🦸♂️ Venture capital is one of America's most important economic superpowers. Let's not undermine it.

Also: 5 Quick Questions for … commentator and author Virginia Postrel on economic dynamism

In This Issue

The Essay: How venture capital is one of America's most important economic superpowers

5QQ: 5 Quick Questions for … commentator and author Virginia Postrel on economic dynamism

Micro Reads: nuclear fusion, innovation prizes, the cost of the pandemic, and more …

Quote of the Issue

“The proponents of the precautionary principle ultimately hope that blocking the development of new technologies will force the rest of us to submit to the more radically communitarian and egalitarian forms of society and economics that they prefer.” - Ronald Bailey, The End of Doom: Environmental Renewal in the Twenty-first Century

The Essay

🦸♂️ How venture capital is one of America's most important economic superpowers

As a long-time comic book fan, I often frame America’s many economic strengths as superpowers. And it’s not just a fun (some would say indulgent) writerly gimmick. It actually makes some sense as an analytical tool. Some superpeople are born with their abilities, such as Superman (at least under a yellow sun) or the X-Men. Kind of like how America is blessed with abundant natural resources and a natural, feisty entrepreneurial spirit that immigrants have brought with them since the country’s very beginning. Of course, these powers can be lost. Nativism can be kryptonite for attracting global talent.

Other special abilities are the product of hard work and smarts. Think Batman and his martial arts skills and crime-fighting gadgets. Or Tony Stark building his Iron Man techno-armor. Similarly, some of America’s greatest strengths are the result of persistent effort and smart decisions: a rule-based democratic capitalist system where private property is respected and entrepreneurial success is rewarded. Another one: a highly educated public with the world’s best university system.

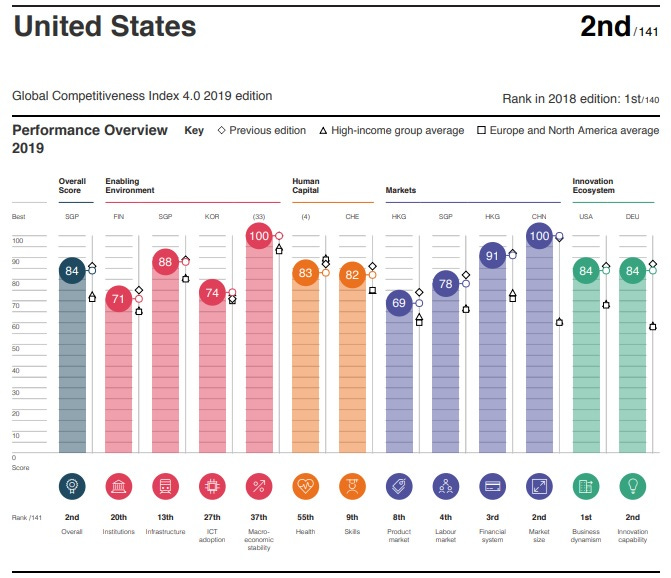

Here’s how the World Economic Forum evaluates America’s economic superpowers, via its 2019 Global Competitiveness Report, which is based on empirical research and a survey of global business leaders:

According to the WEF, America’s financial system is its third strongest superpower. And if you dig into that analysis a bit, you’ll find that one reason for such a high ranking is the US venture capital industry.

Venture capital: America’s economic catalyst

Just to clarify what we’re talking about here: Venture capital is a kind of private equity. It focuses on investing in young companies with high-growth potential. The products and services that these startups produce are core to the modern American economy. This from the new St. Louis Fed paper “Venture Capital: A Catalyst for Innovation and Growth” by Jeremy Greenwood, Pengfei Han, and Juan M. Sánchez:

The companies and products and services VC helped develop are ubiquitous in our daily lives: the Apple iPhone, Google Search, Amazon, Facebook and Twitter, Starbucks, Uber, Tesla electric vehicles, Airbnb, Instacart, and the Moderna COVID-19 vaccine. Although these companies operate in drastically different industries and with dramatically different business models, they share one common and crucial footprint in their corporate histories: All of them received major financing and mentorship support from VC investors in the early stages of their development.

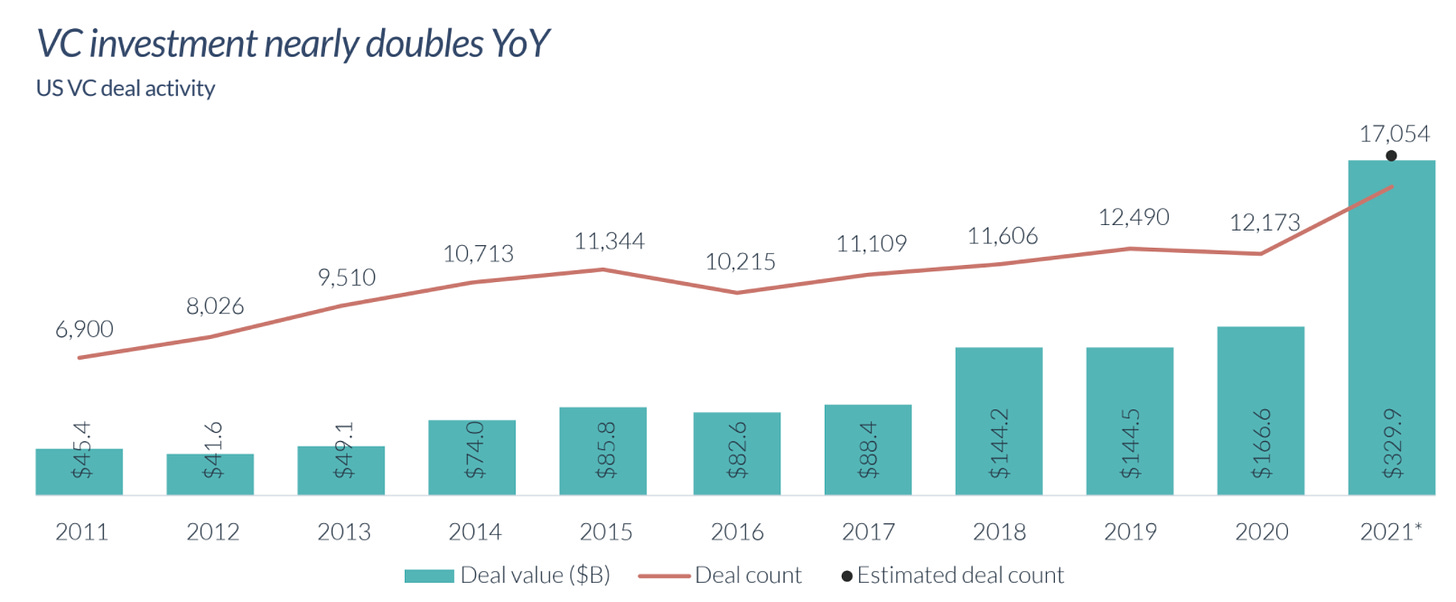

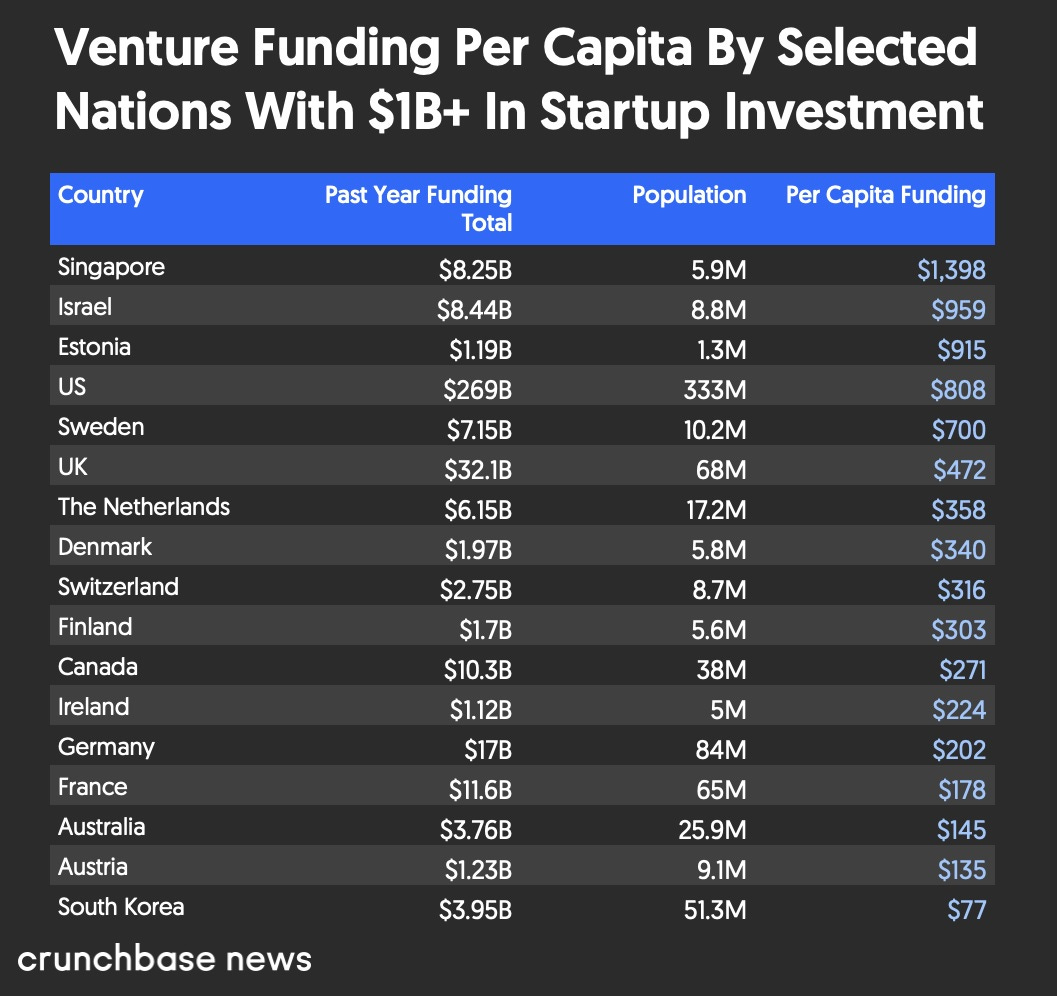

Two charts: The first one, from GeekWire, shows what a phenomenal year 2021 was for VC funding — “everything from crypto to clean tech to health care” — with a record $330 billion invested across 17,054 deals in the United States. The second one shows that whether you’re looking at total funding or funding per capita, it’s clear America is the global leader.

An America without gobs of venture capital is a poorer America

So why should the average American care deeply about any of this if they are not a founder or funder? Consider: An America without such a large and effective VC sector is an America with a radically different economy.

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.