🌡 The 3°C Scenario: What's the economic impact of severe global warming?

Even with an extreme scenario, the world should be richer and more capable in 2050

Quote of the Issue

“Let’s go and invent tomorrow rather than worrying about yesterday.” - Steve Jobs

The Essay

🌡 The 3°C Scenario: What's the economic impact of severe global warming?

You may have noticed some concerning climate headlines popping up today in your smartphone notifications:

“‘Sounding the alarm’: World on track to breach a critical warming threshold in the next five years” - CNN

“Global warming likely to exceed 1.5C within five years, says weather agency” - Financial Times

“Global warming set to break key 1.5C limit for first time” - BBC

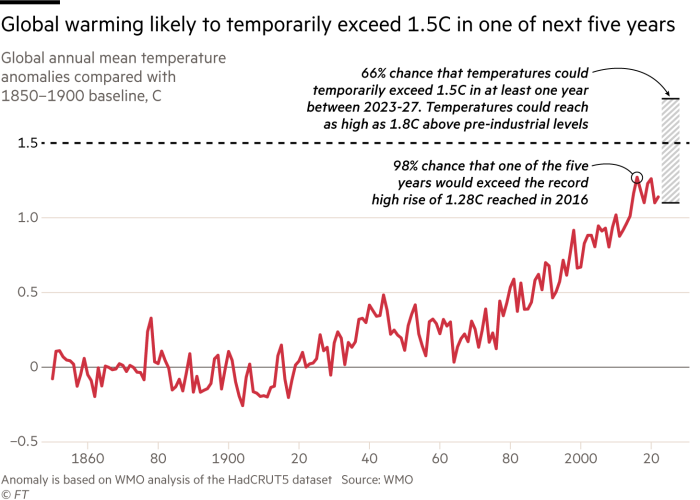

As the above FT chart neatly shows, the newsy forecast is about breaching the 1.5°C level in a single year, not a permanent increase. That said, the UN’s Intergovernmental Panel on Climate Change says humanity better get used to 1.5° and higher without a drastic shift away from fossil fuels. Current global policies, according to the IPCC, make it “likely that warming will exceed 1.5°C during the 21st century and make it harder to limit warming below 2°C.”

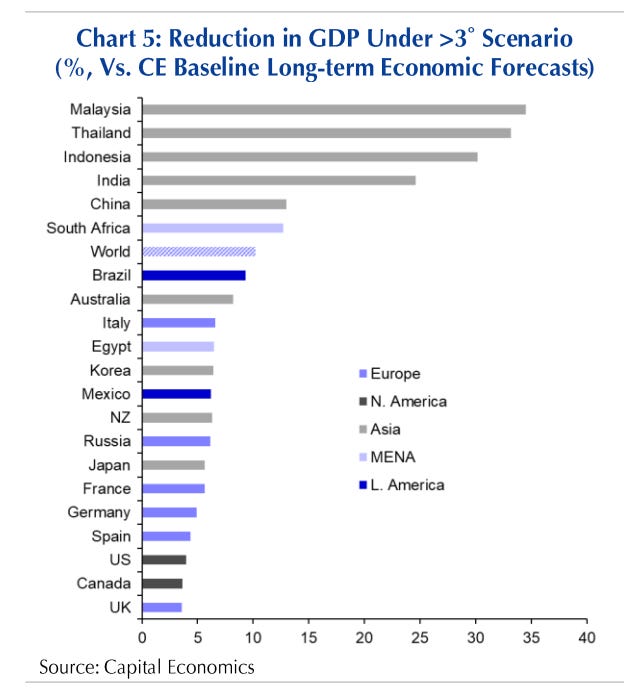

But what if the global heating is more severe than expected? A new analysis by consulting firm Capital Economics looks at a scenario in which the global average temperature rises by more than 3°C from its pre-industrial average and finds that global GDP would still nearly double by 2050.

How could that be possible given all the negative effects predicted by climatologists — which I’m not contesting — such as rising sea levels, more droughts and severe heatwaves, more extreme-weather events such as hurricanes, a loss of biodiversity and ecosystems? From the cautious and meticulous analysis by CE economists David Oxley and Gabriel Ng:

But the key takeaway is that we think global GDP would still nearly double in size between now and mid-century even if the world were to warm by more than we anticipate, largely because developed economies would be affected the least. And even in places where a warmer world would have much bigger impacts on GDP, such as in India and south-east Asia, the physical effects on economic activity would be a headwind to catch-up growth rather than putting economic development in reverse.

(One thing to keep in mind: The firm’s baseline forecast is that the increase in global temperature will be kept just below 2°C thanks to the increasing use of renewable energy sources and other technological improvements, resulting in a 40 percent decline in global greenhouse gas emissions by 2050. This level of warming is already baked into its economic forecast.)

In assembling this forecast, CE highlights some of its key decisions. First, it focused on “physical risks,” such as the impacts of more severe hurricanes and consistently higher temperatures, rather than “transition risks,” the impacts of taxes and regulations meant to mitigate climate change. What’s more, CE also tried to look for economic models that took into account the possibility of non-linear outcomes:

The economist Martin Weitzman of Harvard University succinctly put it in a 2010 paper, "[i]ssues of deep structural uncertainty are fundamental to any economic analysis of climate change." … [The] relationships between climate and economic variables seen in the past will not necessarily be useful guides for the future. Indeed, on the face of it, the wealth of historical data on past weather patterns available to climate researchers should make physical risks from climate change from a given temperature rise relatively easy to assess. But the existence of non-linearities such as tipping points and feedback loops limits the effectiveness of econometric estimation techniques and complicates life. Such effects include the potential melting of ice sheets which could lead to non-linear rises in sea levels with warming temperatures, as well as possible changes to convection currents which could disrupt seasonal rains change on GDP temperature increases in different regions.

As mentioned above, the top-line GDP number hides significant variation by country, especially between rich economies and emerging economies — and especially in southeast Asia where agriculture and tourism are key economic drivers.

But again: The impacts mentioned here won’t result in either advanced or emerging economies becoming poorer a generation from now than they are today. Rather, the physical effects of climate change on economic activity would create headwinds that slow growth. A country suffering some of the biggest impacts from climate change would be Indonesia. Even so, CE still expects the country to become a top-ten economy by 2050. Yet under the 3°C scenario, it would rise to become the eighth largest economy rather than the fifth largest economy under the cooler CE baseline forecast.

Or India: Under both scenarios, it would still be the third largest economy by 2050, but under the 3°C scenario it only be three times as large as fourth place Germany rather than four times in the baseline. CE: “The key point is that while the physical effects of climate change on economic activity would be largest in emerging economies, they would prove a headwind to catch up growth, rather than putting economic development in reverse.”

Finally, this forecast doesn’t attempt to factor in all the things that might have a big impact on long-term economic growth:

For example, some researchers have recently suggested that the widespread adoption of artificial intelligence "could eventually drive a 7% or almost $7trn increase in annual global GDP over a ten-year period". To put this into context, many studies estimate that the absolute effect of physical climate risks on GDP are smaller and much slower. All told, the concept of holding "all else equal" is much easier to fathom in short-term scenario analyses than estimates which span multiple decades.

The good news here is even with a rapid and severe climate outcome over the next 25 years, there’s good reason to think humanity will have even more economic resources and technological capabilities to do something about it — while also preparing for a future where more us can use more energy to turn our dreams into reality. Innovation-driven economic growth is what provides true resilience to America and the world.

Micro Reads

▶ The near- and long-term outlooks for S&P 500 profit margins - Goldman Sachs |

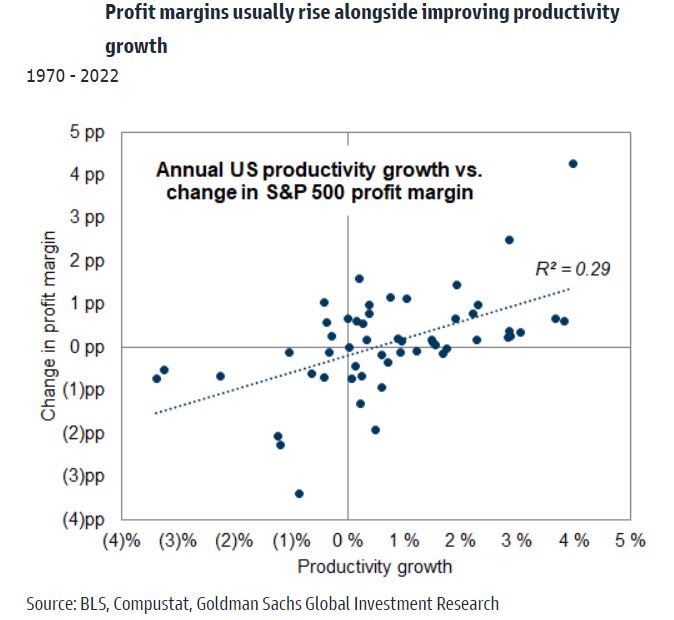

In contrast with these mounting headwinds, strides in AI technology represent potential future tailwinds to profit margins. Our economists have estimated that generative AI could potentially lift US productivity growth by roughly 1.5 pp per year over 10 years following widespread adoption. Based on the historical relationship between productivity growth and corporate profitability, this boost could lift S&P 500 net profit margins by roughly 4 pp over that decade, holding all else equal. The relatively stable share of revenues allocated to SG&A expenses in recent decades, in contrast with large declines in other input costs, underscores the potential gain to profitability from AI. … In addition to the uncertainty around the eventual impact of AI on economic activity, the potential response of government policy to the widespread adoption of AI means the net long-term effect on corporate profits is difficult to predict. Despite strong wage growth and contracting profit margins in recent quarters, the labor share and corporate profit shares of US GDP remain close to their extremes of recent decades.

▶ OpenAI chief says new rules are needed to guard against AI risks - Cristina Criddle in London and Hannah Murphy, FT |

▶ How Humanity Can Avoid an AI Takeover - Gideon Lichfield and Lauren Goode, Wired |

▶ Can we stop runaway AI? - Matthew Hutson, New Yorker |

▶ Dynamism in the West, Stagnation for Much of the Rest - Economic Innovation Group |

▶ China’s $220 Billion Biotech Initiative Is Struggling to Take Off - Bloomberg Businessweek |

▶ What Everyone—Except the U.S.—Has Learned About Immigration - Tom Fairless, WSJ |

▶ Goldman Strategists See Potential Profit Boom From AI - Ksenia Galouchko, Bloomberg |

▶ There's Fresh Hope on One of the Toughest Cancers to Cure - Lisa Jarvis, Bloomberg Opinion |

▶ IBM, Google Give $150 Million for U.S.-Japan Quantum-Computing Push as China Looms - Peter Landers, WSJ |

▶ The First Crispr-Edited Salad Is Here - Emily Mullen, Wired |