🤖⏭ Nvidia's surge hints at AI's transformative potential. But what's next?

'AI optimism across US equities appears high, but not yet Tech Bubble or post-COVID high.'

Quote of the Issue

“The fear of loss, not novelty, underlies social tension over technologies, some of which takes the form of outright opposition by segments of society against change. Fear of loss can lead individuals or groups to avoid change brought by innovation even if that means forgoing gains.1 But much of the concern is driven by perceptions of loss, not necessarily by concrete evidence of loss. The fear or perception of loss may take material forms, but it also includes intellectual and psychological factors such as challenges to established worldviews or identity.” - Calestous Juma, Innovation and Its Enemies: Why People Resist New Technologies

The Conservative Futurist: How To Create the Sci-Fi World We Were Promised

“With groundbreaking ideas and sharp analysis, Pethokoukis provides a detailed roadmap to a fantastic future filled with incredible progress and prosperity that is both optimistic and realistic.”

The Essay

🤖⏭ Nvidia's surge hints at AI's transformative potential. But what's next?

One of my favorite economics papers is “Are We Approaching an Economic Singularity? Information Technology and the Future of Economic Growth” by Nobel laureate William Nordhaus. Among other things, Nordhaus suggests six supply-side tests to determine if we are approaching an economic “Singularity,” a hypothetical future point where superintelligent machines cause explosive economic growth.

1/ Is it getting easier to replace human labor with machines? (Nordhaus: There is some evidence this may be happening, but it's not conclusive.)

2/ Is productivity growth accelerating? (Nordhaus: No, productivity growth has actually slowed down in recent decades.)

3/ Is the share of income going to capital (vs. labor) increasing? (Nordhaus: Yes, the capital share has been increasing, but slowly. At the current rate, it would take over a century to reach Singularity levels.)

4/ Is the ratio of capital to output growing faster and faster? (Nordhaus: No, the capital-output ratio has been stable or falling.)

5/ Is information technology becoming a rapidly increasing share of total capital? (Nordhaus: Yes, but it's still a small share, and projecting current trends, it would take over a century for it to dominate the capital stock.)

6/ Is productivity growth higher than it appears due to mismeasurement, especially of IT? (Nordhaus: Examining data on different industries, any mismeasurement of IT appears small and isn't leading to accelerating productivity growth across the economy.)

Nordhaus’ conclusion, at least as of 2021: “The Singularity is not near.”

Is the stock market telling us something about the AI Revolution?

Of course, a lot has happened since 2021. Maybe you’ve heard of ChatGPT? Still, it’s early days in the (hopefully) emerging Age of AI, especially in the area of generative AI such as chatbots and image generators. Perhaps the most tangible, real-world GenAI effects are happening in government — the EU just gave final approval to a sweeping law regulating artificial intelligence in numerous ways — and in the stock market.

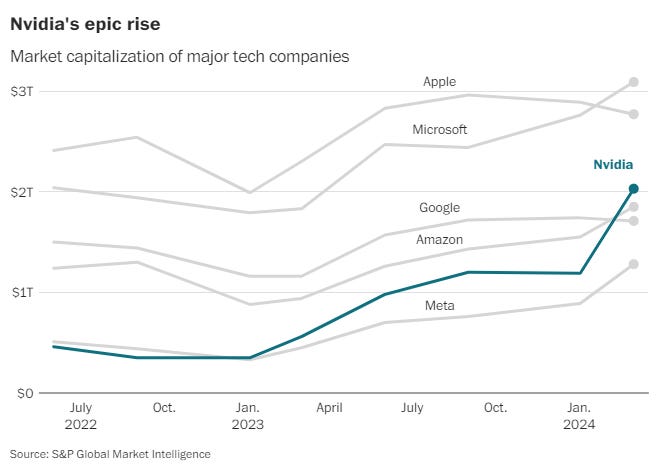

As far as the latter goes, perhaps the most obvious impact can be seen in the shares of Nvidia. The company’s graphics processing units, or GPUs, power the large language models developed by OpenAI, Alphabet, Meta, and numerous well-funded startups competing in the GenAI space. Nvidia's market cap first exceeded $1 trillion in May 2023. The stock continued to surge over the rest of the year, becoming the top-performing S&P 500 Index stock of 2023. In just the first two months of 2024, NVDA has already risen more than 80 percent year-to-date, and its market cap has surpassed $2 trillion.

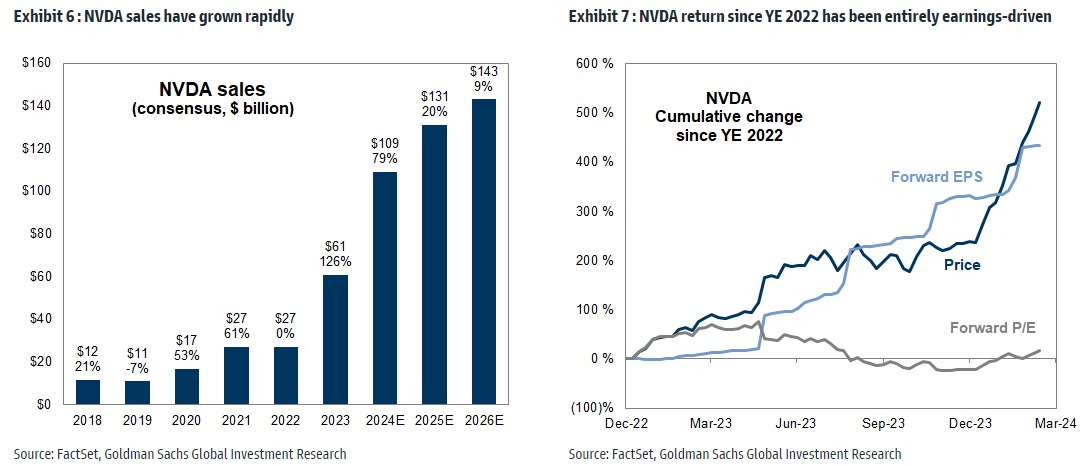

To me, this market action suggests something important and real is likely happening — though not necessarily leading to the Singularity — especially when you see how the rise in Nvidia’s market value has been supported by earnings. It’s not just some speculative play. As Goldman Sachs notes in a new analysis:

NVDA has been the largest near-term AI beneficiary, with earnings driving the entirety of its 522% return since the start of 2023. NVDA sales appear on track to increase by 300% in just 2 years. Despite AI optimism, the stock's forward P/E is virtually unchanged since the start of 2023.

More broadly, GS doesn’t think that while the market’s “long-term growth expectations” have risen — thanks in part to AI optimism — they haven’t yet reached levels seen during the peak of the Tech Bubble in March 2000 or the post-COVID high of 2021.

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.