specifically, value added per worker was about 40 percent lower in 2020 than it was in 1970.

If just three high-productivity cities — New York, San Jose, and San Francisco — changed their housing rules to the level of restrictiveness of the median US city, it would generate a four percent increase in US GDP and an additional $4,000 in average earnings for all American workers.

And while we're talking about growth drivers, it's worth noting that simply replacing the bottom five to 10 percent of teachers with merely average ones could boost US economic growth by 0.8 percentage points annually — suggesting that better teachers alone could drive nearly half the growth improvement we're seeking.

These findings make a strong case that smart deregulation could indeed help bridge the gap from 1.8 to three percent growth — that, even if I’m not exactly sure how, say, deeply reforming the National Environmental Policy Act would translate into higher productivity.

But deregulation isn’t like a stimulus check. It might take time for any growth impulse from deregulation to work its way through the economy. Businesses must adjust to new rules, workers will need retraining, and new infrastructure will need to be built, such as energy supply and transmission. The entire economic ecosystem needs time to realign itself with an altered regulatory environment — and then for that investment to turn into faster productivity growth by American businesses.

Yet I can also envision a more immediate impact. Deregulation could trigger an imminent acceleration if stock markets react positively — as we saw right after the election — boosting company valuations and making capital more accessible. This, combined with the removal of immediate bottlenecks and the presence of ready-to-launch business plans — from nuclear energy to financial tech like cryptocurrency — might help growth sooner rather than later

It might come down to generative AI

But the most important deregulatory move is not to regulate poorly in the first place. This is especially important to keep in mind right now with artificial intelligence. Generative AI, as a significant general-purpose technology, might provide the most likely path back to three percent growth. Yet no major bank or government entity is assuming that will happen in a significant way as they make their growth forecasts for the next few years. Just too much of a wild card.

But Team Trump could get lucky in a major way, as is documented in an expansive new report from the National Academy of Sciences, “Artificial Intelligence and the Future of Work,” by such notable thinkers as Stanford University’s Erik Brynjolfsson, MIT’s David Autor, AEI’s Michael Strain, and Eric Horvitz of Microsoft, among others. Here is a bit of the report’s consensus on AI and growth:

AI has the potential to increase aggregate productivity growth substantially for the broader economy in the coming decade. Although it is notoriously difficult to predict the details of future impact, some estimates suggest as much as a doubling of the rate of growth in the U.S. gross domestic product (GDP) from about 1.4 percent currently to 3 percent. Moreover, generative AI’s potential to accelerate scientific discovery and innovation could further compound productivity gains.

The report also makes this point about regulation: While regulation is necessary to address legitimate risks, overly restrictive or poorly designed regulations could significantly slow AI adoption and delay its potential productivity benefits. That would be bad, as Dean Ball, technology policy analyst at the Mercatus Center, explains in his recent newsletter, “America is better positioned than any other country on Earth to thrive amid the industrial revolution to come. To the extent AI is a race, it is ours to lose. To the extent AI is a new epoch in history, it is ours to master.”

His advice: If the Trump White House follows through on its promise to repeal Biden's AI Executive Order, it should be replaced with a new EO that preserves the key reporting requirements for frontier labs, biological foundation models, and large data centers (though he notes the compute threshold would need updating over time).

Beyond that, Ball advocates for withdrawing from the Council of Europe AI Framework Convention, retracting the Blueprint for an AI Bill of Rights, and revising the OMB's guidance on federal AI use to reduce barriers to government AI adoption. He also sees federal preemption as urgently needed to prevent individual states from creating a complex patchwork of AI regulations that could inadvertently shape national AI policy.

There’s more, but let me finish with this from Ball:

Permitting reform is perhaps the most important AI policy priority for the federal government. It is critical to ensure the construction of the energy generation, data centers, semiconductor manufacturing facilities, and other physical infrastructure we will require. The current compromise on the table in Congress seems reasonable to me.

Before GenAI, deregulation alone might not have been enough to restore a three percent economy. It now seems essential, however, both in terms of increasing the availability of clean energy and creating a mindset to not prematurely regulate GenAI into insignificance. Faster, please!

On sale everywhere The Conservative Futurist: How To Create the Sci-Fi World We Were Promised

Micro Reads

▶ Economics

▶ Business

Apple Should Have Learned a Chinese Lesson on EVs - Bberg Opinion

▶ Policy/Politics

The return of the techno-libertarians - FT Opinion

The Case for a Smarter Antitrust Policy - National Review

Why Scott Bessent could be Trump’s James Baker - FT Opinion

California’s progressive epicenter just went YIMBY - San Francisco Chronicle

▶ AI/Digital

Robots Aren't Just Coming For Your Jobs But For Your Relationships, Too - Institute for family studies

▶ Biotech/Health

▶ Clean Energy/Climate

Geothermal Could Be the Big Winner of This Election Cycle - Heatmap News

Why I’m optimistic about the energy transition - Foresight

▶ Robotics/AVs

Robot Photographer Takes the Perfect Picture - Spectrum

▶ Space/Transportation

Rocket Lab Shows SpaceX Isn’t the Only Game in Orbit - Bberg Opinion

▶ Substacks/Newsletters

How to think like an economist about AI and jobs - Understanding AI

Are we facing an imminent AI-powered wage collapse? - Exponential View

How Will Republican Governance Change the U.S. Energy Transition? - Breakthrough Journal

Getting started with AI: Good enough prompting - One Useful Thing

Will there be an AI Era? - Joshua Gans’ Newsletter