🔃 How bad policy can offset the AI boom

America is accelerating on AI while slamming the brakes on trade — not a great combination

🦃 First things first: It’s Thanksgiving week in America — a perfect moment for a Substack sale. Hit the big blue button below and get 50% off an annual subscription.

I think the next 12 months are going to be wild, and not just because of fresh advances in artificial intelligence or America’s 250th birthday celebration as the original Up Wing nation.

I’ve never look forward to writing FASTER, PLEASE more than I do right now. And I want you along for the entire ride! So hit the big blue button below and get 50% off an annual subscription.

🦃Second things second: Since this is a holiday week, this newsletter will be shorter and perhaps a bit less frequent. There will also be no Week in Review on Saturday, so I will do a brief Up Wing-Down Wing Things in each issue.

As we head into 2026, you should have no doubt that the United States is attempting a difficult economic maneuver: AI acceleration and trade protectionism. Let’s hope we can stick the landing.

As I recently wrote, the St. Louis Fed reports generative AI is now used by over half of American workers, creating self-reported time savings that translate to a nice boost in aggregate labor productivity since ChatGPT’s arrival:

… productivity increased at an average rate of 1.43% per year from 2015-2019, before the COVID-19 pandemic. By contrast, from the fourth quarter of 2022 through the second quarter of 2025, aggregate labor productivity increased by 2.16% on an annualized basis. Relative to its prepandemic trend, this corresponds to excess cumulative productivity growth of 1.89 percentage points since ChatGPT was publicly released.

That’s the sort of momentum that should be spinning the economy into a new, higher-growth gear.

Alas, the sharp rise in US tariffs — an unprecedented 15 percent average increase in 2025 — threatens to grind the gears of the technological engine before it fully engages. As new research from the San Francisco Fed suggests, massive tariff hikes behave less like inflation catalysts and more like broad-based tax increases that dampen investment and suppress demand. I worry this is a needlessly toxic macro backdrop for an emerging technological revolution that benefits from cheap inputs and bold capital spending.

J.P. Morgan rightly notes the discrepancy in a new report: Despite the green shoots, nonfarm business productivity over the past year has returned to its tepid 1.5 percent pre-pandemic trend. The AI momentum, in other words, is now being perfectly offset by structural drags like trade wars and policy uncertainty. JPM cites a possible relevant historical analogy:

One parallel is the UK experience after Brexit. That disruptive event did not produce a recession, and it is hard to identify much change in trend productivity. However, Bloom et al (2025) argue that from 2016 to 2025 Brexit reduced productivity by an average of 0.3-0.4% per year, in comparison to other countries.

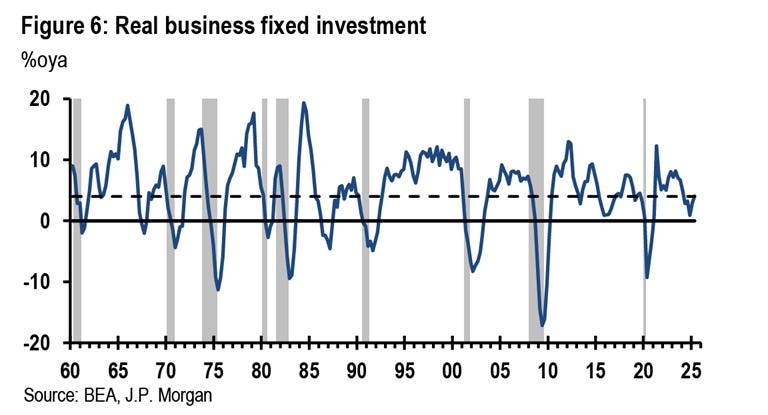

The 1990s tech boom coincided with falling trade barriers and fiscal policy stability. Today’s boom is colliding with rising protectionism and fiscal policy incoherence. Indeed, JPM notes that despite all that AI capex, “total real business fixed investment over the last year has only risen 4.0%, a moderate reading for an economic expansion.”

Policymakers shouldn’t count on an AI investment boom that never goes bust, nor an AI investment boom that leads to superintelligence sooner rather than later. Smart policy — economic openness, regulatory humility, public investment, fiscal prudence — matters even when amazing breakthroughs feel inevitable.

⤴⤵ Up Wing/Down Wing

⤴ Up Wing Things

Waymo gets regulatory approval to expand across Bay Area and Southern California - TechCrunch

The Strange and Totally Real Plan to Blot Out the Sun and Reverse Global Warming - Politico

Amazon’s X-energy gets backing from Jane Street as investors bet big on nuclear - FT

Who will win the trillion-dollar robotaxi race? - Economist

⤵ Down Wing Things

Why America Is Shutting the Door on Immigration—Again - Free Press

Everyone Is Talking About the ‘Affordability Crisis.’ It Can’t Be Solved - WSJ

Trump’s $21 Trillion Investment Boom Is Actually Short Trillions - Bloomberg

On sale everywhere The Conservative Futurist: How To Create the Sci-Fi World We Were Promised