📉 We're thinking too much about the wrong 'recession'

America's long-term 'productivity recession' is just as important as the short-term ups and downs of GDP growth

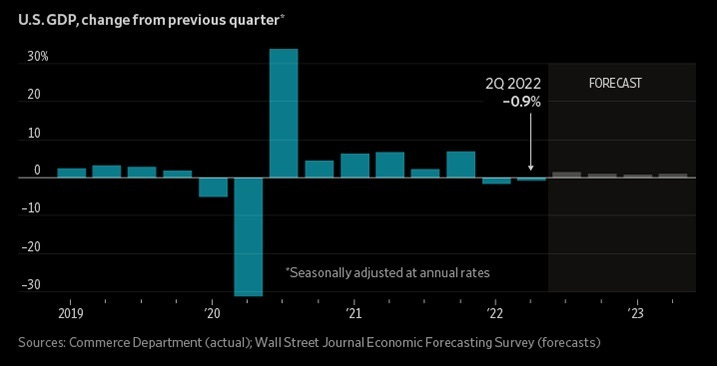

Item: Gross domestic product, a broad measure of the goods and services produced across the economy, fell at an inflation and seasonally adjusted annual rate of 0.9% in the second quarter, the Commerce Department said Thursday. That followed a 1.6% pace of contraction in the first three months of 2022. - The Wall Street Journal, 07.28.22

Item: Democrats’ agreement to move ahead with a tax-and-climate economic package included the promise of separate legislation—expected to move this fall—that would accomplish a bipartisan goal to speed up environmental permitting. - Bloomberg, 07.27.22

Item: The House on Thursday cleared legislation [that] includes various five-year funding authorizations to bolster U.S. scientific research, including $81 billion, or $36 billion over baseline funding, for the National Science Foundation. - Roll Call, 07.28.22

Today’s release of the advanced second-quarter GDP report has exacerbated a definitional debate that is more political than economic: Are we in a recession or not? Or, more accurately, was the US economy in a recession during the first half of the year? The laymen’s definition — consecutive quarters of shrinkage — has been met. But that standard is not how the National Bureau of Economic Research determines a downturn. From the NBER website:

The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee's view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.

Or as Goldman Sachs neatly summed it up today: “[The] official definition of recession is a judgmental mix of levels and rates-of-change across several variables, most of which continued to expand [including nonfarm payrolls, real personal income less transfers, and gross domestic income] in the first half of the year.”

Politicians and pundits should be patient

But there are two other twists worth noting here. First, the NBER isn’t going to make any recession call based on these preliminary numbers. That really bad Q1 number, for instance, might yet get recalculated as positive. Maybe both quarters. That said, if both quarters are eventually determined to be negative, the NBER might well declare them recessionary given past history:

Of course, people trying to score political points don’t care about nuance and timing. It reminds me of when Homer Simpson tries to buy a gun only to be delayed by a five-day waiting period. “Five days!” he exclaims, “But I’m mad now!” Sorry, we’re not going to know if the first half of 2022 really was recessionary for some time yet. About all one probably can say for sure is what JPMorgan economist Michael Feroli told clients this morning (bold by me):