⏰ America’s inflation alarm should awaken it from a bad dream

Also: Let’s remember that Elon Musk, Twitter provocateur, is also revolutionizing space transit, OK?

“Society’s course will be changed only by a change of ideas.”- Friedrich Hayek

In This Issue

Micro Reads: Nuclear power, synthetic biology, defending innovation, and more . . .

Best of the Pod: A conversation with Nicholas Bloom

Short Read: Let’s remember that Elon Musk, Twitter provocateur, is also revolutionizing space transit, OK?

Long Read: America’s inflation alarm should awaken it from a bad dream

Micro Reads

⚛ The discreet charm of nuclear power - The Economist |

Nuclear power has its drawbacks, as do all energy sources. But when well-regulated it is reliable and, despite its reputation, extremely safe. That is why it is foolish to close down perfectly good nuclear power stations such as Diablo Canyon, in California, because of little more than prejudice. It is why some countries, most notably China, are building out their nuclear fleets. It helps explain why others — including, as it happens, Saudi Arabia — are getting into the game for the first time.

🤖 North American companies rush to add robots as demand surges - Reuters | Again, workers on the sidelines might want to get off the sidelines, soonest. “Companies in North America added a record number of robots in the first nine months of this year as they rushed to speed up assembly lines and struggled to add human workers.”

🧬 How Synbio Can Drive Sustainability & Disrupt Manufacturing - Barclays | A fascinating proprietary report from the bank on synthetic biology. And while the technology has many potential applications, including supporting global biodiversity, Barclays is focusing here on the consumer market. What I find particularly interesting is why Synbio has, you know, become a thing.

From the report:

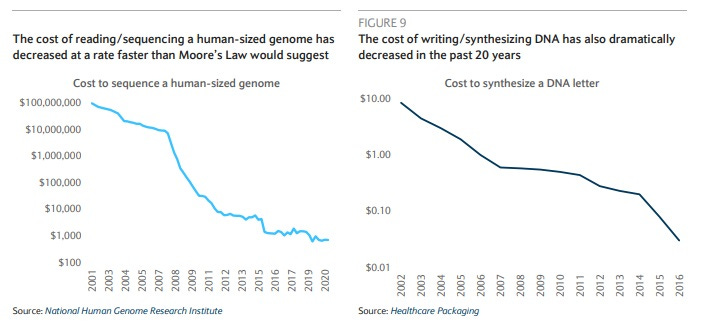

Over the past decade a few factors have helped lay fertile ground, in our view, for synthetic biology to be applied more broadly and with a wide spectrum of business models: First, struggles with biofuels led researchers and companies to take a step back and re-think ways to commercialize, which involved broadening their sector scope and writing new strategic playbooks. Second, genetic engineering tools such as CRISPR-Cas9 broadened R&D capabilities, while the cost to read genomes and write DNA decreased at a rate faster than Moore’s Law would suggest. Third, the development of start-up infrastructure helped to de-risk the early stages of synbio ventures, enabling researchers and entrepreneurs to go after opportunities in markets that are more afield. Fourth — specific to the consumer sector — success stories such as Impossible Foods showed synbio entrepreneurs and investors alike that consumer acceptance is perhaps not the dealbreaker it was once perceived to be. Perhaps most importantly, climate change has come to the foreground of political, corporate, and investor conversations and synthetic biology has the potential to be very effective in replacing carbon-heavy manufacturing methods at scale.

⚛ Nuclear Fusion Is Close Enough to Start Dreaming - Tyler Cowen | Rather than analyze the progress of nuclear fusion, Cowen speculates about the potential of cheap, clean, abundant power to change the world. And it mostly sounds pretty good!

How about a supersonic or perhaps suborbital flight from Washington to Tokyo? A trip to Antarctica would no longer seem so daunting. . . . Desalinating water would become cheap and easy, enabling the transformation and terraforming of many landscapes. . . . Over time, Mali and the Middle East would become much greener. . . . Wages would also rise significantly. Not only would more goods and services be available, but the demand for labor would also skyrocket. . . . Cheap energy would also make supercomputing more available, crypto more convenient, and nanotechnology more likely.

⏩ Defending Innovation Against Attacks from All Sides - Adam Thierer, Discourse | “The utilitarian case for innovation is that it is the primary driver of improvements in human welfare. That’s also the ethical basis for innovation. After all, if we know that technological change is the most essential ingredient for economic growth and human flourishing, then we have a moral obligation to defend it. Indeed, it would be unethical not to.”

Best of the Pod

My conversation with Nicholas Bloom

An insightful bit from my recent Political Economy chat with the William Eberle Professor of Economics at Stanford University. Last summer, Bloom co-authored, along with Tarek Hassan, Aakash Kalyani, Josh Lerner, and Ahmed Tahoun, the working paper “The Diffusion of Disruptive Technologies.” In the spring, he and Jose Maria Berrero and Steven Davis released a working paper titled “Why Working from Home Will Stick.”

Pethokoukis: [Many of us] look at new technologies, whether it’s machine learning or SpaceX, or CRISPR, and there’s this emerging case that that decade or more of weak productivity growth is at an end. We’re going to have maybe a decade of much higher productivity growth. I noticed that Robert Gordon and Erik Brynjolfsson did a long bet on this very idea. And you co-wrote along with Charles Jones, John Van Reenen, and Michael Webb, a fantastic paper about ideas getting harder to find and how we have to throw more resources at those to get those ideas. Do you think that we’re going to have higher productivity growth, for whatever reason, in the decade ahead?

Bloom: So I would love for there to be increased productivity growth. My suspicion is probably not. So one thought is that I don’t think the pandemic has made it easier to have faster productivity growth because, in many ways, these game-changing technologies, take AI — you could have done AI pre-pandemic. There’s nothing about the pandemic that’s made AI particularly easier to use. I mean, maybe you could argue it’s made it more appealing to have robots rather than people to, say, serve your coffee, but that incentive is already there. The pandemic, I know from Stanford University, has been hugely disruptive. It closed down a lot of the labs, still the social distancing capacity is down, et cetera, et cetera. So it could be we have a productivity revival. If we do (again, apart from working from home, which is maybe a one-up lift of 2 or 3 percent), I don’t think the pandemic itself would generate a permanently higher rate of productivity growth.

But if we saw [an upturn], the most likely reason would be that in 2018 or 2019, we had all these technologies that were ripe for expansion — AI, computer vision, driverless cars — and finally the light switch gets turned on, or something clicks, and they finally take off. I mean, just to set this in the course of history, productivity growth was roughly zero basically until the industrial revolution, and then it suddenly starts growing from roughly zero up to about its peak of around 2 percent in 1950. And then it’s been declining back down since 1950 to roughly less than 1 percent pre-pandemic. So it can change direction. It just hasn’t done that often in history. So I would probably bet against there being a productivity turnaround, but it’s not impossible.

Short Read

🚀 Let’s remember that Elon Musk, Twitter provocateur, is also revolutionizing space transit, OK?

If I were running a traffic-obsessed media organization, I might also laser focus on the oddities of Elon Musk. Such as, for instance, the world’s richest man conducting a Twitter poll to decide (supposedly, but maybe not) if he should sell a multibillion-dollar chunk of Tesla stock. Or sending a crude tweet to a US senator. One can’t argue those stunts aren’t newsy.

But good judgment is at the heart of good journalism. And if people are way more aware of Musk the Social Media Provocateur rather than Musk the Space Economy Pioneer, then the public is being done a disservice by media (also, to be clear, by Musk himself). And I’m pretty that’s the case. Which is too bad.

Consider the “billionaire space race,” which is often framed as some vanity space-tourism project. It isn’t. And here’s a good example of Musk using social media in an educational way on what’s happening with SpaceX:

That tweet was in response to this SpaceX vs. the World (and China) chart tweeted out by CNBC space reporter Michael Sheetz:

Musk is right. With its power and reusability, the successful development of Starship would be a very big deal, offering a payload capacity to low-Earth orbit that would be five times that of the Falcon 9 rocket, which carried four astronauts to the International Space Station from Florida on Wednesday evening. As SpaceX describes it:

SpaceX’s Starship spacecraft and Super Heavy rocket (collectively referred to as Starship) represent a fully reusable transportation system designed to carry both crew and cargo to Earth orbit, the Moon, Mars and beyond. Starship will be the world’s most powerful launch vehicle ever developed, with the ability to carry in excess of 100 metric tonnes to Earth orbit.

And don’t forget the potential of point-to-point travel here on Earth. A thousand passengers, anywhere on the planet, in under an hour. Of course, Musk and SpaceX still have to do it. It’s one thing to space talk the space talk, another to space walk the space walk. But if they do, the achievement will be worth at least a tweetstorm or two.

Long Read

💥 America’s inflation shock should awaken it from a bad dream

News item: France will start building new nuclear reactors, President Emmanuel Macron said on Tuesday, "to guarantee France's energy independence, to guarantee our country's electricity supply and achieve our objectives, in particular carbon neutrality in 2050.” The move, a response to the impact of Europe's natural gas crisis on energy prices, prompted one industry observer to remark that “Europe has woken from a dream.”

That kicker quote really struck me when I read it.

“Europe has woken from a dream.”

America is perhaps finally waking from its own unhelpful dream. And while that fantasy does include dreamy thinking about energy, it’s about more than just energy. It also involves the big economic story this week: US inflation hit a three-decade high in October, the Labor Department announced on Tuesday. It was the fastest 12-month pace since 1990 and the fifth straight month with inflation above 5 percent.

Not surprisingly, rising prices are doing a number on consumer confidence. There was also an unexpectedly large drop in the University of Michigan consumer confidence index in early November from the impact of broadening inflation fears. This is important because one way inflation really gets out of hand is when it starts changing people’s expectations. Capital Economics offers this worrisome conclusion: “The bottom line is that, while it remains difficult to predict how far or for how long the various ‘transitory’ factors will boost inflation, there is mounting evidence that inflationary pressures are building throughout the economy. That underlines our view that inflation will remain elevated for much longer than Fed officials expect.”

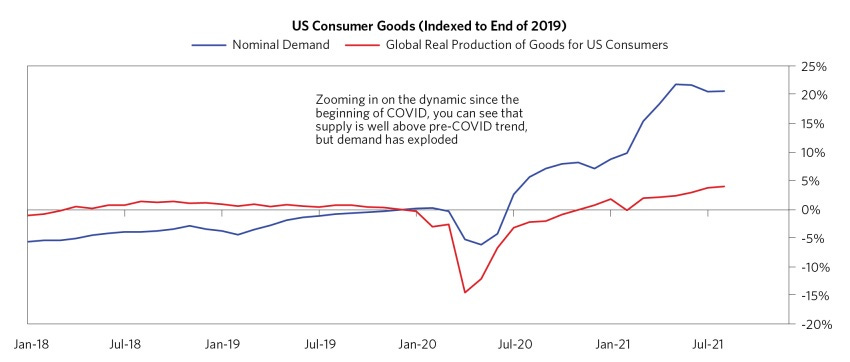

What’s going on here? I think hedge fund Bridgewater sums things up well (bold by me): “Today, demand is surging, and supply is also growing, but it just can’t keep up with demand. There are not enough raw materials, energy, productive capacity, inventories, housing, or workers.” Indeed, supply has recovered — and quickly, as this Bridgewater chart shows:

So, about that dream. It was one dreamed by people unhappy — as to why they were unhappy, I won’t speculate — about the foundational assumptions about how the American economy works. They began arguing “true prosperity” comes not from the productive capacity of the private economy but rather middle-class purchasing power, as enabled by government. What the American economy needed from public policy, then, was a dramatic, redistributional shifting of national resources away from wealthier Americans and American businesses to the broad middle class.

(A New York Times columnist recently called this dream “the driving theory of most of the progressive policy agenda, most of the time: give people money or a moneylike voucher they can use to buy something they need or even just want.”)

Good news: Policymakers didn’t have to worry about how taxes and regulation might affect the productivity capacity of the private sector. The wonder-working power of juiced-up consumer demand is what would generate innovation and entrepreneurship. And, of course, this Middle Out Economy would be a “green” one powered, as soon as possible, by solar and wind power. All in all, quite the dream.

And throughout the COVID-19 pandemic, the dreamers have been pushing for ever-more government economic support for consumer purchasing power — with apparently little thought about whether such spending could be matched by productive capacity, both in the US and globally. For instance: Progressive Democrats lobbied hard to get enhanced jobless benefits expanded and permanently extended. (They also pushed Congress to pass a $10 trillion infrastructure plan instead of one around $1 trillion.)

Contrarian voices were ridiculed and tweeted down, perhaps most notably economist Larry Summers, a former US Treasury Secretary in the Clinton administration and top adviser to President Obama. Back in March, Summers called the $1.9 trillion coronavirus stimulus package the “least responsible” economic policy in 40 years. He warned that “the primary risk to the U.S. economy is overheating — and inflation.”

Summers now looks prescient. The economy’s surprisingly strong — well, surprising to some, I guess — inflation response has led Goldman Sachs to predict the Federal Reserve will start raising interest rates a year earlier than it was previously forecasting. And with the start of a new Fed rate-raising cycle comes the risk of an economic hard landing and recession. Those of us concerned about seeing the benefits of an expansion reach low-wage workers should want expansions to continue as long as possible and until there’s substantive evidence that inflationary forces are taking hold.

But now, I hope, “American has woken” from a dream. And learned some lessons, including the following:

Cutting endless checks may be the simple and elegant way to boost incomes — indeed, it sometimes seems to be the one thing that government does well — but too much money chasing too few goods still can cause prices to surge. The only sustainable, long-term way to boost incomes is by making workers more productive. (To be clear, I’m not arguing against the safety net/welfare state or even its expansion in some areas.)

While there are things government can do to boost productivity growth, it also can work the other way around. Case in point: A key supply-chain bottleneck at the Port of Long Beach where local NIMBY rules prohibit stacking containers more than two high. It took a viral tweetstorm to persuade the city manager to waive the rule. I often write about the big ways regulations hinder growth — from density housing to making infrastructure costlier and longer to build — but there are lots of little hurdles creating myriad bottlenecks. (Good luck to the Biden administration getting all that offshore wind capacity built with existing environmental regs. ) There are perhaps far more of those than even the most fervent libertarians ever imagined.

The spike in energy prices is another reminder of the importance of cheap, abundant energy to power the economy. The American Automobile Association says the national average price of gasoline is up 62 percent from a year ago. And, notes the Wall Street Journal, “utilities are facing the highest natural-gas prices in years as they build stockpiles for winter. The reason: Exporters are sending more gas than ever to countries starved for the fuel.”

Which brings us back to France and nuclear. Oh, and it isn’t just France. Rolls-Royce, also said on Tuesday that it was forming a business to build a series of smaller, cheaper nuclear reactors. Japanese Prime Minister Fumio Kishida says it’s “crucial” the nation re-start the nuclear plants that were shut down after the Fukushima disaster. And right before the just-concluded UN climate summit in Scotland, the United Nations Economic Commission for Europe released a document arguing for the importance of nuclear power in meeting climate goals.

So, too, the United States. Secretary of Energy Jennifer Granholm says the Biden administration is “very bullish” on building new nuclear reactors in the United States and overall sounding like a huge advocate:

We are very bullish on these advanced nuclear reactors. We have, in fact, invested a lot of money in the research and development of those. We are very supportive of that. . . . Half of the United States’ clean power now — when I say ‘clean’ I’m talking about net-zero carbon emissions — is through the nuclear fleet. If you look at the overall power, it’s about 20 percent. Globally, 29 percent of the clean power is nuclear. . . . These advanced nuclear reactors, and the existing fleet, are safe. We have the gold standard of regulation in the United States. . . . And they’re baseload power. The holy grail is to identify clean, baseload power. . . . Nuclear is dispatchable, clean baseload power, so we want to be able to bring more on.

And it’s isn’t just rhetoric, given the nuclear credit program in the recently passed infrastructure bill. There’s also a proposed production tax credit for operating nuclear plants in the reconciliation bill still under consideration.

Now nuclear fission or advanced nuclear is the key to clean abundant energy. Or maybe it’s fusion. Or maybe geothermal. But solar and wind don’t seem like the sole solutions here, as a growing number of global leaders now realize.

Getting real about energy is important. Even more so conceding that the key to greater prosperity and more opportunity is generating more productive capacity. And that means thinking hard about taxes, regulation, trade, immigration, R&D investment, and their impact on productivity. The supply-side of the economy matters a lot, as do policies that influence it. I hope the Middle Outers have woken to this reality.