🌈 5 reasons why I still believe in my New Roaring '20s thesis

Also: 5 Quick Questions for … economist Dan Sichel on economic and productivity growth in the (hopefully) New Roaring '20s

In This Issue

The Essay: 5 reasons why I still believe in my New Roaring '20s thesis

5QQ: 5 Quick Questions for … economist Dan Sichel on economic and productivity growth in the New Roaring ’20s

Micro Reads: AI and language, reusable rockets, troubles with Chinese bullet trains, and more …

Quote of the Issue

“The view that the 1920s was a drunken spree destructive of civilized values can be substantiated only by the systematic distortion or denial of the historical record. The prosperity was very widespread and very solid.” - Paul Johnson, Modern Times

⏩ 5 reasons why I still believe in my New Roaring '20s thesis

“New Roaring ’20s” is a big Faster, Please! theme, and I will concede that the 2020s have been kind of a bummer so far. The worst pandemic in a century. A mini-depression. War in Europe.

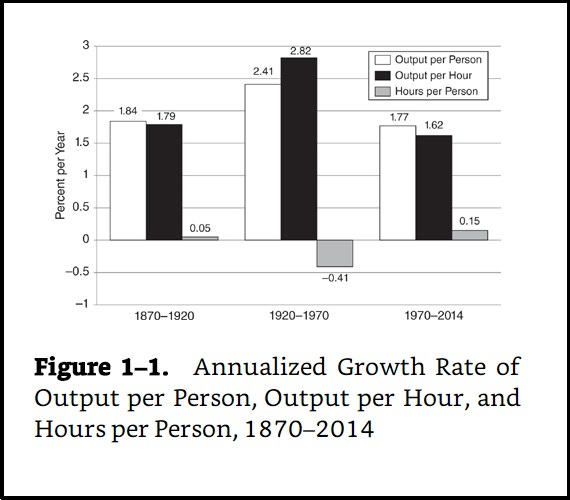

Of course, the original Roaring ’20s, the 1920s, didn’t start out so well, either. Europe was recovering from the Great War, and the world from the Great Influenza. Economically, the 1920s began with its own thoroughly nasty mini-depression. Output fell by nearly 10 percent, stock prices were cut almost in half, and unemployment surged to about a fifth of the labor force. (In The Forgotten Depression, financial journalist James Grant points out the “bitterly sardonic” lyrics of the 1921 hit “Ain’t We Got Fun” were inspired by the decade’s depressionary start, not its later Jazz Age ebullience.) Rapid economic growth, driven by big productivity gains, came later.

So I’m not going to abandon my notion of New Roaring ’20s despite its similarly stumbling start. At the same time, however, I have to pay serious attention to economic reality. No dismissive hand-waving of bad news or contrary evidence here. Michael Feroli, the highly respected chief US economist at JPMorgan, does a fair and reasonable job of summarizing that evidence in a new report, “The US real economy: Same as it ever was.” Well, the same with one obvious exception: inflation. From Feroli’s analysis:

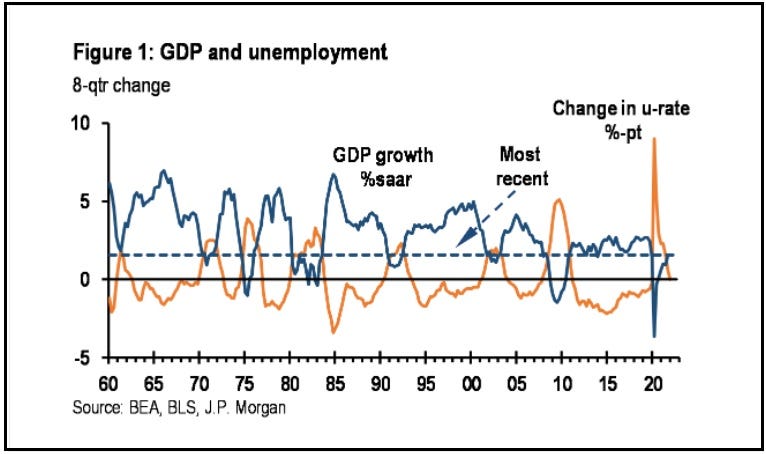

One of the defining features of the pre-pandemic economy was entrenched very low inflation. In the last year that feature of the old economy has been completely overturned. Moreover, it doesn’t look like we’re returning to those low inflation readings anytime soon. Low inflation was one defining feature of the pre-pandemic economy, but not the only feature. … Shortly after the pandemic began there were some reasons to believe that trend GDP growth would slow further, and even a few reasons to believe it would pick up. But the early evidence is consistent with potential GDP growth remaining subdued near 1.5%.

As always, let’s focus on growth. Over the eight-quarter stretch between 4Q19 and 4Q21, Feroli notes, real GDP expanded at a 1.56 percent annual rate, just about his pre-pandemic estimate of potential GDP growth of 1.5 percent. “If this continues to hold the good news is that the pandemic did not lower the rate of trend growth,” Feroli observes. Then again, as Feroli also observes, “1.5% is a historically very slow rate of growth.” Indeed, that's a percentage point below average real GDP growth between 1990 and 2019. And sub-2 percent growth will not a New Roaring ’20s make.

So why am I still optimistic about the coming years and beyond?

Keep reading with a 7-day free trial

Subscribe to Faster, Please! to keep reading this post and get 7 days of free access to the full post archives.