⚛☢ Here's what can end the nuclear renaissance, according to America's biggest bank

JPMorgan outlines the headwinds facing an emerging New Atomic Age

We're currently in the midst of, what, maybe the third or fourth nuclear "renaissance" of the past 40 years? Sounds about right. As such, a third or fourth nuclear revival failure would hardly be an unreasonable baseline expectation.

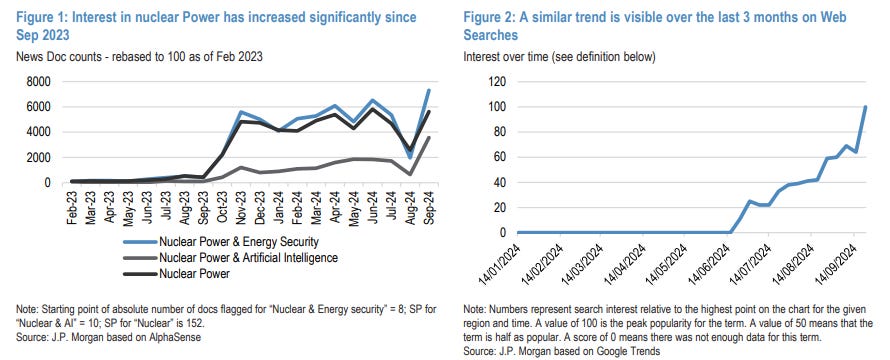

There are, however, some pretty powerful tailwinds that give cause for optimism, as outlined in a new report from JP Morgan, America’s biggest bank.

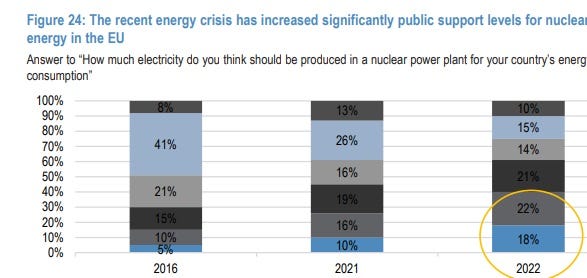

⚛ First, climate change — and the failure of scarcity-driven policymaking — has shifted the risk-benefit calculation of many governments. The ability of nuclear power to generate vast amounts of carbon-free energy is increasingly seen as outweighing any other environmental and safety concerns. “This trend should continue to gain in importance going forward, especially as the world fails to keep on a 1.5°C trajectory.” What’s the alternative? Degrowth?

⚛ Second, energy security has become a much bigger priority since Russia invaded Ukraine. (Here’s looking at you, Germany.)

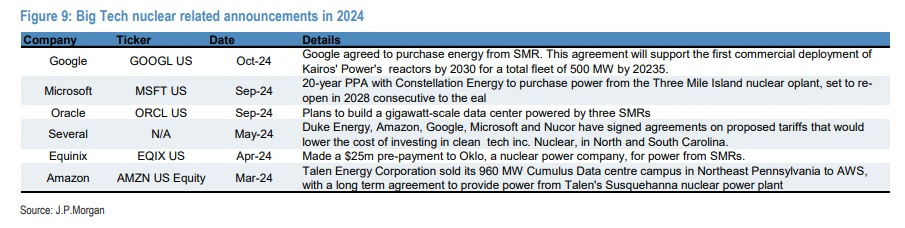

⚛ Third, there's the explosive growth of AI and data centers. JPM points out that this exploding techno-demand will essentially add another Japan's worth of global electricity demand by 2026. “This should be in particular a strong component of the forecast rebound in electricity demand in the US for the three years to come.”

⚛ Fourth, mini nuclear reactors, or “small modular reactors,” might provide an innovative fix to nuclear power’s biggest headaches — high costs and slow build times. SMRs are simpler, factory-built, and getting real orders, especially from tech firms. While SMRs won't hit the market until around 2028 — assuming everything goes well with technology and regulations — they could be the innovation breakthrough nuclear has been waiting for, finally. Think about this: The world’s current reactor fleet is 32 years old on average, according to JPM. Time for an upgrade.

But it’s the various headwinds confronting this promising nuclear revival that prompt the name of the JPM report:

From the report:

We believe the growing interest in civil nuclear energy is genuine and could boost investment in nuclear capacity. However, financial market participants should remain mindful of the inherent challenges in the nuclear industry to avoid falling into a "NucleHype."

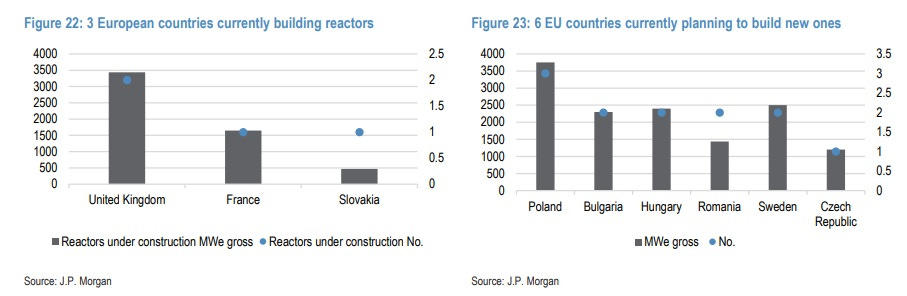

The report is Europe focused, which makes sense since a growing number of governments are reembracing nuclear or turning to nuclear for the first time. But there are plenty of cautionary notes highlighted and explained by JPM that apply to the United States, which we will quickly zip through:

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.