🚀 End of Summer Sale! 25% off!

Also: 👁 Will the Great (Economic) Awakening lead to a Great Re-Acceleration?

😎 I’ll keep this short and sweet. Between right now and August 31st, all my wonderful free subscribers can become paid subscribers at a 25 percent discount from the regular annual price of $70 a year. An annual subscription works out to about $52 a year, or $4.38 a month. (Or about $5 + a bit if you pay month-to-month.)

Click the big blue buttons for more details.

And for that value, you get all essays, Q&As, and podcasts (with transcripts) that put forward an ambitious-yet-practical vision of how to discover, create, and invent a better America and world. I hope you think Faster, Please! is worth it. I sure love bringing it to you.

Melior Mundus

👁 Will the Great (Economic) Awakening lead to a Great Re-Acceleration?

Fifty years ago, inflation, energy shocks, and overregulation helped end America's postwar Golden Age. Now our response to those factors may help start a new one.

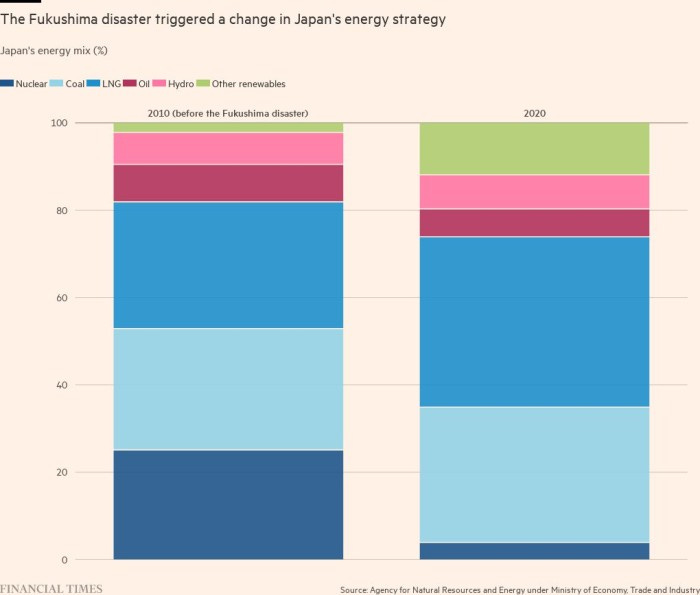

Back in 2012, a year after the Fukushima nuclear disaster, a poll found that 80 percent of Japanese favored phasing out the country's reliance on nuclear power and eventually eliminating it. And over the years, energy policy followed overwhelming public opinion with the country taking most of its reactors offline.

During that period, however, there was also a slowly growing awareness that generating reliable (Tokyo almost suffered a blackout earlier this summer) zero-carbon energy was probably going to require nuclear being a key part of the nation’s power portfolio. Then came Russia’s invasion of Ukraine and a resulting global energy shock. And now we see an important consequence of that shock, via the Financial Times:

Prime Minister Fumio Kishida has moved to restore Japan’s status as a nuclear-powered nation for the first time since the 2011 Fukushima crisis, accelerating the restart of reactors and signalling the construction of new plants. Kishida’s decision to throw his political weight behind the nuclear power sector is intended to rein in soaring energy costs for households and companies and to support Japan’s nuclear technology manufacturers. “As a result of Russia’s invasion of Ukraine, the global energy situation has drastically changed,” Kishida said on Wednesday. “Whatever happens globally, we need to prepare every possible measure in advance to minimise the impact on people’s lives,” he said, adding that the government would aim to come up with concrete plans for the nuclear sector by the end of the year.

Policy may again be following public opinion with 60 percent of Japanese now favoring a nuclear restart — the highest level of support since Fukushima. Energy reality has awakened the Japanese people, as well as those in numerous other countries taking a new look at nuclear, including the UK and France.

Reality is waking up Americans, too, and not just as it concerns nuclear energy. Finally. Next year marks the 50th anniversary of the end of what some call America’s “Golden Age.” The period — generally dated as starting in 1948 and finishing with the nasty 16-month recession from November 1973 through March 1975 — saw rapid economic and productivity growth. Then came the half-century “Great Stagnation” where growth continued but far slower than most predicted during the years preceding that downshift. Both the postwar Atomic Age and Space Age came to a close. Humanity, it turns out, was not on the verge of becoming a nuclear fusion-powered, multiplanetary civilization. And Hollywood continued to have a monopoly on flying cars.

Modern economic research has identified at least two big secular factors contributing to the stagnation, specifically the slowdown in productivity growth. First, we squeezed all the big gains out of the inventions and innovations of the later Industrial Revolution, such as the internal combustion engine, electrification, and transportation networks. Second, big economy-altering ideas became harder to find, requiring more researchers and resources.

Early on, however, economists focused on the obvious factors that were right in front of them. “The slowdown appears to be caused by major shifts in relative prices from, for example, oil price shocks, inflation, and regulation” was the conclusion of the Congressional Budget Office in a 1981 memo. A bit more from CBO on that third factor:

The 1969-1972 period was one of intense regulatory proliferation in the United States, with new legislation concerning air emissions, discharges into waterways, noise pollution, and occupational safety. The industries most severely affected — mining, paper, chemicals, refining, and primary metal — have suffered the sharpest decelerations in productivity growth since 1973. In mining, for example, productivity declined at an annual average rate of 3.2 percent per year during 1973-1978, after growing at an annual rate of 2.8 percent during 1948-1965 and at 1.6 percent during 1965-1973.

Economy-wide inflation, energy shocks, and regulation that makes business activity harder and more expensive — three anti-growth culprits that are pretty familiar and relevant to 2022 America and, perhaps, the citizens of many other rich economies. And just as those factors played some role in the Great Stagnation, perhaps they will play a role in a Great Re-Acceleration. It would be wonderfully ironic if these three horsemen of today’s economic troubles awakened us to the necessity of addressing the structural problems helping cause them. A Great Re-Acceleration caused by a Great Awakening of sorts.

Some evidence for my thesis can be found in the new Inflation Reduction Act:

Inflation. Rising prices, of course, helped sink the IRA’s previous Build Back Better incarnation. More importantly, one of the selling points of the law is that it would be anti-inflationary over the long run by increasing the economy’s productive capacity. This focus on productivity follows a similar emphasis by the Biden administration when it was pitching the Bipartisan Infrastructure Act. I love when policymakers talk about the productivity impacts of legislation and not just how it would create “good jobs.”

Energy. The energy shocks resulting from the West’s response to Russia’s invasion, along with the growing evidence of disruptive climate change, can be seen in the IRAs energy components, especially several technology-agnostic tax credits the apply to the nuclear industry. This modestly substantive endorsement of a nuclear future pairs nicely with administration rhetoric like this:

Regulation. When the IRA was announced, Sen. Joe Manchin, a West Virginia Democrat, said his party’s leaders had “committed to advancing a suite of commonsense permitting reforms this fall that will ensure all energy infrastructure, from transmission to pipelines and export facilities, can be efficiently and responsibly built.” This was a welcome acknowledgement by an important policymaker that America’s 1970s environmental regulatory structure has long outlived its usefulness without significant reform. More reality-based economics. I sure hope these reforms happen!

It’s a theme the media also picked up. From “‘Friction in the system’: the problem with Biden’s $369bn clean energy push” in the FT:

The landmark US climate, tax and spending law signed by president Joe Biden on Tuesday holds potential to spark an explosion of new renewable power projects across the country. Clean-energy executives, climate advocates and scholars have praised it, saying it is the first serious legislative attempt to tackle emissions that fuel global warming. But a host of obstacles may stand in the way. They range from tariffs and import controls that are driving up the cost of solar panels to state land-use laws over which the federal government has no control.

And this from “Energy Projects Sought Across the U.S. Face Local Hurdles” in the WSJ:

The U.S. needs more power to meet rising energy needs. Building the infrastructure necessary to make that happen has proven difficult. Utility-scale energy projects such as power transmission lines and offshore wind farms have to win approval from authorities in several jurisdictions, which can take years. Communities near the projects, environmental groups and others frequently oppose the projects and challenge them in court. The result is that projects are often delayed and costs elevated, according to industry experts and executives.

So maybe we’re at a pro-progress turning point. Maybe the inflation surge is reminding us of another reason why productivity is important. Maybe we’re now recognizing that our climate change problem is actually a clean energy problem. Maybe we’re realizing that intermittent power sources aren’t sufficient to power an expanding 21st century America. Maybe we're now ready to accept that complaints about regulation stifling our ability to build — clean energy, infrastructure, housing — don’t just reflect some libertarian or Silicon Valley bugaboo. Maybe geopolitical competition is forcing us to reevaluate the necessity of an efficient and well-funded national R&D effort. Maybe this Great Economics Awakening, combined with emerging advances in AI, biology, energy, and space, will lay the foundation for a second Golden Age or even a Golden Century.

Micro Reads

▶ Student Debt Forgiveness Likely, With Modest Economic Effects - Goldman Sachs, 08/23/2022 | While we have not yet estimated the effects of the plan that the White House looks likely to announce, it appears similar to a potential policy we wrote about shortly after the 2020 election. In that analysis, we found that debt forgiveness of $10k per borrower would discharge around $300bn (1.2% of GDP) of debt but would boost consumption by less than by less than 0.1% of GDP over the year following implementation. Two policies have changed since that prior analysis: (1) the American Rescue Plan Act of 2021 (ARPA) exempted most discharged student debt from tax (discharged debt normally counts as income), which slightly increases the near-term growth effects of student debt relief. (2) The Biden Administration has extended the student loan payment pause several times and appears likely to extend it again, which reduces the near-term impact of debt forgiveness as borrowers' monthly payments would not change (they would be zero with or without debt forgiveness). However, neither issue is likely to meaningfully change our estimate that forgiving $10k in student debt per borrower would have a very modest economic effect.

▶ An all-of-the-above approach for permitting energy infrastructure - Liza Reed and David Bookbinder, The Hill Opinion | Ensuring energy abundance in the coming decades will require an extensive expansion of energy infrastructure, including at least doubling American electric transmission capacity and creating pipeline systems for hydrogen and CO2. Yet transmission infrastructure projects are stuck in a state and local regulatory rut that will block these ambitious (and necessary) goals. In July, Senate Majority Leader Chuck Schumer (D-N.Y.) and Sen. Joe Manchin (D-W.Va.) announced they would introduce permitting reform legislation — with transmission as a priority. Luckily, model legislation for permitting transmission already exists in the form of the proposed 2021 Streamlining Interstate Transmission of Electricity (SITE) Act. Congress should include the SITE Act in a permitting reform bill and use it as a framework for regulatory structures for CO2 and hydrogen pipelines.

▶ Nasa’s new rocket is the last hurrah for US space agency’s old ways - Richard Waters, Financial Times | Nasa is coming to a similar view, even though Boeing, the main contractor, says it is working on ways to bring down the cost of future SLS launches. The agency’s auditor wrote late last year that in order to put its manned space flight programme on a secure long-term footing, it would have to turn to cheaper commercial alternatives to SLS. These are likely to include several heavy-launch rockets that employ varying degrees of reusability to bring down their cost. SpaceX’s Starship, Blue Origin’s New Glenn and the Vulcan rocket being developed by United Launch Alliance, a joint venture between Boeing and Lockheed Martin, are all awaiting their first test flights. Nasa has scheduled four missions for the SLS, with the third due to take humans to the Moon. After that, it is unclear whether the rocket will ever fly again.

▶ The Global State of Fusion Development - American Security Project |