🎲 Recession odds vs. the chances of a New Roaring '20s

Also: 5 Quick Questions for … tech policy analyst James Bessen on Big Tech, AI, and Big Data

In This Issue

The Essay: Recession odds vs. the chances of a New Roaring '20s

5QQ: 5 Quick Questions for … tech policy analyst James Bessen on Big Tech, AI, and Big Data

Micro Reads: Bard and ChatGPT, pandemics, permitting reform, and more

Quote of the Issue

“Today, the scale of the largest AI computations is doubling every six months, far outpacing Moore’s Law. At the same time, advanced generative AI and large language models are capturing the imaginations of people around the world. … Two years ago we unveiled next-generation language and conversation capabilities powered by our Language Model for Dialogue Applications. We’ve been working on an experimental conversational AI service, powered by LaMDA, that we’re calling Bard. And today, we’re taking another step forward by opening it up to trusted testers ahead of making it more widely available to the public in the coming weeks.” - an announcement today from Sundar Pichai, CEO of Google and Alphabet

The Essay

🎲 Recession odds vs. the chances of a New Roaring '20s

My aspirational New Roaring ‘20s thesis doesn’t depend on uninterrupted economic growth. (Though, of course, that would be awesome.) As I have previously noted, the Roaring 1920s of rapid productivity and economic growth began with a brutal mini-depression that lasted from Jan. 1920 to July 1921. (In The Forgotten Depression, financial journalist James Grant points out the “bitterly sardonic” lyrics of the 1921 hit “Ain’t We Got Fun” were inspired by the decade’s depressionary start, not its later Jazz Age ebullience. You can thank me when this fact wins you a bar trivia contest some day.)

So even if the US economy were to slip into recession this year, it wouldn’t negate the thesis. That said, many economists are predicting a downturn as higher interest tamp down and consumer demand and business investment. In last month’s Wall Street Journal survey of business and academic economists, the aggregate forecast put the probability of a recession in the next 12 months at 61 percent.

But who are you going to believe, economists answering a survey or business owners hiring gobs of workers? It’s hard to ignore what’s happening in the US labor market. The January jobs report released last Friday was a whopper. In a report titled “This one goes to 11” — a reference to the film Spinal Tap, JPMorgan economist Michael Feroli gave a sense of its whopper-ness: “The January jobs report was shockingly strong, as the 517,000 nonfarm job growth figure was almost double the December outturn and nearly three times greater than expectations. Just as surprising, average weekly hours surged 0.3 hour to 34.7 hours. The combination of the two—total hours worked—increased a whopping 1.2%, one of the strongest prints outside the immediate post-pandemic period.”

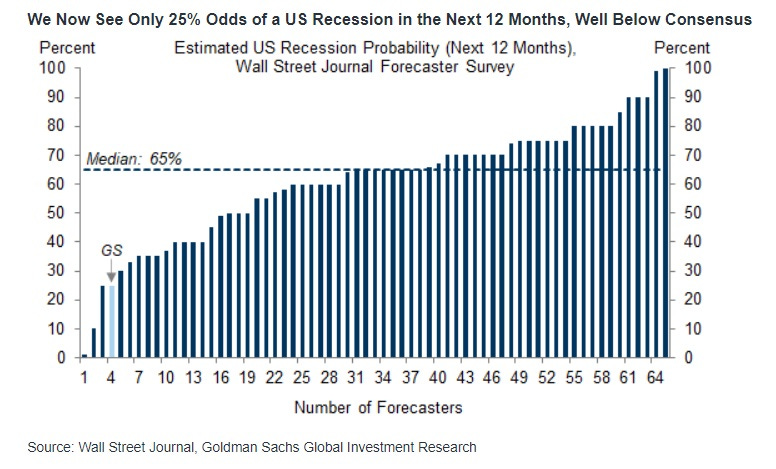

So at least over the near term, things look OK. But Recession Not Now doesn’t mean Recession Never, of course. That said, there’s some reason to think the recession odds are declining. This from the econ team at Goldman Sachs today [Note that GS is using the median of the WSJ survey, while the newspaper uses the average or mean]:

We have cut our subjective probability that the US economy will enter a recession in the next 12 months from 35% to 25%, less than half the 65% consensus estimate in the latest Wall Street Journal survey. Continued strength in the labor market and early signs of improvement in the business surveys suggest that the risk of a near-term slump has diminished notably. And while Q1 GDP still looks soft—our latest tracking estimate is +0.4%—we expect growth to pick up in the spring as real disposable income continues to increase, the drag from tighter financial conditions abates, and faster growth in China and Europe supports the US manufacturing sector.

To dig down just a bit into the bank’s reasoning:

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.