🌅 America's new Golden Age: an update

Chaotic trade policy is a bad start. And the Age of AI isn't yet here

“Yet even amid the plethora of positivity (about AI and other technological advances), the risk to growth from Trumponomics — especially regarding immigration, trade, and overall policy uncertainty — shouldn’t be dismissed. Not at all.” - “A (new) American Golden Age,” published in Faster, Please! on Jan. 20, 2025.

The 2020s have been a tumultuous decade for America, a superpower with global interests. It’s quite the list: a pandemic, a pandemic-driven recession, the biggest European war since World War Two, the nastiest inflationary surge in 40 years, and now a “US vs. the World” trade war instigated by the former. (Well, to be specific, instigated by President Donald Trump.)

Everything everywhere seemingly all at once, basically.

My concern right now: America’s embrace of tariffs as an all-purpose policy tool — haphazardly and unpredictably employed — will lead to an economy where everything we want up will be down (economic growth, productivity) and everything we want down will up (inflation, unemployment.) Standard economic theory would suggest such a scenario is hardly implausible. The profession long ago reached consensus: Trade barriers impoverish nations by undermining the specialization/comparative advantage that drives prosperity in market economies.

But it gets worse: To the well-documented downsides of trade protectionism … add a ginormous dollop of policy uncertainty. When confronted with a foggy outlook — such as, for instance, not knowing what the US president will do next on trade, why he will do it, or for how long he will do it — CEOs predictably retreat to "wait-and-see" postures. They shelve difficult-to-reverse decisions on capital investments and hiring. And if companies en masse postpone investments, economic momentum will falters, and prospects for sustained expansion will fade.

In short, that’s the risk we face. And it’s no way to start the “golden age of America” that Trump claimed in his second presidential inaugural address was ready to roll.

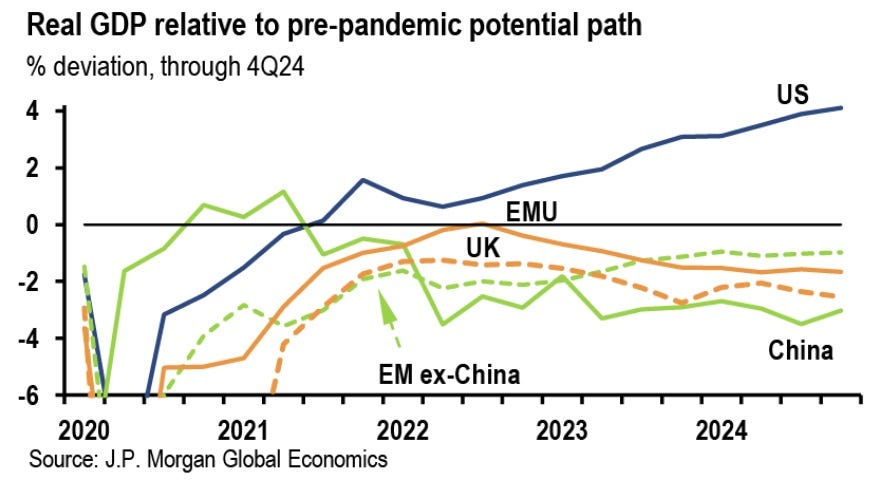

Exiting exceptionalism

The same sort of thinking is expressed in the new research note “What a less-exceptional world” by the well-respected JPMorgan economists Bruce Kasman and Joseph Lupton. In the piece, they note that America for years has been the standout performer in the global economy. Its post-pandemic recovery has left competitors in the dust, with GDP soaring to 4 percent above its pre-pandemic potential by late 2024 while other rich economies floundered. A potent cocktail of fiscal stimulus, robust household balance sheets, surging labor incomes and an immigration boom fueled this remarkable outperformance, according to the economists.

But the exceptional American economy now faces some extreme headwinds.

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.